Multiple-Choice Questions on Preferred Stock Ownership

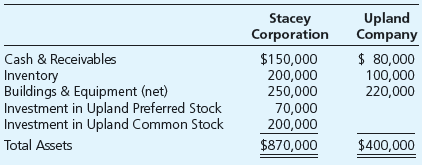

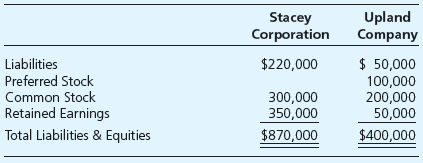

Stacey Corporation owns 80 percent of the common shares and 70 percent of the

The preferred stock issued by Upland pays a 10 percent dividend and is cumulative. For 20X2, Upland reports net income of $30,000 and pays no dividends. Stacey reports income from its separate operations of $100,000 and pays dividends of $40,000 during 20X2.

Required

Select the correct answer for each of the following questions.

What amount of income is attributable to the controlling interest for 20X2?

- $116,000.

- $123,000.

- $124,000.

- $130,000.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Advanced Financial Accounting