Bundle: Cornerstones of Cost Management, Loose-Leaf Version, 4th + CengageNOWv2, 1 term Printed Access Card

4th Edition

ISBN: 9781337539098

Author: Hansen

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 7CE

Variances

Refer to Cornerstone Exercise 9.6.

Required:

- 1. Calculate the variable

overhead spending variance using the formula approach. (If you compute the actual variable overhead rate, carry your computations out to five significant digits and round the variance to the nearest dollar.) - 2. Calculate the variable overhead efficiency variance using the formula approach.

- 3. Calculate the variable overhead spending variance and variable overhead efficiency variance using the three-pronged graphical approach.

- 4. What if 26,100 direct labor hours were actually worked in February? What impact would that have had on the variable overhead spending variance? On the variable overhead efficiency variance?

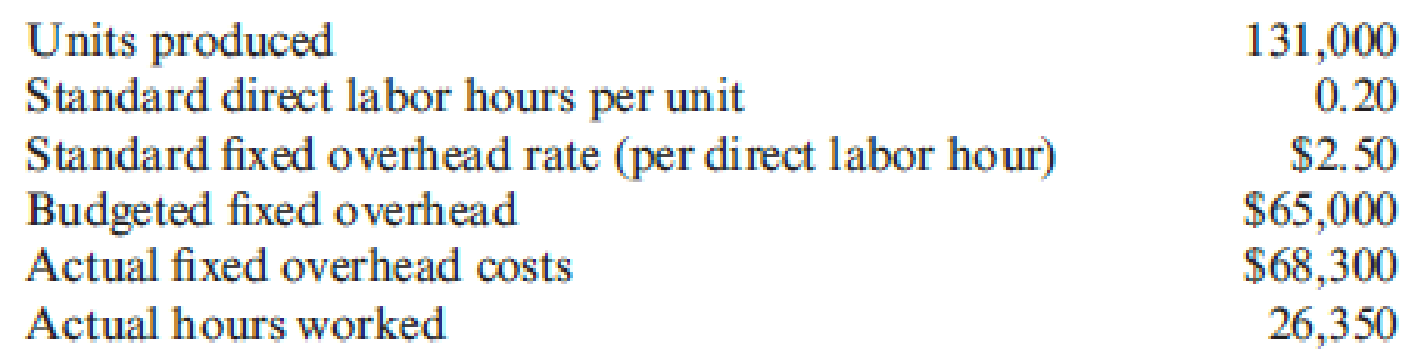

Standish Company manufactures consumer products and provided the following information for the month of February:

Required:

- 1. Calculate the fixed overhead spending variance using the formula approach.

- 2. Calculate the volume variance using the formula approach.

- 3. Calculate the fixed overhead spending variance and volume variance using the three-pronged graphical approach.

- 4. What if 129,600 units had actually been produced in February? What impact would that have had on the fixed overhead spending variance? On the volume variance?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

PLEASE HELP. ALL RED CELLS ARE INCORRECT. NOTICE, REVENUE ACCOUNTS ARE IN THE DROPDOWN!

Journalize these transactions, also post the transcations to T-accounts and determine month-end balances. Finally prepare a trail balance.

Suppose during 2023, BlueStar Shipping reported the following financial information (in

millions):

Net Sales: $40,000

Net Income: $150

Total Assets at Beginning of Year: $26,000

•

Total Assets at End of Year: $24,800

Calculate the following:

(a) Asset Turnover

(b) Return on Assets (ROA) as a percentage

Chapter 9 Solutions

Bundle: Cornerstones of Cost Management, Loose-Leaf Version, 4th + CengageNOWv2, 1 term Printed Access Card

Ch. 9 - Discuss the difference between budgets and...Ch. 9 - What is the quantity decision? The pricing...Ch. 9 - Why is historical experience often a poor basis...Ch. 9 - Prob. 4DQCh. 9 - How does standard costing improve the control...Ch. 9 - The budget variance for variable production costs...Ch. 9 - Explain why the direct materials price variance is...Ch. 9 - The direct materials usage variance is always the...Ch. 9 - The direct labor rate variance is never...Ch. 9 - Prob. 10DQ

Ch. 9 - Prob. 11DQCh. 9 - What is the cause of an unfavorable volume...Ch. 9 - Prob. 13DQCh. 9 - Explain how the two-, three-, and four-variance...Ch. 9 - Prob. 15DQCh. 9 - Prob. 1CECh. 9 - Direct Materials Usage Variance Refer to...Ch. 9 - Refer to Cornerstone Exercise 9.1. Guillermos Oil...Ch. 9 - Kavallia Company set a standard cost for one item...Ch. 9 - Yohan Company has the following balances in its...Ch. 9 - Standish Company manufactures consumer products...Ch. 9 - Variances Refer to Cornerstone Exercise 9.6....Ch. 9 - Standish Company manufactures consumer products...Ch. 9 - Mangia Pizza Company makes frozen pizzas that are...Ch. 9 - Mangia Pizza Company makes frozen pizzas that are...Ch. 9 - Refer to Cornerstone Exercise 9.9. Required: 1....Ch. 9 - Quincy Farms is a producer of items made from farm...Ch. 9 - During the year, Dorner Company produced 280,000...Ch. 9 - Zoller Company produces a dark chocolate candy...Ch. 9 - Oerstman, Inc., uses a standard costing system and...Ch. 9 - Refer to the data in Exercise 9.15. Required: 1....Ch. 9 - Chypre, Inc., produces a cologne mist using a...Ch. 9 - Refer to Exercise 9.17. Chypre, Inc., purchased...Ch. 9 - Delano Company uses two types of direct labor for...Ch. 9 - Jameson Company produces paper towels. The company...Ch. 9 - Madison Company uses the following rule to...Ch. 9 - Laughlin, Inc., uses a standard costing system....Ch. 9 - Responsibility for the materials price variance...Ch. 9 - Which of the following is true concerning labor...Ch. 9 - A company uses a standard costing system. At the...Ch. 9 - Relevant information for direct labor is as...Ch. 9 - Which of the following is the most likely...Ch. 9 - Haversham Corporation produces dress shirts. The...Ch. 9 - Plimpton Company produces countertop ovens....Ch. 9 - Algers Company produces dry fertilizer. At the...Ch. 9 - Misterio Company uses a standard costing system....Ch. 9 - Petrillo Company produces engine parts for large...Ch. 9 - Business Specialty, Inc., manufactures two...Ch. 9 - Vet-Pro, Inc., produces a veterinary grade...Ch. 9 - Refer to the data in Problem 9.34. Vet-Pro, Inc.,...Ch. 9 - Energy Products Company produces a gasoline...Ch. 9 - Nuevo Company produces a single product. Nuevo...Ch. 9 - Ingles Company manufactures external hard drives....Ch. 9 - As part of its cost control program, Tracer...Ch. 9 - Aspen Medical Laboratory performs comprehensive...Ch. 9 - Leather Works is a family-owned maker of leather...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please fill all cells! I need helparrow_forwardHilary owns a fruit smoothie shop at the local mall. Each smoothie requires 1/2 pound of mixed berries, which are expected to cost $5.50 per pound during the summer months. Shop employees are paid $7.00 per hour. Variable overhead consists of utilities and supplies, with a variable overhead rate of $0.12 per minute of direct labor time. Each smoothie should require 4 minutes of direct labor time. Determine the following standard costs per smoothie: Direct materials cost Direct labor cost Variable overhead costarrow_forwardgeneral accountingarrow_forward

- The following financial information is provided for Brightstar Corp.: Net Income (2023): $500 million Total Assets on January 1, 2023: $3,500 million Total Assets on December 31, 2023: $4,500 million What is Brightstar Corp. _ s return on assets (ROA) for 2023? A. 11.80% B. 12.50% C. 13.20% D. 14.00%arrow_forwardPLEASE FILL ALL CELLS. ALL RED CELLS ARE INCORRECT OR EMPTY.arrow_forwardAssume Bright Cleaning Service had a net income of $300 for the year. The company's beginning total assets were $4,500, and ending total assets were $4,100. Calculate Bright Cleaning Service's Return on Assets (ROA). A. 6.50% B. 7.25% C. 6.98% D. 5.80%arrow_forward

- what is the investment turnover?arrow_forwardA California-based company had a raw materials inventory of $135,000 on December 31, 2022, and $115,000 on December 31, 2023. During 2023, the company purchased $160,000 worth of raw materials, incurred direct labor costs of $230,000, and manufacturing overhead costs of $340,000. What is the total manufacturing cost incurred by the company? A. $720,000 B. $750,000 C. $705,000 D. $735,000arrow_forwardPLEASE HELP WITH THIS PROBLEM. ALL RED CELLS ARE EMPTY OR INCORRECT.arrow_forward

- Suppose during 2023, BlueStar Shipping reported the following financial information (in millions): Net Sales: $40,000 Net Income: $150 Total Assets at Beginning of Year: $26,000 • Total Assets at End of Year: $24,800 Calculate the following: (a) Asset Turnover (b) Return on Assets (ROA) as a percentagearrow_forwardprovide correct answer accounting questionarrow_forwardKubin Company’s relevant range of production is 11,000 to 14,000 units. When it produces and sells 12,500 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $ 7.20 Direct labor $ 4.20 Variable manufacturing overhead $ 1.70 Fixed manufacturing overhead $ 5.20 Fixed selling expense $ 3.70 Fixed administrative expense $ 2.70 Sales commissions $ 1.20 Variable administrative expense $ 0.70 Required: For financial accounting purposes, what is the total product cost incurred to make 12,500 units? For financial accounting purposes, what is the total period cost incurred to sell 12,500 units? For financial accounting purposes, what is the total product cost incurred to make 14,000 units? For financial accounting purposes, what is the total period cost incurred to sell 11,000 units?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY