Concept explainers

Adjustment for uncollectible accounts

Using data in Exercise 9-9, assume that the allowance for doubtful accounts for Waddell Industries has a credit balance of $6,350 before adjustment on August 31. Journalize the

Reference:

EX 9-9 Estimating allowance for doubtful accounts OBJ. 4

Waddell Industries has a past history of uncollectible accounts, as follows. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule you completed in Exercise 9-8.

| Age Class | Percent Uncollectible |

| Not past due | 3% |

| 1-30 days past due | 4 |

| 31-60 days past due | 15 |

| 61-90 days past due | 35 |

| Over 90 days past due | 80 |

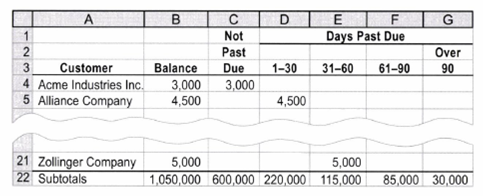

EX 9-8 Aging of receivables schedule OBJ. 4

The

The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals:

| Customer | Balance | Due Date |

| Builders Industries | $44,500 | May 1 |

| Elkhorn Company | 21,000 | June 20 |

| Granite Creek Inc. | 7,500 | July 13 |

| Lockwood Company | 14,000 | September 9 |

| Teton Company | 13,000 | August 7 |

a. Determine the number of days past due for each of the preceding accounts as of August 31.

b. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.

Trending nowThis is a popular solution!

Chapter 9 Solutions

Working Papers, Chapters 1-17 for Warren/Reeve/Duchac's Accounting, 26th and Financial Accounting, 14th

- Hello tutor please provide correct answer general accounting question with correct solution do fastarrow_forwardI want to this question answer for General accounting question not need ai solutionarrow_forwardPlease given correct answer for General accounting question I need step by step explanationarrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage