Concept explainers

Adjustment for uncollectible accounts

Using data in Exercise 9-9, assume that the allowance for doubtful accounts for Waddell Industries has a credit balance of $6,350 before adjustment on August 31. Journalize the

Reference:

EX 9-9 Estimating allowance for doubtful accounts OBJ. 4

Waddell Industries has a past history of uncollectible accounts, as follows. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule you completed in Exercise 9-8.

| Age Class | Percent Uncollectible |

| Not past due | 3% |

| 1-30 days past due | 4 |

| 31-60 days past due | 15 |

| 61-90 days past due | 35 |

| Over 90 days past due | 80 |

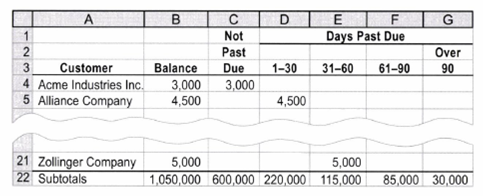

EX 9-8 Aging of receivables schedule OBJ. 4

The

The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals:

| Customer | Balance | Due Date |

| Builders Industries | $44,500 | May 1 |

| Elkhorn Company | 21,000 | June 20 |

| Granite Creek Inc. | 7,500 | July 13 |

| Lockwood Company | 14,000 | September 9 |

| Teton Company | 13,000 | August 7 |

a. Determine the number of days past due for each of the preceding accounts as of August 31.

b. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.

Trending nowThis is a popular solution!

Chapter 9 Solutions

2 Semester Cengage Now, Warren Accounting

- ?? Financial accountingarrow_forwardA firm has a market value equal to its book value. Currently, the firm has excess cash of $1,000, other assets of $5,500, and equity of $6,500. The firm has 650 shares of stock outstanding and a net income of $600. The firm has decided to spend half of its excess cash on a share repurchase program. How many shares of stock will be outstanding after the stock repurchase is completed? a. 625 shares b. 640 shares c. 600 shares d. 630 shares e. 615 sharesarrow_forwardProvide correct answer general accounting questionarrow_forward

- answer plzarrow_forwardThe controller of Afton Manufacturing has collected the following monthly expense data for use in analyzing the cost behavior of maintenance costs: ⚫ January: $2,800 and 3,500 machine hours • February: $3,200 and 4,200 machine hours ⚫ March: $3,800 and 6,000 machine hours ⚫ April: $4,500 and 7,500 machine hours • May: $3,600 and 5,200 machine hours • June: $5,200 and 7,000 machine hours Using the high-low method, determine the estimated fixed cost element and the variable cost per unit of machine hour.arrow_forwardSubject general accountingarrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage