Accounting (Text Only)

26th Edition

ISBN: 9781285743615

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 9.19EX

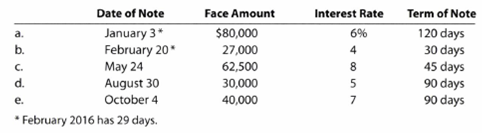

Determine due date and interest on notes

Determine the due date and the amount of interest due at maturity on the following notes dated in 2016:

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

I need help with this financial accounting problem using proper accounting guidelines.

Ingram Fabrication applies manufacturing overhead to jobs based on machine hours used. Overhead costs are expected to total $294,000 for the year, and machine usage is estimated at 126,000 hours. For the year, $342,720 of overhead costs are incurred, and 132,800 machine hours are used. Requirement: Compute the budgeted and actual manufacturing overhead rates for the year. (Round answers to 2 decimal places.)

None

Chapter 9 Solutions

Accounting (Text Only)

Ch. 9 - What are the three classifications of receivables?Ch. 9 - Dans Hardware is a small hardware store in the...Ch. 9 - What kind of an account (asset, liability, etc.)...Ch. 9 - After the accounts are adjusted and closed at the...Ch. 9 - A firm has consistently adjusted its allowance...Ch. 9 - Which of the two methods of estimating...Ch. 9 - Neptune Company issued a note receivable to...Ch. 9 - If a note provides for payment of principal of...Ch. 9 - The maker of a 240,000, 6%, 90-day note receivable...Ch. 9 - The note receivable dishonored in Discussion...

Ch. 9 - Prob. 9.1APECh. 9 - Direct write-off method Journalize the following...Ch. 9 - Allowance method Journalize the following...Ch. 9 - Allowance method Journalize the following...Ch. 9 - Percent of sales method At the end of the current...Ch. 9 - Percent of sales method At the end of the current...Ch. 9 - Analysis of receivables method At the end of the...Ch. 9 - Analysis of receivables method At the end of the...Ch. 9 - Note receivable Guzman Company received a 60-day,...Ch. 9 - Note receivable Prefix Supply Company received a...Ch. 9 - Prob. 9.6APECh. 9 - Prob. 9.6BPECh. 9 - Prob. 9.1EXCh. 9 - Nature of uncollectible accounts MGM Resorts...Ch. 9 - Entries for uncollectible accounts, using direct...Ch. 9 - Entries for uncollectible receivables, using...Ch. 9 - Entries to write off accounts receivable Creative...Ch. 9 - Providing for doubtful accounts At the end of the...Ch. 9 - Number of days past due Toot Auto Supply...Ch. 9 - Aging of receivables schedule The accounts...Ch. 9 - Estimating allowance for doubtful accounts Waddell...Ch. 9 - Adjustment for uncollectible accounts Using data...Ch. 9 - Estimating doubtful accounts Selbys Bike Co. is a...Ch. 9 - Entry for uncollectible accounts Using the data in...Ch. 9 - Entries for bad debt expense under the direct...Ch. 9 - Entries for bad debt expense under the direct...Ch. 9 - Effect of doubtful accounts on net income During...Ch. 9 - Effect of doubtful accounts on net income Using...Ch. 9 - Entries for bad debt expense under the direct...Ch. 9 - Entries for bad debt expense under the direct...Ch. 9 - Determine due date and interest on notes Determine...Ch. 9 - Entries for notes receivable Master Designs...Ch. 9 - Entries for notes receivable The series of seven...Ch. 9 - Entries for notes receivable, including year-end...Ch. 9 - Entries for receipt and dishonor of note...Ch. 9 - Entries for receipt and dishonor of notes...Ch. 9 - Prob. 9.25EXCh. 9 - Accounts receivable turnover and days sales in...Ch. 9 - Prob. 9.27EXCh. 9 - Prob. 9.28EXCh. 9 - Prob. 9.29EXCh. 9 - Entries related to uncollectible accounts The...Ch. 9 - Aging of receivables; estimating allowance for...Ch. 9 - Compare two methods of accounting for...Ch. 9 - Details of notes receivable and related entries...Ch. 9 - Notes receivable entries The following data relate...Ch. 9 - Sales and notes receivable transactions The...Ch. 9 - Entries related to uncollectible accounts The...Ch. 9 - Aging of receivables; estimating allowance for...Ch. 9 - Compare two methods of accounting for...Ch. 9 - Details of notes receivable and related entries...Ch. 9 - Notes receivable entries The following data relate...Ch. 9 - Sales and notes receivable transactions The...Ch. 9 - Prob. 9.1CPCh. 9 - Estimate uncollectible accounts For several years,...Ch. 9 - Prob. 9.3CPCh. 9 - Prob. 9.4CPCh. 9 - Accounts receivable turnover and days sales in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What characterizes modified unit attribution in cost structures? (a) Complexity adds no value (b) Cost drivers reflect multi-level operational relationships (c) Attribution remains constant (d) Single drivers explain all costs helparrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forwardTaxpayer has a warehouse where she acquired equipment for $24,000. Over time, depreciation of $13,500 was claimed. In the current year, taxpayer sells the asset for $28,000. What is the amount and nature of the gain/loss from the sale? a. $13,500 of ordinary income, $4,000 long-term capital gain b. $17,500 ordinary income c. $4,000 of ordinary income, $13,500 long-term capital gain d. $17,500 long-term capital gain need helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

7.2 Ch 7: Notes Payable and Interest, Revenue recognition explained; Author: Accounting Prof - making it easy, The finance storyteller;https://www.youtube.com/watch?v=wMC3wCdPnRg;License: Standard YouTube License, CC-BY