Concept explainers

(a)

Accounting Cycle: The accounting cycle refers to the entire process of recording the accounting transactions of an organization and then processing them. The accounting cycle starts when a transaction takes places and it ends at the time when these transactions are recorded in the financial statements of the company.

To Prepare: the

(a)

Explanation of Solution

Prepare the journal entries for the transactions 1-9.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | |

| 2017 | |||||

| February | 1 | Cash | 12,000 | ||

| Unearned Service Revenue | 12,000 | ||||

| (To record the service revenue received in advance.) | |||||

| February | 1 | Equipment (1) | 9,600 | ||

| Cash | 3,000 | ||||

| Accounts Payable | 6,600 | ||||

| (To record the purchase of computer equipment.) | |||||

| March | 1 | Patents | 9,600 | ||

| Cash | 9,600 | ||||

| (To record the acquisition of patents.) | |||||

| March | 28 | Accounts Receivable | 140,000 | ||

| Service Revenue | 140,000 | ||||

| (To record sales on account.) | |||||

| March | 29 | Cash | 133,000 | ||

| Accounts Receivable | 133,000 | ||||

| (To record the cash collected from customers.) | |||||

| March | 29 | Accounts Payable | 16,370 | ||

| Cash | 16,370 | ||||

| (To record amount paid on accounts payable.) | |||||

| March | 29 | Operating Expenses | 97,525 | ||

| Cash | 97,525 | ||||

| (To record the payment of operating expenses.) | |||||

| March | 31 | Allowance for Doubtful Accounts | 200 | ||

| Accounts Receivable | 200 | ||||

| (To record the writing off receivable) | |||||

| March | 31 |

| 500 | ||

|

| 500 | ||||

| (To record the depreciation expense of the equipment sold.) | |||||

| March | 31 | Cash | 1,620 | ||

| Accumulated Depreciation-Equipment (3) | 8,500 | ||||

| Loss on Disposal of Plant Assets (4) | 880 | ||||

| Equipment | 11,000 | ||||

| (To record the sale of equipment.) | |||||

Table (1)

Working Notes:

Calculate the total amount of equipment.

Calculate the depreciation expense for building.

Calculate the amount of accumulated depreciation for equipment sold on March 31, 2017.

Calculate the amount of gain / (loss) on disposal of equipment.

(e)

To prepare: a

(e)

Explanation of Solution

Prepare a bank reconciliation statement as on March 31, 2017.

| A Corporation | ||

| Bank Reconciliation | ||

| March 31, 2017 | ||

| Particulars | Amount ($) | Amount ($) |

| Cash balance as per bank statement, March 31, 2017 | 64,594 | |

| Add: Deposits in transit | 1,620 | |

| Less: Outstanding Checks | ||

| #440 | 3,444 | |

| #454 | 5,845 | |

| #455 | 3,000 | |

| #456 | 9,600 | (21,889) |

| Adjusted cash balance per bank | 44,325 | |

| Cash balance as per books, March 31, 2017 | $44,425 | |

| Less: Bank Service Charge | 100 | |

| Adjusted cash balance per books | 44,325 | |

Table (2)

(f)

To journalize: the entries related to bank reconciliation and all

(f)

Explanation of Solution

Journalize the entries related to bank reconciliation and all adjusting entries.

| Date | Account Titles and Narration | Post Ref. | Debit ($) | Credit ($) | |

| 2017 | |||||

| March | 31 | Operating Expenses | 100 | ||

| Cash | 100 | ||||

| (To record the payment of operating expenses.) | |||||

| March | 31 | Unearned Service Revenue | 2,000 | ||

| Service Revenue (5) | 2,000 | ||||

| (To record the service revenue earned.) | |||||

| March | 31 |

| 800 | ||

| Allowance for Doubtful Accounts | 800 | ||||

| (To record the bad debt expense) | |||||

| March | 31 | Depreciation Expense (7) | 505 | ||

| Accumulated Depreciation-Equipment | 505 | ||||

| (To record the depreciation expense of the equipment.) | |||||

| March | 31 | Depreciation Expense (8) | 750 | ||

| Accumulated Depreciation-Building | 750 | ||||

| (To record the depreciation expense of the building.) | |||||

| March | 31 | Patent Amortization Expense (9) | 80 | ||

| Patents | 80 | ||||

| (To record the amortization expense ) | |||||

| March | 31 | Income Tax Expense (10) | 12,258 | ||

| Income Taxes Payable | 12,258 | ||||

| (To record the income tax expense.) | |||||

Table (3)

Working notes:

Calculate the service revenue earned as on March 31, 2017.

Calculate the bad debt expense.

Calculate the depreciation expense on equipment.

Calculate the depreciation expense on building.

Calculate the amortization expense for patent purchased on March 1, 2017.

Calculate the amount of income tax expense.

Description

March 31: Record the adjusting entry for operating expense paid in cash

- Operating Expense is an expense and is increased by $100 that decreases the stockholders' equity due to payment of bank service charges. Therefore, Operating Expense account is debited with $100.

- Cash is an asset and is decreased by $100 due to the amount paid of bank service charges in cash. Therefore, Cash account is credited with $100.

March 31: Record the adjusting entry for service revenue earned.

- Unearned Service Revenue is a liability and it decreases by $2,000 due to the service revenue is earned. Therefore, Unearned Service Revenue is debited with $2,000.

- Service Revenue is a component of

Stockholders’ Equity . It is increased by $2,000. Therefore, Service Revenue account is credited with $2,000.

March 31: Record the adjusting entry for bad Debt Expense.

- Bad Debt Expense is an expense that decreases the stockholders’ equity account. It is increased by $800 due to writing off of accounts receivable. Therefore, Bad Debt Expense account is debited with $800.

- Allowance for Doubtful Accounts is a contra asset with a normal credit balance. Its increased value decreases the value of the asset by $800. Therefore, Allowance for Doubtful Accounts account is credited with $800.

March 31: Record the adjusting entry for Depreciation expense for equipment.

- Depreciation expense is an expense, and it decreases the stockholder’s equity by $505. Therefore, Depreciation expense – Equipment is debited with $505.

- Accumulated depreciation is a contra asset with a normal credit balance. It is increased by $505 that decreases the value of assets by $505. Therefore, the Accumulated depreciation-Equipment account is credited with $505.

March 31: Record the adjusting entry for Depreciation expense for building.

- Depreciation expense is an expense, and it decreases the stockholder’s equity by $750. Therefore, Depreciation expense – Building is debited with $750.

- Accumulated depreciation is a contra asset with a normal credit balance. It is increased by $750 that decreases the value of assets by $750. Therefore, the Accumulated depreciation-Building account is credited with $750.

March 31: Record the adjusting entry for amortization expense for patents

- Amortization expense is an expense, and it decreases the stockholder’s equity by $80. Therefore, Amortization Expense is debited with $80.

- Patent is an intangible asset and is decreased by $80 due to amortization. Therefore, Patents account is credited with $80.

March 31: Record the adjusting entry for income tax expense

- Income Tax expense is an expense, and it decreases the stockholder’s equity by $12,258. Therefore, Income Tax Expense is debited with $12,258.

- Income Tax Payable is a liability and is increased by $12,258 due to income tax expense accrued. Therefore, Interest Payable account is credited with $12,258.

(b), (c), & (f)

To post: all the journal entries for transaction 1-9, entries related to bank reconciliation, and the adjusting entries into the T-accounts.

(b), (c), & (f)

Explanation of Solution

Post the all the journal entries for transaction 1-9, entries related to bank reconciliation, and the adjusting entries into the T-accounts to determine the balances of the respective accounts.

Cash is an asset with a normal debit balance.

| Cash Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| December 31, 2016 | Balance | 24,300 | February 1 | Equipment | 3,000 | |

| February 1 | Unearned Service Revenue | 12,000 | March 1 | Patents | 9,600 | |

| March 29 | Accounts Receivable | 133,000 | March 29 | Accounts Payable | 16,370 | |

| March 31 | Equipment | 1,620 | March 29 | Operating Expenses | 97,525 | |

| March 31 | Balance before adjustment | 44,425 | ||||

| March 31,2017 | Total | 170,920 | March 31 | Total | 170,920 | |

| March 31 | Balance before adjustment | 44,425 | March 31 | Adjustment | 100 | |

| March 31 | Ending Balance | 44,325 | ||||

| March 31 | Total | 44,425 | March 31 | Total | 44,425 | |

Table (1)

Accounts Receivable is an asset with a normal debit balance.

| Accounts Receivable Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| December 31, 2016 | Balance | 22,400 | March 29 | Cash | 133,000 | |

| March 28 | Service Revenue | 140,000 | March 31 | Allowance for Doubtful Accounts | 200 | |

| March 31 | Ending Balance | 29,200 | ||||

| March 31,2017 | Total | 162,400 | March 31,2017 | Total | 162,400 | |

Table (2)

Allowance for Doubtful Accounts is an asset with a normal credit balance.

| Allowance for Doubtful Accounts | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| March 31 | Accounts Receivable | 200 | December 31, 2016 | Balance | 1,200 | |

| March 31 | Balance before adjustment | 1,000 | ||||

| March 31,2017 | Total | 1,200 | March 31,2017 | Total | 1,200 | |

| March 31 | Ending Balance | 1,800 | March 31 | Balance before adjustment | 1,000 | |

| March 31 | Adjustment | 800 | ||||

| March 31,2017 | Total | 1,800 | March 31,2017 | Total | 1,800 | |

Table (3)

Equipment is an asset with a normal debit balance.

| Equipment Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| December 31, 2016 | Balance | 20,000 | March 31 | Cash | 1,620 | |

| March 31 | Accumulated Depreciation-Equipment | 8,500 | ||||

| March 31 | Loss on Disposal of Plant Assets | 880 | ||||

| February 1 | Cash | 3,000 | March 31 | Ending Balance | 18,600 | |

| February 1 | Accounts Payable | 6,600 | ||||

| March 31 | Total | 29,600 | March 31 | Total | 29,600 | |

Table (4)

Accumulated Depreciation-Equipment is a contra asset account with a normal credit balance.

| Accumulated Depreciation-Equipment Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| March 31 | Equipment | 8,500 | December 31, 2016 | Balance | 15,000 | |

| March 31 | Balance before adjustment | 7,000 | March 31 | Depreciation expense | 500 | |

| March 31 | Total | 15,500 | March 31 | Total | 15,500 | |

| Mach 31 | Ending Balance | 7,505 | March 31 | Balance before adjustment | 7,000 | |

| March 31 | Adjustment | 505 | ||||

| March 31 | Total | 7,505 | March 31 | Total | 7,505 | |

Table (5)

Land is an asset with a normal debit balance.

| Land Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| December 31, 2016 | Balance | 20,000 | March 31 | Ending Balance | 20,000 | |

| March 31 | Total | 20,000 | March 31 | Total | 20,000 | |

Table (6)

Building is an asset with a normal debit balance.

| Building Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| December 31, 2016 | Balance | 100,000 | March 31 | Ending Balance | 100,000 | |

| March 31 | Total | 100,000 | March 31 | Total | 100,000 | |

Table (7)

Accumulated Depreciation-Building is a contra asset account with a normal credit balance.

| Accumulated Depreciation-Equipment Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| March 31 | Balance before adjustment | 15,000 | December 31, 2016 | Balance | 15,000 | |

| March 31 | Total | 15,000 | March 31 | Total | 15,000 | |

| Mach 31 | Ending Balance | 15,750 | March 31 | Balance before adjustment | 15,000 | |

| March 31 | Adjustment | 750 | ||||

| March 31 | Total | 15,750 | March 31 | Total | 15,750 | |

Table (8)

Patents is an intangible asset account with a normal debit balance.

| Patents Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| March 31 | Balance | 9,600 | March 31 | Balance before adjustment | 9,600 | |

| March 31 | Total | 9,600 | March 31 | Total | 9,600 | |

| March 31 | Balance before adjustment | 9,600 | March 31 | Adjustment | 80 | |

| March 31 | Ending Balance | 9,520 | ||||

| March 31 | Total | 9,600 | March 31 | Total | 9,600 | |

Table (9)

Accounts Payable is a liability with a normal credit balance.

| Accounts Payable Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| March 29 | Cash | 16,370 | December 31, 2016 | Balance | 12,370 | |

| March 31 | Ending Balance | 2,600 | February 1 | Equipment | 6,600 | |

| March 31,2017 | Total | 18,970 | March 31,2017 | Total | 18,970 | |

Table (10)

Unearned Service Revenue is a liability with a normal credit balance.

| Unearned Service Revenue Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| March 31 | Balance before adjustment | 12,000 | February 1 | Service Revenue | 12,000 | |

| March 31,2017 | Total | 12,000 | March 31,2017 | Total | 12,000 | |

| March 31 | Adjustment | 2,000 | March 31 | Balance before adjustment | 12,000 | |

| March 31 | Ending Balance | 10,000 | ||||

| March 31 | Total | 12,000 | March 31 | Total | 12,000 | |

Table (11)

Income Taxes Payable is a liability with a normal credit balance.

| Income Taxes Payable Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| March 31 | Ending Balance | 12,258 | March 31 | Adjustment | 12,258 | |

| March 31,2017 | Total | 12,258 | March 31,2017 | Total | 12,258 | |

Table (12)

Common Stock is a component of stockholders’ equity with a normal credit balance.

| Common Stock Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| March 31 | Ending Balance | 90,000 | December 31,2016 | Balance | 90,000 | |

| March 31,2017 | Total | 90,000 | March 31,2017 | Total | 90,000 | |

Table (13)

| Retained Earnings Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| March 31 | Ending Balance | 53,130 | December 31,2016 | Balance | 53,130 | |

| March 31,2017 | Total | 53,130 | March 31,2017 | Total | 53,130 | |

Table (14)

Service Revenue is a component of stockholders’ equity with a normal credit balance.

| Service Revenue Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| March 31 | Balance before adjustment | 140,000 | March 28 | Accounts Receivable | 140,000 | |

| March 31,2017 | Total | 140,000 | March 31,2017 | Total | 140,000 | |

| March 31 | Ending Balance | 142,000 | March 31 | Balance before adjustment | 140,000 | |

| March 31 | Adjustment | 2,000 | ||||

| March 31,2017 | Total | 142,000 | March 31,2017 | Total | 142,000 | |

Table (15)

Operating Expense is a component of stockholders’ equity with a normal debit balance.

| Operating Expense Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| March 29 | Cash | 97,525 | March 31 | Balance before adjustment | 97,525 | |

| March 31,2017 | Total | 97,525 | March 31,2017 | Total | 97,525 | |

| March 31 | Balance before adjustment | 97,525 | March 31 | Ending Balance | 97,625 | |

| March 31 | Adjustment | 100 | ||||

| March 31,2017 | Total | 97,625 | March 31,2017 | Total | 97,625 | |

Table (16)

Depreciation Expense is a component of stockholders’ equity account with a normal debit balance.

| Depreciation Expense Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| March 31 | Accumulated Depreciation-Equipment | 500 | March 31 | Balance before adjustment | 500 | |

| March 31,2017 | Total | 14,975 | March 31,2017 | Total | 14,975 | |

| March 31 | Balance before adjustment | 500 | March 31 | Ending Balance | 1,755 | |

| March 31 | Adjustment | 505 | ||||

| March 31 | Adjustment | 750 | ||||

| March 31,2017 | Total | 1,755 | March 31,2017 | Total | 1,755 | |

Table (17)

Loss on Disposal of Plant Assets is a component of stockholders’ equity account with a normal debit balance.

| Loss on Disposal Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| March 31 | Equipment | 880 | March 31 | Ending Balance | 880 | |

| January 31,2017 | Total | 880 | January 31,2017 | Total | 880 | |

Table (18)

Amortization Expense is a component of stockholders’ equity account with a normal debit balance.

| Amortization Expense Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| March 31 | Adjustment | 80 | March 31 | Ending Balance | 80 | |

| March 31,2017 | Total | 80 | March 31,2017 | Total | 80 | |

Table (19)

Bad Debt Expense is a component of stockholders’ equity account with a normal debit balance.

| Bad Debt Expense Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| March 31 | Adjustment | 800 | March 31 | Ending Balance | 800 | |

| March 31 | Total | 800 | March 31 | Total | 800 | |

Table (20)

Income Tax Expense is a component of stockholders’ equity account with a normal debit balance.

| Income Tax Expense Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| March 31 | Adjustment | 12,258 | March 31 | Ending Balance | 12,258 | |

| March 31 | Total | 12,258 | March 31 | Total | 12,258 | |

Table (21)

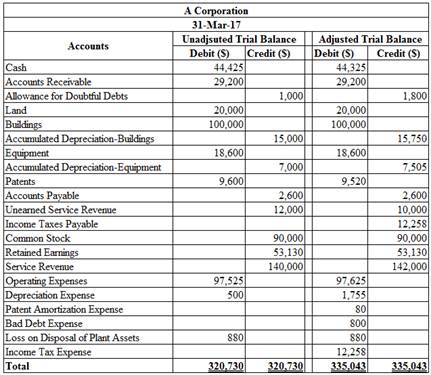

(d) & (g)

To prepare: an unadjusted and an adjusted trial balance at March 31, 2017.

(d) & (g)

Explanation of Solution

Prepare an unadjusted and an adjusted trial balance at March 31, 2017.

Figure (1)

(h)

To prepare: the income statement of A Corporation for the year ended March 31, 2017.

(h)

Explanation of Solution

Prepare the income statement of A Corporation for the year ended March 31, 2017.

| A Corporation | ||

| Income Statement | ||

| For the year ended March 31, 2017 | ||

| Details | Amount ($) | Amount ($) |

| Revenue | ||

| Service Revenue | – | 142,000 |

| Less: Operating Expenses | ||

| Operating Expense | 97,625 | |

| Depreciation Expense | 1,755 | |

| Bad Debt Expense | 800 | |

| Amortization Expense | 80 | |

| Total Operating Expenses | (100,260) | |

| Income from operations | 41,740 | |

| Less: Other expenses and losses | ||

| Loss on Disposal of Plant Assets | (880) | |

| Income before income taxes | 40,860 | |

| Less: Income Tax Expense | (12,258) | |

| Net Income | 28,602 | |

Table (22)

Want to see more full solutions like this?

Chapter 9 Solutions

Financial Accounting 8th Edition

- What is Bobby's 2019 net income using accrual accounting?arrow_forwardJob 786 was one of the many jobs started and completed during the year. The job required $8,400 in direct materials and 35 hours of direct labor time at a total direct labor cost of $9,300. If the job contained five units and the company billed at 70% above the unit product cost on the job cost sheet, what price per unit would have been charged to the customer?arrow_forwardWhat is the company's gross profit?arrow_forward

- MOH Cost: Top Dog Company has a budget with sales of 7,500 units and $3,400,000. Variable costs are budgeted at $1,850,000, and fixed overhead is budgeted at $970,000. What is the budgeted manufacturing cost per unit?arrow_forwardWhat was Ghana's cost of goods sold for 2023?arrow_forwardNeed Answerarrow_forward

- Sameer has $9,800 of net long-term capital gain and $5,200 of net short-term capital loss. This nets out to a: (a) $4,700 net long-term loss (b) $4,600 net long-term gain (c) $4,700 net short-term gain (d) $4,700 short-term loss helparrow_forwardWhat is the adjusted cost of goods sold for the year?arrow_forwardcan you show the step by step i am confused on a partarrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning