Loose Leaf Intermediate Accounting

10th Edition

ISBN: 9781260481952

Author: David Spiceland, James Sepe, Mark W. Nelson, Wayne M Thomas

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 9.5E

Lower of cost or market

• LO9–1

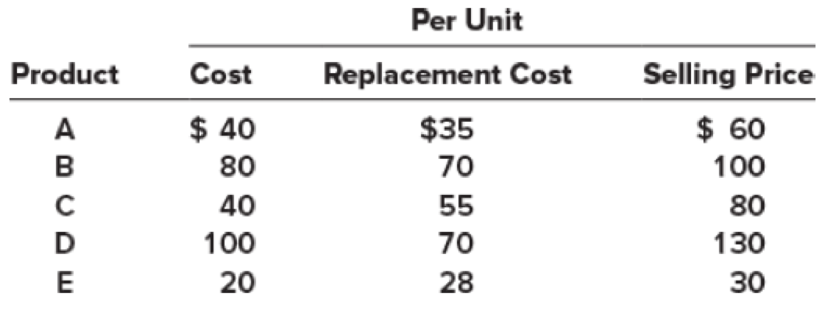

[This is a variation of E 9–2, modified to focus on the lower of cost or market.] The inventory of Royal Decking consisted of five products. Information about the December 31, 2018, inventory is as follows:

Selling costs consist of a sales commission equal to 10% of selling price and shipping costs equal to 5% of cost. The normal gross profit percentage is 30% of selling price.

Required:

What unit value should Royal Decking use for each of its products when applying the lower of cost or market (LCM) rule to units of ending inventory?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the impact of recording depreciation expense on the financial statements?A. Assets increase; Net income increasesB. Assets decrease; Net income decreasesC. Liabilities increase; Net income increasesD. Assets increase; Liabilities increase

Which financial statement shows a company’s financial position at a specific point in time?A. Income StatementB. Balance SheetC. Statement of Cash FlowsD. Statement of Retained Earnings

Which account is closed at the end of the accounting period? A. Accumulated Depreciation B. Salaries Payable C. Service Revenue D. Retained Earnings

need c

Chapter 9 Solutions

Loose Leaf Intermediate Accounting

Ch. 9 - Explain the (a) lower of cost or net realizable...Ch. 9 - What are the various levels of aggregation to...Ch. 9 - Describe the alternative approaches for recording...Ch. 9 - Explain the gross profit method of estimating...Ch. 9 - The Rider Company uses the gross profit method to...Ch. 9 - Explain the retail inventory method of estimating...Ch. 9 - Both the gross profit method and the retail...Ch. 9 - Define each of the following retail terms: initial...Ch. 9 - Explain how to estimate the average cost of...Ch. 9 - Prob. 9.10Q

Ch. 9 - Explain the LIFO retail inventory method.Ch. 9 - Discuss the treatment of freight-in, net markups,...Ch. 9 - Explain the difference between the retail...Ch. 9 - Prob. 9.14QCh. 9 - Prob. 9.15QCh. 9 - Explain the accounting treatment of material...Ch. 9 - Identify any differences between U.S. GAAP and...Ch. 9 - (Based on Appendix 9) Define purchase commitments....Ch. 9 - (Based on Appendix 9) Explain how purchase...Ch. 9 - Lower of cost or net realizable value LO91 Ross...Ch. 9 - Lower of cost or net realizable value LO91 SLR...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Prob. 9.5BECh. 9 - Gross profit method; solving for unknown LO92...Ch. 9 - Retail inventory method; average cost LO93 Kiddie...Ch. 9 - Retail inventory method; LIFO LO93 Refer to the...Ch. 9 - Conventional retail method LO94 Refer to the...Ch. 9 - Conventional retail method LO94 Roberson...Ch. 9 - Lower of cost or net realizable value LO91 Herman...Ch. 9 - Lower of cost or net realizable value LO91 The...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Prob. 9.11ECh. 9 - Concepts; terminology LO91 through LO97 Listed...Ch. 9 - Prob. 9.1PCh. 9 - Prob. 9.3PCh. 9 - Prob. 9.8PCh. 9 - Prob. 9.1DMPCh. 9 - Prob. 9.3DMPCh. 9 - Prob. 9.4DMPCh. 9 - Prob. 9.5DMPCh. 9 - Prob. 9.6DMPCh. 9 - Prob. 9.7DMPCh. 9 - Real World Case 98 Various inventory issues;...Ch. 9 - Prob. 9.9DMPCh. 9 - Judgment Case 910 Inventory errors LO97 Some...Ch. 9 - Prob. 9.12DMPCh. 9 - Prob. 2CCTC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which account is closed at the end of the accounting period?A. Accumulated DepreciationB. Salaries PayableC. Service RevenueD. Retained Earningsarrow_forward12. Which account is closed at the end of the accounting period?A. Accumulated DepreciationB. Salaries PayableC. Service RevenueD. Retained Earningsneed helparrow_forward12. Which account is closed at the end of the accounting period?A. Accumulated DepreciationB. Salaries PayableC. Service RevenueD. Retained Earningsarrow_forward

- Which account is closed at the end of the accounting period?A. Accumulated DepreciationB. Salaries PayableC. Service RevenueD. Retained Earningsneed helparrow_forwardWhich account is closed at the end of the accounting period?A. Accumulated DepreciationB. Salaries PayableC. Service RevenueD. Retained Earningsarrow_forwardThe principle that requires companies to record expenses in the same period as the revenues they help generate is the:A. Revenue Recognition PrincipleB. Consistency PrincipleC. Matching PrincipleD. Cost Principleneed hekparrow_forward

- No AI The principle that requires companies to record expenses in the same period as the revenues they help generate is the:A. Revenue Recognition PrincipleB. Consistency PrincipleC. Matching PrincipleD. Cost Principlearrow_forwardThe principle that requires companies to record expenses in the same period as the revenues they help generate is the:A. Revenue Recognition PrincipleB. Consistency PrincipleC. Matching PrincipleD. Cost Principlearrow_forwardNo ai 14. A company receives a bill for electricity to be paid next month. What is the journal entry today?A. Debit Utilities Expense; Credit Accounts PayableB. Debit Cash; Credit Utilities ExpenseC. Debit Accounts Payable; Credit Utilities ExpenseD. No entry until payment is madearrow_forward

- 14. A company receives a bill for electricity to be paid next month. What is the journal entry today?A. Debit Utilities Expense; Credit Accounts PayableB. Debit Cash; Credit Utilities ExpenseC. Debit Accounts Payable; Credit Utilities ExpenseD. No entry until payment is made i need helparrow_forward14. A company receives a bill for electricity to be paid next month. What is the journal entry today?A. Debit Utilities Expense; Credit Accounts PayableB. Debit Cash; Credit Utilities ExpenseC. Debit Accounts Payable; Credit Utilities ExpenseD. No entry until payment is made helparrow_forwardeBook Operating income for profit center Show Me How The centralized Data Analytics Department of Drewlink Company has expenses of $340,000. The department has provided a total of 8,000 hours of service for the period. The Retail Division has used 2,000 hours of data analytics service during the period, and the Commercial Division has used 6,000 hours of data analytics service. Additional data for the two divisions is following below: Retail Division Commercial Division Sales Cost of goods sold $2,550,000 1,450,000 Selling expenses 230,000 $1,700,000 750,000 170,000 Determine the divisional operating income for the Retail Division and the Commercial Division. Do not round interim calculations. Drewlink Company Divisional Operating income Line Item Description Sales Cost of goods sold Selling expenses Support department allocations Operating income Retail Division Commercial Division 2,550,000 1,450,000 $ 1,700,000 750,000 10000 785,000 525,000 Check My Work 1 more Check My Work uses…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

IAS 29 Financial Reporting in Hyperinflationary Economies: Summary 2021; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=55luVuTYLY8;License: Standard Youtube License