Multiple-Choice Questions on Preferred Stock Ownership

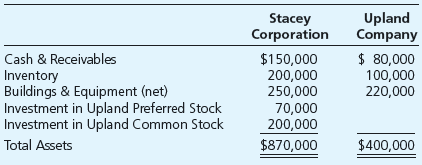

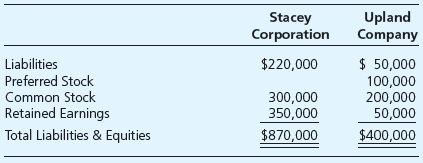

Stacey Corporation owns 80 percent of the common shares and 70 percent of the

The preferred stock issued by Upland pays a 10 percent dividend and is cumulative. For 20X2, Upland reports net income of $30,000 and pays no dividends. Stacey reports income from its separate operations of $100,000 and pays dividends of $40,000 during 20X2.

Required

Select the correct answer for each of the following questions.

Total noncontrolling interest reported in the consolidated

- $30,000.

- $50,000.

- $70,000.

- $80,000.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

LOOSE-LEAF Advanced Financial Accounting with Connect

- Joe transferred land worth $200,000, with a tax basis of $40,000, to JH Corporation, an existing entity, for 100 shares of its stock. JH Corporation has two other shareholders, Ethan and Young, each of whom holds 100 shares. With respect to the transfer:a. Joe has no recognized gain. b. JH Corporation has a basis of $160,000 in the land.c. Joe has a basis of $200,000 in his 100 shares in JH Corporation. d. Joe has a basis of $40,000 in his 100 shares in JH Corporation. e. None of the above.arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forward

- accounting question?arrow_forwardThree individuals form JEY Corporation with the following contributions: Joe, cash of $50,000 for 50 shares; Ethan, land worth $20,000 (basis of $11,000) for 20 shares; and Young, cattle worth $9,000 (basis of $6,000) for 9 shares and services worth $21,000 for 21 shares. a. These transfers are fully taxable and not subject to § 351. b. Young’s basis in her stock is $27,000. c. Young’s basis in her stock is $6,000. d. Ethan’s basis in his stock is $20,000. e. None of the above.arrow_forwardNonearrow_forward