1.

Compute the issue price of bonds and complete the first three rows of an amortization schedule, if the market interest rate is 6% and the bonds issue at face amount.

1.

Explanation of Solution

Bonds are a kind of interest bearing notes payable, usually issued by companies, universities and governmental organizations. It is a debt instrument used for the purpose of raising fund of the corporations or governmental agencies. If selling price of the bond is equal to its face value, it is called as par on bond. If selling price of the bond is lesser than the face value, it is known as discount on bond. If selling price of the bond is greater than the face value, it is known as premium on bond.

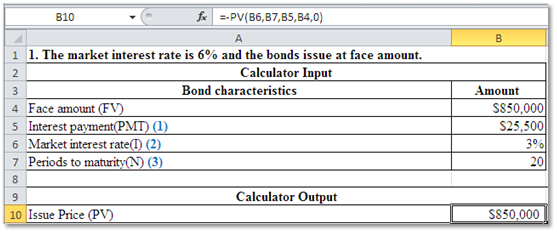

Determine the issue price of bonds.

Figure (1)

Prepare amortization schedule.

| Amortization Schedule | ||||

|

Date (1) |

Cash paid (2) |

Interest expense (3) |

Increase in carrying value (4) |

Carrying value (5) |

| 2018 | ||||

| January 01 | $850,000 | |||

| June 30 | $25,500 | $25,500 | $0 | $850,000 |

| December 31 | $25,500 | $25,500 | $0 | $850,000 |

Table (1)

Working Notes:

Determine the amount of Interest Payment (PMT).

Determine the amount of Market interest rate (I).

Determine the amount of periods to maturity (N).

2.

Compute the issue price of bonds and complete the first three rows of an amortization schedule, if the market interest rate is 7% and the bonds issue at a discount.

2.

Explanation of Solution

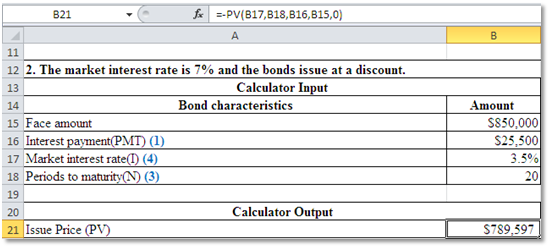

Determine the issue price of bonds.

Figure (2)

Prepare amortization schedule.

| Amortization Schedule | ||||

|

Date (1) |

Cash paid (2) |

Interest expense (3) |

Increase in carrying value (4) |

Carrying value (5) |

| 2018 | ||||

| January 01 | $789,597 | |||

| June 30 | $25,500 | $27,636 | $2,136 | $791,733 |

| December 31 | $25,500 | $27,711 | $2,211 | $793,944 |

Table (2)

Working note:

Determine the amount of Market interest rate (I).

3.

Compute the issue price of bonds and complete the first three rows of an amortization schedule, if the market interest rate is 5% and the bonds issue at a premium.

3.

Explanation of Solution

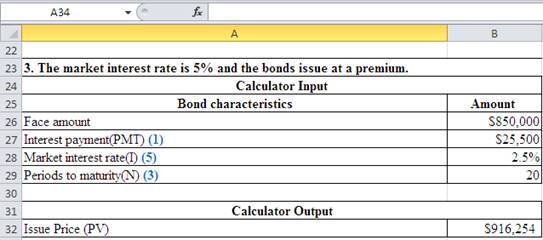

Determine the issue price of bonds.

Figure (3)

Prepare amortization schedule.

| Amortization Schedule | ||||

|

Date (1) |

Cash paid (2) |

Interest expense (3) |

Decrease in carrying value (4) |

Carrying value (5) |

| 2018 | ||||

|

January 01 | $916,254 | |||

| June 30 | $25,500 | $22,906 | $2,594 | $913,660 |

| December 31 | $25,500 | $27,711 | $2,658 | $911,002 |

Table (3)

Working note:

Determine the amount of Market interest rate (I).

Want to see more full solutions like this?

Chapter 9 Solutions

FINANCIAL ACCOUNTING

- On November 10 of year 1, Javier purchased a building, including the land it was on, to assemble his new equipment. The total cost of the purchase was $1,200,000; $300,000 was allocated to the basis of the land, and the remaining $900,000 was allocated to the basis of the building. (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. Problem 10-51 Part e (Static) e. What would be the depreciation for 2024, 2025, and 2026 if the property were nonresidential property purchased and placed in service November 10, 2007 (assume the same original basis)?arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardCan you explain the process for solving this general accounting question accurately?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education