Intermediate Accounting

3rd Edition

ISBN: 9780136912644

Author: Elizabeth A. Gordon; Jana S. Raedy; Alexander J. Sannella

Publisher: Pearson Education (US)

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 9.4E

Giaraldi Garden Products: Aged Schedule of Accounts Receivable

| Past Due | ||||||

| Customer | Current | 1-30 Days | 31-60 Days | 61-90 Days | Over 90 Days | Totals |

| Carey Company | $ 10,000 | $34,500 | $ 44.500 | |||

| Gibson, Ltd | $423,000 | $ 27000 | 450,000 | |||

| KW Quarterly | 33,000 | $ 67,000 | 1,500 | 101,500 | ||

| Onix Construction | 100,000 | 45,000 | 90,500 | 235,500 | ||

| Carpenter Lumber | 387.000 | 125,000 | 500 | 512,500 | ||

| Totals | $810,000 | $185,000 | $167,000 | $55,000 | $127,000 | $1,344,000 |

The company estimated an allowance for uncollectible accounts based on the following estimates

| Aging Category | Allowance Provided |

| Current | 3% |

| 1 -30 days past due | 6 |

| 31-60 days past due | 18 |

| 61-90 days past due | 45 |

| Over 90 days past due | 100 |

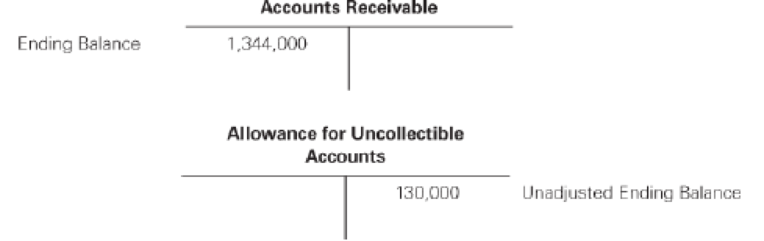

Giaraldi reported net credit sales of $18,500,000 for the current year. We present the company’s of accounts receivable and the allowance for uncollectible accounts:

Required

- a. Compute the balance required in the allowance for uncollectible accounts at the end of the year.

- b. Prepare the journal entry to record the bad debt provision for the current year.

- c. Independent of your answer to part (b) prepare the journal entry to record the bad debt provision for the current year assuming that the allowance for uncollectible accounts had a $30,000 debit balance.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I need help solving this financial accounting question with the proper methodology.

Please fill the empty cell in this problem. It is the only thing I need.

Please explain the solution to this financial accounting problem with accurate principles.

Chapter 9 Solutions

Intermediate Accounting

Ch. 9 - Prob. 9.1QCh. 9 - Do companies always classify cash as a current...Ch. 9 - Prob. 9.3QCh. 9 - Do accountants typically measure accounts...Ch. 9 - Under the allowance method, will the actual...Ch. 9 - How does an entity record a subsequent recovery of...Ch. 9 - Does the aging of accounts receivable method of...Ch. 9 - What is the difference between pledging accounts...Ch. 9 - How do companies account for receivables that are...Ch. 9 - Is the face value of a note receivable exchanged...

Ch. 9 - What do firms use to record the sales value of a...Ch. 9 - Explain why a company must have highly effective...Ch. 9 - The following are held by YRT Corporation at...Ch. 9 - Fernandez Company had an accounts receivable...Ch. 9 - On its December 31, Year 2, balance sheet, Red...Ch. 9 - Stanberry Company sold 500,000 of net accounts...Ch. 9 - On November 30, Year 1, Derin Corporation agreed...Ch. 9 - Which of the following disclosures about accounts...Ch. 9 - Prob. 9.1BECh. 9 - Prob. 9.2BECh. 9 - Prob. 9.3BECh. 9 - Prob. 9.4BECh. 9 - Prob. 9.5BECh. 9 - Sales Discounts, Most-Likely-Amount Method. On...Ch. 9 - Allowance for Uncollectible Accounts, Write-Off....Ch. 9 - Allowance for Uncollectible Accounts, Write-Off....Ch. 9 - Allowance for Uncollectible Accounts, Recovery....Ch. 9 - Bad Debt Expense, Journal Entry. Paul Anchor...Ch. 9 - Bad Debt Expense. Journal Entry. Paul Anchor,...Ch. 9 - Bad Debt Expense, Aging of Accounts Receivable,...Ch. 9 - Bad Debt Expense, Aging of Accounts Receivable,...Ch. 9 - Prob. 9.14BECh. 9 - Prob. 9.15BECh. 9 - Assigned Receivables. Using the information...Ch. 9 - Factoring Receivables without Recourse. Nicks...Ch. 9 - Prob. 9.18BECh. 9 - Prob. 9.19BECh. 9 - Prob. 9.20BECh. 9 - Prob. 9.21BECh. 9 - Prob. 9.22BECh. 9 - Internal Controls. Identify whether the following...Ch. 9 - Prob. 9.24BECh. 9 - Prob. 9.25BECh. 9 - Prob. 9.26BECh. 9 - Prob. 9.27BECh. 9 - Prob. 9.28BECh. 9 - Prob. 9.1ECh. 9 - Volume Discounts, Sales Discounts. Sodesta Company...Ch. 9 - Allowance for Uncollectible Accounts, Journal...Ch. 9 - Bad Debt Expense, Aging of Accounts Receivable....Ch. 9 - Bad Debt Expense, Write-Offs, Journal Entry....Ch. 9 - Bad Debt Expense, Aging of Accounts Receivable,...Ch. 9 - Bad Debt Expense, Aging of Accounts Receivable,...Ch. 9 - Bad Debt Expense, Percentage of Accounts...Ch. 9 - Prob. 9.9ECh. 9 - Assigning Receivables, Factoring Receivables....Ch. 9 - Prob. 9.11ECh. 9 - Factoring Receivables with and without Recourse....Ch. 9 - Factoring Receivables without Recourse, Factoring...Ch. 9 - Prob. 9.14ECh. 9 - Prob. 9.15ECh. 9 - Prob. 9.16ECh. 9 - Prob. 9.17ECh. 9 - Prob. 9.18ECh. 9 - Allowance for Uncollectible Accounts, Journal...Ch. 9 - Prob. 9.2PCh. 9 - Prob. 9.3PCh. 9 - Prob. 9.4PCh. 9 - Bad Debt Expense, Aging of Accounts Receivable....Ch. 9 - Bad Debt Expense, Aging of Accounts Receivable,...Ch. 9 - Prob. 9.7PCh. 9 - Prob. 9.8PCh. 9 - Aging of Accounts Receivable, Write-Offs,...Ch. 9 - Disclosure. Using the transactions listed in P9-9,...Ch. 9 - Prob. 9.11PCh. 9 - Prob. 1JCCh. 9 - Prob. 1FSCCh. 9 - Prob. 1SSCCh. 9 - Surfing the Standards Case 2: Costs Associated...Ch. 9 - Prob. 1BCC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What exactly are intangible assets and how are they defined? How are intangible assets different from plant assets?arrow_forwardAnswer this without using chatgtp or AIarrow_forwardNicole is a calendar-year taxpayer who accounts for her business using the cash method. On average, Nicole sends out bills for about $12,000 of her services on the first of each month. The bills are due by the end of the month, and typically 70 percent of the bills are paid on time and 98 percent are paid within 60 days. a. Suppose that Nicole is expecting a 2 percent reduction in her marginal tax rate next year. Ignoring the time value of money, estimate the tax savings for Nicole if she postpones mailing the December bills until January 1 of next year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License