Concept explainers

Lower of cost or net realizable value

• LO9–1

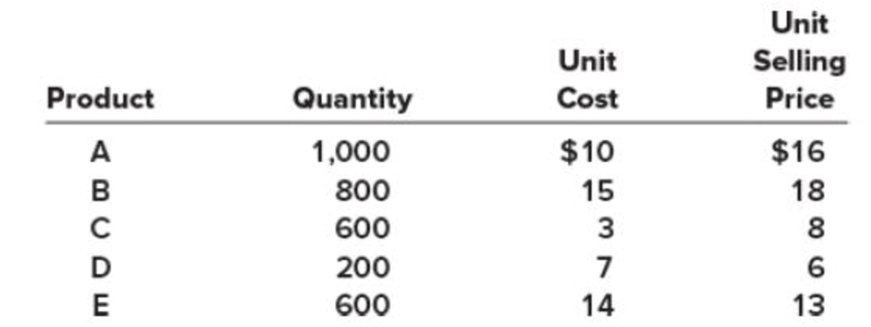

Decker Company has five products in its inventory. Information about the December 31, 2018, inventory follows.

The cost to sell for each product consists of a 15 percent sales commission.

Required:

- 1. Determine the carrying value of inventory at December 31, 2018, assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual products.

- 2. Determine the carrying value of inventory at December 31, 2018, assuming the LCNRV rule is applied to the entire inventory. Also, assuming inventory write-downs are usual business practice for Decker, record any necessary year-end

adjusting entry.

1.

LCM (Lower of Cost or Market) approach: It is an approach that values the inventory at historical cost or lesser than the market replacement cost. The replacement cost refers to the amount that could be realized from the sale of the inventory.

NRV (Net Realizable Value): It refers to an estimated selling price that a company expects to collect in the form of cash from the customers by the sale of inventory. The value is reduced by the expected cost of completion, disposal and transportation. Sales commission and shipping costs also included in the predictable cost.

To Calculate: The carrying value of inventory at December 31, 2018 by using the rule of LCM and NRV.

Explanation of Solution

The following table shows the carrying value of inventory at December 31, 2018 by using the rule of LCM and NRV.

| Lower of Cost or NRV | |||||

| Product | Units | Unit Cost ($) | Cost ($) | NRV ($) | Inventory value ($) |

| (A) | (B) | (A) × (B) | |||

| A | 1,000 | 10 | 10,000 | 13,600 (1) | 10,000 |

| B | 800 | 15 | 12,000 | 12,240 (2) | 12,000 |

| C | 600 | 3 | 1,800 | 4,080 (3) | 1,800 |

| D | 200 | 7 | 1,400 | 1,020 (4) | 1,020 |

| E | 600 | 14 | 8,400 | 6,630 (5) | 6,630 |

| Total | 33,600 | 37,570 | 31,450 | ||

Table (1)

Working Notes:

Calculate the amount of NRV for product A.

Calculate the amount of NRV for product B.

Calculate the amount of NRV for product C.

Calculate the amount of NRV for product D.

Calculate the amount of NRV for product E.

Therefore, the carrying value of inventory at December 31, 2018 by using the rule of LCM and NRV is $31,450.

2.

Explanation of Solution

The total aggregate inventory cost and aggregate inventory net realizable value is $33,600 and $37,570 respectively. Therefore, the carrying value of inventory at December 31, 2018, using the LCNRV rule applied for entire inventory is $33,600. There is no inventory write-downs as the LCNRV is already recorded at cost.

Want to see more full solutions like this?

Chapter 9 Solutions

Connect Access Card for Intermediate Accounting

- On May 31, 2026, Oriole Company paid $3,290,000 to acquire all of the common stock of Pharoah Corporation, which became a division of Oriole. Pharoah reported the following balance sheet at the time of the acquisition: Current assets $846,000 Current liabilities $564,000 Noncurrent assets 2,538,000 Long-term liabilities 470,000 Stockholder's equity 2,350,000 Total assets $3,384,000 Total liabilities and stockholder's equity $3,384,000 It was determined at the date of the purchase that the fair value of the identifiable net assets of Pharoah was $2,914,000. At December 31, 2026, Pharoah reports the following balance sheet information: Current assets $752,000 Noncurrent assets (including goodwill recognized in purchase) 2,256,000 Current liabilities (658,000) Long-term liabilities (470,000) Net assets $1,880,000 It is determined that the fair value of the Pharoah division is $2,068,000.arrow_forwardOn May 31, 2026, Oriole Company paid $3,290,000 to acquire all of the common stock of Pharoah Corporation, which became a division of Oriole. Pharoah reported the following balance sheet at the time of the acquisition: Current assets $846,000 Current liabilities $564,000 Noncurrent assets 2,538,000 Long-term liabilities 470,000 Stockholder's equity 2,350,000 Total assets $3,384,000 Total liabilities and stockholder's equity $3,384,000 It was determined at the date of the purchase that the fair value of the identifiable net assets of Pharoah was $2,914,000. At December 31, 2026, Pharoah reports the following balance sheet information: Current assets $752,000 Noncurrent assets (including goodwill recognized in purchase) 2,256,000 Current liabilities (658,000) Long-term liabilities (470,000) Net assets $1,880,000 It is determined that the fair value of the Pharoah division is $2,068,000.arrow_forwardThe following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025. 1.) Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business. 2.) Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. 3.) In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years. 4.) Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029. 5.) Oriole incurred $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining unamortized cost of…arrow_forward

- Reffering to fair value of an asset, division, or organization, What exactly is fair value and how is it assessed?arrow_forwardThe following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025. 1.) Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business. 2.) Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. 3.) In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years. 4.) Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029. Oriole incurred 5.) $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining unamortized cost of…arrow_forwardNonearrow_forward

- I need help solving this general accounting question with the proper methodology.arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education