Concept explainers

(LO9–2, LO9–8)

On January 1, 2018, the general ledger of Freedom Fireworks includes the following account balances:

| Accounts | Debit | Credit |

| Cash | $ 11,200 | |

| 34,000 | ||

| Allowance for Uncollectible Accounts | $ 1,800 | |

| Inventory | 152,000 | |

| Land | 67,300 | |

| Buildings | 120,000 | |

| 9,600 | ||

| Accounts Payable | 17,700 | |

| Common Stock | 200,000 | |

| 155,400 | ||

| Totals | $384,500 | $384,500 |

During January 2018, the following transactions occur.

January 1 Borrow $100,000 from Captive Credit Corporation. The installment note bears interest at 7% annually and matures in 5 years. Payments of $1,980 are required at the end of each month for 60 months.

January 4 Receive $31,000 from customers on accounts receivable.

January 10 Pay cash on accounts payable, $11,000.

January 15 Pay cash for salaries, $28,900.

January 30 Firework sales for the month total $195,000. Sales include $65,000 for cash and $130,000 on account. The cost of the units sold is $112,500.

January 31 Pay the first monthly installment of $1,980 related to the $100,000 borrowed on January 1. Round your interest calculation to the nearest dollar.

Required:

1. Record each of the transactions listed above.

2. Record

a. Depreciation on the building for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a service life of 10 wars and a residual value of $24,000.

b. At the end of January, $3,000 of accounts receivable are past due, and the company estimates that 50% of these accounts will not be collected. Of the remaining accounts receivable, the company estimates that 2% will not be collected. No accounts were written off as uncollectible in January.

c. Unpaid salaries at the end of January are $26,100.

d. Accrued income taxes at the end of January are $8,000.

3. Prepare an adjusted

4. Prepare a multiple-step income statement for the period ended January 31, 2018.

5. Prepare a classified

6. Record closing entries.

7. Analyze the following for Freedom Fireworks:

a. Calculate the debt to equity ratio. If the average debt to equity ratio for the industry is 1.0, is Freedom Fireworks more or less leveraged than other companies in the same industry?

b. Calculate the times interest earned ratio. If the average times interest earned ratio for the industry is 20 times, is the company more or less able to meet interest payments than other companies in the same industry?

c. Based on the ratios calculated in (a) and (b), would Freedom Fireworks be more likely to receive a higher or lower interest rate than the average borrowing rate in the industry?

1.

To record: The journal entries for given transactions.

Explanation of Solution

Journal:

Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

The journal entries for given transactions of FF are as follows:

| Date | Account titles and Explanation | Debit | Credit |

| January 1 | Cash | $100,000 | |

| Notes payable | $100,000 | ||

| (To record issuance of notes payable) | |||

| Date | Account titles and Explanation | Debit | Credit |

| January 4 | Cash | $31,000 | |

| Accounts receivable | $31,000 | ||

| (To record cash received on account) | |||

| Date | Account titles and Explanation | Debit | Credit |

| January 11 | Accounts payable | $11,000 | |

| Cash | $11,000 | ||

| (To record cash payment made on account) | |||

| Date | Account titles and Explanation | Debit | Credit |

| January 15 | Salaries expense | $28,900 | |

| Cash | $28,900 | ||

| (To record cash payment made for salaries) | |||

| Date | Account titles and Explanation | Debit | Credit |

| January 30 | Cash | $65,000 | |

| Accounts receivable | $130,000 | ||

| Sales revenue | $195,000 | ||

| (To record inventory sold for cash and an account) | |||

| Date | Account titles and Explanation | Debit | Credit |

| January 30 | Cost of goods sold | $112,500 | |

| Inventory | $112,500 | ||

| (To record cost of merchandise inventory sold) | |||

| Date | Account titles and Explanation | Debit | Credit |

| January 31 | Interest expense | $583 | |

| Notes payable | $1,397 | ||

| Cash | $1,980 | ||

| (To record payment of monthly installment note) |

Table (1)

2.

To record: The given adjusting entries of FF.

Explanation of Solution

Adjusting entries:

Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. The purpose of adjusting entries is to adjust the revenue, and the expenses during the period in which they actually occurs.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Adjusting entries of FF are as follows:

| Date | Account titles and Explanation | Debit | Credit |

| January 31 | Depreciation expenses (1) | $800 | |

| Accumulated depreciation | $800 | ||

| (To record Depreciation expense) | |||

| Date | Account titles and Explanation | Debit | Credit |

| January 31 | Bad debt expense | $2,300 | |

| Allowance for uncollectible Accounts | $2,300 | ||

| (To record uncollectible accounts) | |||

| Date | Account titles and Explanation | Debit | Credit |

| January 31 | Salaries expense | $26,100 | |

| Salaries payable | $26,100 | ||

| (To record salaries payable) | |||

| Date | Account titles and Explanation | Debit | Credit |

| January 31 | Income tax expense | $8,000 | |

| Income tax payable | $8,000 | ||

| (To record income tax expenses) |

Table (2)

Working Notes:

a.

Calculate the depreciation on the equipment.

b.

Calculate the bad debt expense.

3.

To Prepare: Adjusted trial balance for the month January 31, 2018.

Explanation of Solution

| Adjusted Trail Balance | ||

| January 31, 2018 | ||

| Accounts | Debit | Credit |

| Cash | $165,320 | |

| Accounts receivable | $133,000 | |

| Allowance for uncollectible accounts | $4,100 | |

| Inventory | $39,500 | |

| Land | $67,300 | |

| Buildings | $120,000 | |

| Accumulated depreciation | $10,400 | |

| Accounts payable | $6,700 | |

| Salaries payable | $26,100 | |

| Income tax payable | $8,000 | |

| Notes payable | $98,603 | |

| Common stock | $200,000 | |

| Retained earnings | $155,400 | |

| Sales revenue | $195,000 | |

| Cost of goods sold | $112,500 | |

| Salaries expense | $55,000 | |

| Bad debt expense | $2,300 | |

| Depreciation expense | $800 | |

| Interest expense | $583 | |

| Income tax expense | $8,000 | |

| Total | $704,303 | $704,303 |

Table (3)

Calculation of adjusted trial balance of FF for the month January:

| Accounts | Ending Balance |

| |

| Cash | $165,320 | = |

|

| Accounts Receivable | $133,000 | = |

|

| Allowance for uncollectible accounts | $4,100 | = |

|

| Inventory | $39,500 | = |

|

| Land | $67,300 | = | $67,300 |

| Buildings | $120,000 | = | $120,000 |

| Accumulated Depreciation | $10,400 | = |

|

| Accounts Payable | $6,700 | = |

|

| Salaries payable | $26,100 | = |

|

| Income Tax Payable | $8,000 | = | $8,000 |

| Notes Payable | $98,603 | = |

|

| Common Stock | $200,000 | = | $200,000 |

| Retained Earnings | $155,400 | = | $155,400 |

| Sales Revenue | $195,000 | = |

|

| Cost of Goods Sold | $112,500 | = |

|

| Salaries Expense | $55,000 | = |

|

| Bad Debt Expense | $2,300 | = | $2,300 |

| Depreciation Expense | $800 | = | $800 |

| Interest Expense | $583 | = | $583 |

| Income Tax Expense | $8,000 | = | $8,000 |

(Table 4)

4.

To Prepare: the multiple income statement for the period ended January 31, 2018.

Explanation of Solution

| FF | ||

| Multiple - Step Income Statement | ||

| For the Year month ended January 31, 2018 | ||

| Sales revenue | $195,000 | |

| Less: Cost of goods sold | $112,500 | |

| Gross profit | $82,500 | |

| Less: Operating expenses: | ||

| Salaries expenses | $55,000 | |

| Bad debt expenses | $2,300 | |

| Depreciation expenses | $800 | |

| Total operating expenses | $58,100 | |

| Operating income | $24,400 | |

| Less: Interest expenses | $583 | |

| Income before taxes | $23,817 | |

| Less: Income tax expense | $8,000 | |

| Net income | $15,817 | |

Table (5)

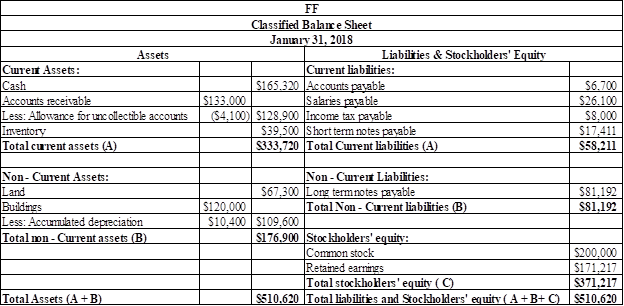

5.

To Prepare: classified balance sheet as on January 31, 2018.

Explanation of Solution

Figure (1)

Working Notes:

6.

To Record: the closing entries.

Explanation of Solution

| Date | Account titles and Explanation | Debit | Credit |

| January 31, 2018 | Sales revenue | $195,000 | |

| Retained earnings | $195,000 | ||

| (To record the closing revenue accounts) | |||

| Date | Account titles and Explanation | Debit | Credit |

| January 31, 2018 | Retained earnings | $179,183 | |

| Cost of goods sold | $112,500 | ||

| Salaries expense | $55,000 | ||

| Bad debt expense | $2,300 | ||

| Depreciation expense | $800 | ||

| Interest expense | $583 | ||

| Income tax expense | $8,000 | ||

| (To record the closing expenses accounts) |

Table (6)

7. a

To Calculate: the debt to equity ratio at the end of January.

Explanation of Solution

Calculate the debt to equity ratio at the end of January.

FF has liquidity less than the average level required by industry. They have low portion of total liabilities to meet out their total stockholders ‘equity which is comparatively lesser than the industry average of 1.0.

b.

To Calculate: the times interest earned ratio at the end of January.

Explanation of Solution

Calculate the times interest earned ratio at the end of January.

FF has more able to meet interest payments than other companies in the same industry, since, FF has (41.9 times) more than the industry average of (20 times).

c.

To Indicate: whether the revised ratio would increase, decrease or remain unchanged compared to the requirement a and b.

Explanation of Solution

Based on the debt to equity ratio and times interest earned ratio, FF would likely receive lesser interest rate than the average borrowing rate in the industry. Because, FF conveys lesser debt than the industry average and is capable to meet interest payments than the average company in the industry.

Want to see more full solutions like this?

Chapter 9 Solutions

Financial Accounting

- Can you solve this financial accounting question using valid financial methods?arrow_forwardI am searching for the accurate solution to this financial accounting problem with the right approach.arrow_forwardPlease provide the accurate answer to this financial accounting problem using valid techniques.arrow_forward

- Please provide the correct answer to this financial accounting problem using valid calculations.arrow_forwardI need help with this financial accounting question using the proper financial approach.arrow_forwardCan you solve this financial accounting problem using appropriate financial principles?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education