Concept explainers

1.

Compute the issue price of bonds and complete the first three rows of an amortization schedule if the market interest rate is 7% and the bonds are issued at face amount.

1.

Explanation of Solution

Bonds:

Bonds are long-term promissory notes that are issued by a company while borrowing money from investors to raise fund for financing the operations.

Amortization Schedule:

A schedule that gives the detail about each loan payment and shows the allocation of principal and interest over the life of the note, or bond is called amortization schedule.

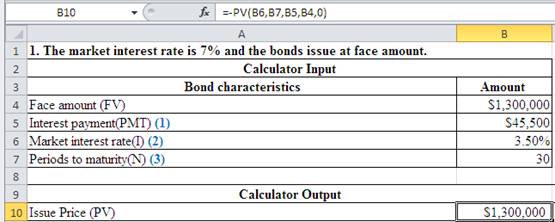

Calculate the issue price of bonds:

Figure (1)

Working Note:

Determine the amount of Interest Payment (PMT).

Determine the amount of Market interest rate (I).

Determine the amount of periods to maturity (N).

Complete the first three rows of an amortization schedule for the issuance of bonds:

| Amortization Schedule | ||||

|

Date (1) |

Cash paid (2) |

Interest expense (3) |

Increase in carrying value (4) |

Carrying value (5) |

| January 01 | $1,300,000 | |||

| June 30 | $45,500 | $45,500 | $0 | $1,300,000 |

| December 31 | $45,500 | $45,500 | $0 | $1,300,000 |

Table (1)

2.

Compute the issue price of bonds and complete the first three rows of an amortization schedule if the market interest rate is 8% and the bonds are issued at a discount.

2.

Explanation of Solution

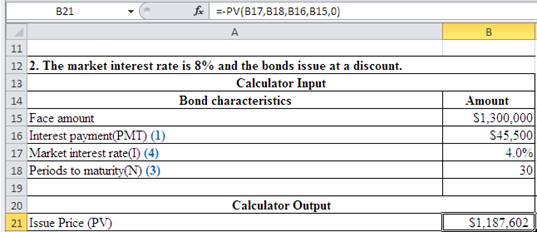

Calculate the issue price of bonds:

Figure (2)

Working note:

Determine the amount of Market interest rate (I).

Complete the first three rows of an amortization schedule for the issuance of bonds:

| Amortization Schedule | ||||

|

Date (1) |

Cash paid (2) |

Interest expense (3) |

Increase in carrying value (4) |

Carrying value (5) |

| January 01 | $1,187,602 | |||

| June 30 | $45,500 | $47,504 | $2,004 | $1,189,606 |

| December 31 | $45,500 | $47,584 | $2,084 | $1,191,690 |

Table (2)

3.

Compute the issue price of bonds and complete the first three rows of an amortization schedule if the market interest rate is 6% and the bonds are issued at a premium.

3.

Explanation of Solution

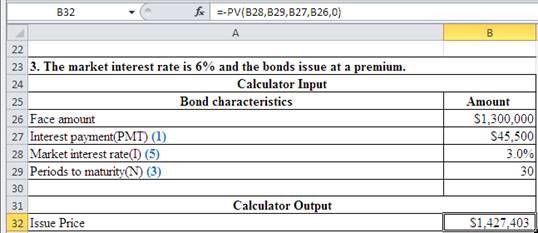

Calculate the issue price of bonds:

Figure (3)

Working note:

Determine the amount of Market interest rate (I).

Complete the first three rows of an amortization schedule for the issuance of bonds:

| Amortization Schedule | ||||

|

Date (1) |

Cash paid (2) |

Interest expense (3) |

Decrease in carrying value (4) |

Carrying value (5) |

|

January 01 | $1,427,403 | |||

| June 30 | $45,500 | $42,822 | $2,678 | $1,424,725 |

| December 31 | $45,500 | $42,742 | $2,758 | $1,421,967 |

Table (3)

Want to see more full solutions like this?

Chapter 9 Solutions

Financial Accounting (Connect NOT Included)

- Get correct answer accounting questionarrow_forwardSolve this MCQarrow_forwardLee Company applies manufacturing overhead to jobs on the basis of machine hours used. Overhead costs are expected to total $329,500 for the year, and machine usage is estimated at 138,200 hours. For the year, $296,534 of overhead costs are incurred and 132,300 hours are used. Compute the manufacturing overhead rate for the year.arrow_forward

- Verto Manufacturing produces a product whose direct labor standards are 1.5hours per unit at $15 per hour. In May, the company produced 6,000 units using 9,200 direct labor hours. The actual direct labor cost was $129,200. What is the labor rate variance for May?arrow_forwardGeneral accountingarrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education