Concept explainers

Cho Sportswear: Aged Schedule of Accounts Receivable

| Past Due | ||||||

| Customer | Current | 1-30 Days | 31-60 Days | 61-90 Days | Over 90 Days | Totals |

| Ryoko Design Assosciates | $100,000 | $23,800 | $ 123,800 | |||

| Marcy Fashions, Inc | 657,000 | 198,000 | $76,000 | 931,000 | ||

| Conory Clothing | $456,000 | $789,412 | 1,245,412 | |||

| Lee Womensware | 237,200 | 10,230 | 54,570 | 349,200 | 651,200 | |

| Bauer Brands, Ltd. | 100,230 | 76,770 | 41,588 | 19,000 | 237,588 | |

| Totals | $1,094,430 | $308,800 | $130,570 | $846,788 | $808,412 | $3,189,000 |

The company estimated an allowance for uncollectible accounts based on the following estimates

| Aging Category | Allowance Provided |

| Current | 5% |

| 1 -30 days past due | 9 |

| 31-60 days past due | 20 |

| 61-90 days past due | 55* |

| Over 90 days past due | 80* |

After a specific review of the company’s accounts receivable, Cho’s credit manager decided to provide a full allowance against all Bauer Brands’ balances that are more than 60 days past due. The percentage allowance is applied to the 61-90 days and over 90 days past due aging categories only after deducting the balances due from Bauer Brands.

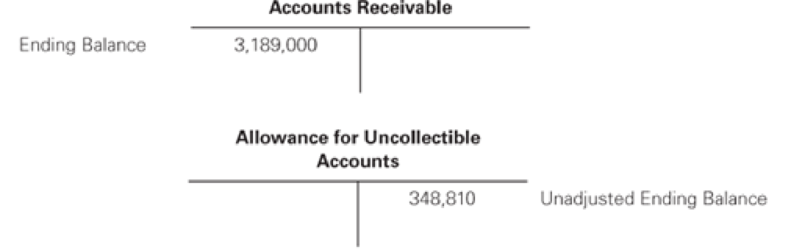

Cho reported net credit sales of $45,000,000 for the current year. We present the company’s of accounts receivable and the allowance for uncollectible accounts:

Required

- a. Compute the balance required in the allowance for uncollectible accounts at the end of the year.

- b. Prepare the journal entry to record the bad debt provision for the current year.

- c. Independent of your answer to part (b) prepare the journal entry to record the bad debt provision for the current year assuming that the allowance for uncollectible accounts had a $331,000 debit balance.

- d. In the following year, Cho’s credit management decided to write off all accounts that were over 90 days past due. Prepare the journal entry.

- e. After the write-offs recorded in part (d), assume that Conroy Clothing pays the entire balance due. Prepare the journal entries required to record the subsequent recovery of the Conroy Clothing receivables.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

EBK INTERMEDIATE ACCOUNTING

- I need correct answer 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forwardNo chatgpt 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedneed anarrow_forward

- No ai 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forwardI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forward

- Development costs in preparing the mine $ 3,400,000 Mining equipment 159,600 Construction of various structures on site 77,900 After the minerals are removed from the mine, the equipment will be sold for an estimated residual value of $12,000. The structures will be torn down. Geologists estimate that 820,000 tons of ore can be extracted from the mine. After the ore is removed, the land will revert back to the state of New Mexico. The contract with the state requires Hecala to restore the land to its original condition after mining operations are completed in approximately four years. Management has provided the following possible outflows for the restoration costs: Cash Outflow Probability $ 620,000 40% 720,000 30% 820,000 30% Hecala’s credit-adjusted risk-free interest rate is 7%. During 2024, Hecala extracted 122,000 tons of ore from the mine. The company’s fiscal year ends on December 31. Required: Determine the amount at which Hecala will record the mine. Calculate the…arrow_forwardI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardwhat are the Five List of Michael Porter's 5 Force Framework that describes the competitive dynamics of a firm and the industry they are in?arrow_forward

- Hello tutor i need help I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwarddefine each item below: A competitive advantage. 2) Data incorporation. 3) Financial Statement Analysis. 4) Product Differentiation. 5) Strategic positioning for a business firmarrow_forwardHello tutor i need help I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College