1.

Compute the issue price of bonds and complete the first three rows of an amortization schedule, if the market interest rate is 6% and the bonds issue at face amount.

1.

Explanation of Solution

Bonds are a kind of interest bearing notes payable, usually issued by companies, universities and governmental organizations. It is a debt instrument used for the purpose of raising fund of the corporations or governmental agencies. If selling price of the bond is equal to its face value, it is called as par on bond. If selling price of the bond is lesser than the face value, it is known as discount on bond. If selling price of the bond is greater than the face value, it is known as premium on bond.

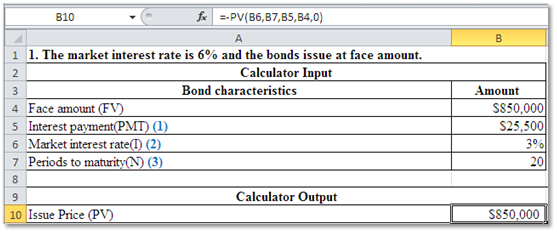

Determine the issue price of bonds.

Figure (1)

Prepare amortization schedule.

| Amortization Schedule | ||||

|

Date (1) |

Cash paid (2) |

Interest expense (3) |

Increase in carrying value (4) |

Carrying value (5) |

| 2018 | ||||

| January 01 | $850,000 | |||

| June 30 | $25,500 | $25,500 | $0 | $850,000 |

| December 31 | $25,500 | $25,500 | $0 | $850,000 |

Table (1)

Working Notes:

Determine the amount of Interest Payment (PMT).

Determine the amount of Market interest rate (I).

Determine the amount of periods to maturity (N).

2.

Compute the issue price of bonds and complete the first three rows of an amortization schedule, if the market interest rate is 7% and the bonds issue at a discount.

2.

Explanation of Solution

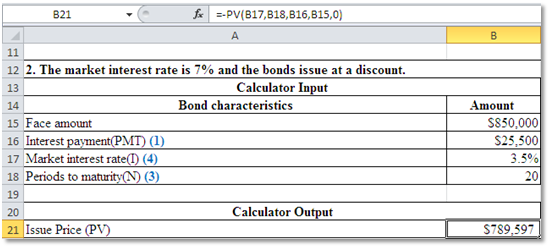

Determine the issue price of bonds.

Figure (2)

Prepare amortization schedule.

| Amortization Schedule | ||||

|

Date (1) |

Cash paid (2) |

Interest expense (3) |

Increase in carrying value (4) |

Carrying value (5) |

| 2018 | ||||

| January 01 | $789,597 | |||

| June 30 | $25,500 | $27,636 | $2,136 | $791,733 |

| December 31 | $25,500 | $27,711 | $2,211 | $793,944 |

Table (2)

Working note:

Determine the amount of Market interest rate (I).

3.

Compute the issue price of bonds and complete the first three rows of an amortization schedule, if the market interest rate is 5% and the bonds issue at a premium.

3.

Explanation of Solution

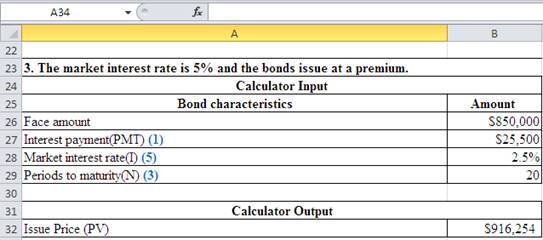

Determine the issue price of bonds.

Figure (3)

Prepare amortization schedule.

| Amortization Schedule | ||||

|

Date (1) |

Cash paid (2) |

Interest expense (3) |

Decrease in carrying value (4) |

Carrying value (5) |

| 2018 | ||||

|

January 01 | $916,254 | |||

| June 30 | $25,500 | $22,906 | $2,594 | $913,660 |

| December 31 | $25,500 | $27,711 | $2,658 | $911,002 |

Table (3)

Working note:

Determine the amount of Market interest rate (I).

Want to see more full solutions like this?

Chapter 9 Solutions

FINANCIAL ACCOUNTING- LL W CONNECT PKG

- GHI Industries had total net sales of $750,000. The beginning and ending accounts receivable were $62,000 and $68,000, respectively. What is the days' sales in receivables?arrow_forwardA firm has $4 million in average inventories, $2 million in average accounts payable, a receivables period of 45 days, and an annual cost of goods sold of $22 million. What is the cash conversion cycle for the firm?arrow_forwardHow much goodwill will result?arrow_forward

- Summit Furniture shipped out an order on April 5th (FOB destination) for a total of $32,500.00. The terms of payment are 3/10, net 40. The order arrived on April 6th. On April 7th, the customer returned $3,800.00 worth of items due to damage. On April 9th, a credit of $5,000.00 was granted for minor defects, but the customer kept the items. The customer paid the invoice on April 12th. What is the balance in the Accounts Receivable (AR) account on April 8th?arrow_forwardGeneral accounting questionarrow_forwardA promissory note has the following details: Principal: $5,000 . Term: 90 days . Interest: $150 Find the interest rate (Assume a 360- day year).arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education