INTER. ACCOUNTING - CONNECT+ALEKS ACCESS

10th Edition

ISBN: 9781264770335

Author: SPICELAND

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 9, Problem 9.4E

Lower of cost or market

• LO9–1

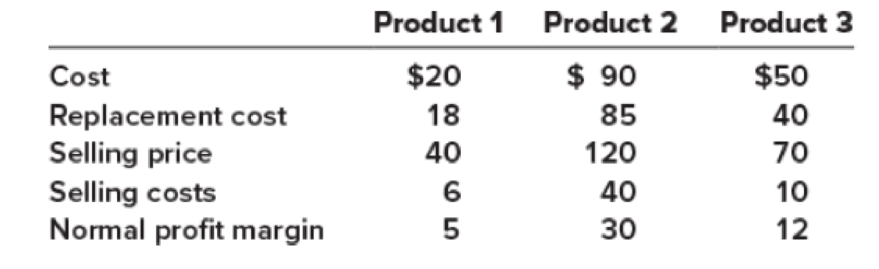

[This is a variation of E 9–1, modified to focus on the lower of cost or market.] Herman Company has three products in its ending inventory. Specific per unit data at the end of the year for each of the products are as follows:

Required:

What unit values should Herman use for each of its products when applying the lower of cost or market (LCM) rule to ending inventory?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you explain this financial accounting question using accurate calculation methods?

Financial accounting

Please provide the answer to this financial accounting question using the right approach.

Chapter 9 Solutions

INTER. ACCOUNTING - CONNECT+ALEKS ACCESS

Ch. 9 - Explain the (a) lower of cost or net realizable...Ch. 9 - What are the various levels of aggregation to...Ch. 9 - Describe the alternative approaches for recording...Ch. 9 - Explain the gross profit method of estimating...Ch. 9 - The Rider Company uses the gross profit method to...Ch. 9 - Explain the retail inventory method of estimating...Ch. 9 - Both the gross profit method and the retail...Ch. 9 - Define each of the following retail terms: initial...Ch. 9 - Explain how to estimate the average cost of...Ch. 9 - Prob. 9.10Q

Ch. 9 - Explain the LIFO retail inventory method.Ch. 9 - Discuss the treatment of freight-in, net markups,...Ch. 9 - Explain the difference between the retail...Ch. 9 - Prob. 9.14QCh. 9 - Prob. 9.15QCh. 9 - Explain the accounting treatment of material...Ch. 9 - Identify any differences between U.S. GAAP and...Ch. 9 - (Based on Appendix 9) Define purchase commitments....Ch. 9 - (Based on Appendix 9) Explain how purchase...Ch. 9 - Lower of cost or net realizable value LO91 Ross...Ch. 9 - Lower of cost or net realizable value LO91 SLR...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Prob. 9.5BECh. 9 - Gross profit method; solving for unknown LO92...Ch. 9 - Retail inventory method; average cost LO93 Kiddie...Ch. 9 - Retail inventory method; LIFO LO93 Refer to the...Ch. 9 - Conventional retail method LO94 Refer to the...Ch. 9 - Conventional retail method LO94 Roberson...Ch. 9 - Lower of cost or net realizable value LO91 Herman...Ch. 9 - Lower of cost or net realizable value LO91 The...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Prob. 9.11ECh. 9 - Concepts; terminology LO91 through LO97 Listed...Ch. 9 - Prob. 9.1PCh. 9 - Prob. 9.3PCh. 9 - Prob. 9.8PCh. 9 - Prob. 9.1DMPCh. 9 - Prob. 9.3DMPCh. 9 - Prob. 9.4DMPCh. 9 - Prob. 9.5DMPCh. 9 - Prob. 9.6DMPCh. 9 - Prob. 9.7DMPCh. 9 - Real World Case 98 Various inventory issues;...Ch. 9 - Prob. 9.9DMPCh. 9 - Judgment Case 910 Inventory errors LO97 Some...Ch. 9 - Prob. 9.12DMPCh. 9 - Prob. 2CCTC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardPlease show me the correct way to solve this financial accounting problem with accurate methods.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forward

- Can you explain the process for solving this financial accounting problem using valid standards?arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forward

- I am trying to find the accurate solution to this financial accounting problem with appropriate explanations.arrow_forwardI need help finding the correct solution to this financial accounting problem with valid methods.arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

INVENTORY & COST OF GOODS SOLD; Author: Accounting Stuff;https://www.youtube.com/watch?v=OB6RDzqvNbk;License: Standard Youtube License