ACCOUNTING,CHAP.1-13

26th Edition

ISBN: 9781305088412

Author: WARREN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 9.12EX

Entry for uncollectible accounts

Using the data in Exercise 9-11, assume that the allowance for doubtful accounts for Selby’s Bike Co. had a debit balance of $7,200 as of December 31, 2016.

Journalize the

EX 9-11 Estimating doubtful accounts OBJ. 4

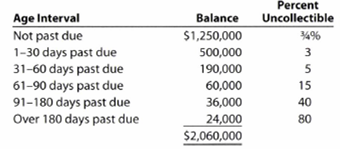

Selby’s Bike Co. is a wholesaler of motorcycle supplies. An aging of the company’s

Estimate what the proper balance of the allowance for doubtful accounts should be as of December 31, 2016.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

General Account Questions Answer Want

?

i need this question answer General accounting

Chapter 9 Solutions

ACCOUNTING,CHAP.1-13

Ch. 9 - What are the three classifications of receivables?Ch. 9 - Dans Hardware is a small hardware store in the...Ch. 9 - What kind of an account (asset, liability, etc.)...Ch. 9 - After the accounts are adjusted and closed at the...Ch. 9 - A firm has consistently adjusted its allowance...Ch. 9 - Which of the two methods of estimating...Ch. 9 - Neptune Company issued a note receivable to...Ch. 9 - If a note provides for payment of principal of...Ch. 9 - The maker of a 240,000, 6%, 90-day note receivable...Ch. 9 - The note receivable dishonored in Discussion...

Ch. 9 - Prob. 9.1APECh. 9 - Direct write-off method Journalize the following...Ch. 9 - Allowance method Journalize the following...Ch. 9 - Allowance method Journalize the following...Ch. 9 - Percent of sales method At the end of the current...Ch. 9 - Percent of sales method At the end of the current...Ch. 9 - Analysis of receivables method At the end of the...Ch. 9 - Analysis of receivables method At the end of the...Ch. 9 - Note receivable Guzman Company received a 60-day,...Ch. 9 - Note receivable Prefix Supply Company received a...Ch. 9 - Prob. 9.6APECh. 9 - Prob. 9.6BPECh. 9 - Prob. 9.1EXCh. 9 - Nature of uncollectible accounts MGM Resorts...Ch. 9 - Entries for uncollectible accounts, using direct...Ch. 9 - Entries for uncollectible receivables, using...Ch. 9 - Entries to write off accounts receivable Creative...Ch. 9 - Providing for doubtful accounts At the end of the...Ch. 9 - Number of days past due Toot Auto Supply...Ch. 9 - Aging of receivables schedule The accounts...Ch. 9 - Estimating allowance for doubtful accounts Waddell...Ch. 9 - Adjustment for uncollectible accounts Using data...Ch. 9 - Estimating doubtful accounts Selbys Bike Co. is a...Ch. 9 - Entry for uncollectible accounts Using the data in...Ch. 9 - Entries for bad debt expense under the direct...Ch. 9 - Entries for bad debt expense under the direct...Ch. 9 - Effect of doubtful accounts on net income During...Ch. 9 - Effect of doubtful accounts on net income Using...Ch. 9 - Entries for bad debt expense under the direct...Ch. 9 - Entries for bad debt expense under the direct...Ch. 9 - Determine due date and interest on notes Determine...Ch. 9 - Entries for notes receivable Master Designs...Ch. 9 - Entries for notes receivable The series of seven...Ch. 9 - Entries for notes receivable, including year-end...Ch. 9 - Entries for receipt and dishonor of note...Ch. 9 - Entries for receipt and dishonor of notes...Ch. 9 - Prob. 9.25EXCh. 9 - Accounts receivable turnover and days sales in...Ch. 9 - Prob. 9.27EXCh. 9 - Prob. 9.28EXCh. 9 - Prob. 9.29EXCh. 9 - Entries related to uncollectible accounts The...Ch. 9 - Aging of receivables; estimating allowance for...Ch. 9 - Compare two methods of accounting for...Ch. 9 - Details of notes receivable and related entries...Ch. 9 - Notes receivable entries The following data relate...Ch. 9 - Sales and notes receivable transactions The...Ch. 9 - Entries related to uncollectible accounts The...Ch. 9 - Aging of receivables; estimating allowance for...Ch. 9 - Compare two methods of accounting for...Ch. 9 - Details of notes receivable and related entries...Ch. 9 - Notes receivable entries The following data relate...Ch. 9 - Sales and notes receivable transactions The...Ch. 9 - Prob. 9.1CPCh. 9 - Estimate uncollectible accounts For several years,...Ch. 9 - Prob. 9.3CPCh. 9 - Prob. 9.4CPCh. 9 - Accounts receivable turnover and days sales in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject - General accountarrow_forwardDetermine the predetermined overhead ratearrow_forwardFor a recent period, the balance sheet for Costco Wholesale Corporation reported accrued expenses of $1,720 million. For the same period, Costco reported income before income taxes of $1,714 million. Assume that the adjusting entry for $1,720 million of accrued expenses was not recorded at the end of the current period. What would have been the income (loss) before income taxes?arrow_forward

- Kindly help me with general accounting questionarrow_forwardcan you help me with this General accounting questionarrow_forwardSummit Manufacturing produces a product that requires 8.5 standard hours per unit at a standard hourly rate of $16.50 per hour. If 4,500 units required 39,200 hours at an hourly rate of $16.20 per hour, compute the following: (a) Direct Labor Rate Variance (b) Direct Labor Time Variance (c) Direct Labor Cost Variancearrow_forward

- Brahma Manufacturing uses a job order cost system and applies overhead based on estimated rates. The overhead application rate is based on total estimated overhead costs of $310,000 and direct labor hours of 10,500. During the month of March 2022, actual direct labor hours of 11,200 were incurred. Use this information to determine the amount of factory overhead that was applied in March. (Round the answer to the nearest whole dollar.)helparrow_forwardThe records of Tillman Corporation's initial and unaudited accounts show the following ending inventory balances, which must be adjusted to actual costs: Units Unaudited Costs Work-in-process inventory 53,500 $ 352,880 Finished goods inventory 20,500 129,650 As the auditor, you have learned the following information. Ending work-in-process inventory is 35 percent complete with respect to conversion costs. Materials are added at the beginning of the manufacturing process, and overhead is applied at the rate of 90 percent of the direct labor costs. There was no finished goods inventory at the start of the period. The following additional information is also available: Units Costs Direct Materials Direct Labor Beginning inventory (25% complete as to labor) 32,000 $ 118,840 $ 16,440 Units started 118,000 Current costs 537,060 221,600 Units completed and transferred to finished goods inventory 96,500 Required: Prepare a production cost report for…arrow_forwardGeneral Accountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License