Cain Components manufactures and distributes various plumbing products used in homes and other buildings. Over time, the production staff has noticed that products they considered easy to make were difficult to sell at margins considered reasonable, while products that seemed to take a lot of staff time were selling well despite recent price increases. A summer intern has suggested that the cost system might be providing misleading information.

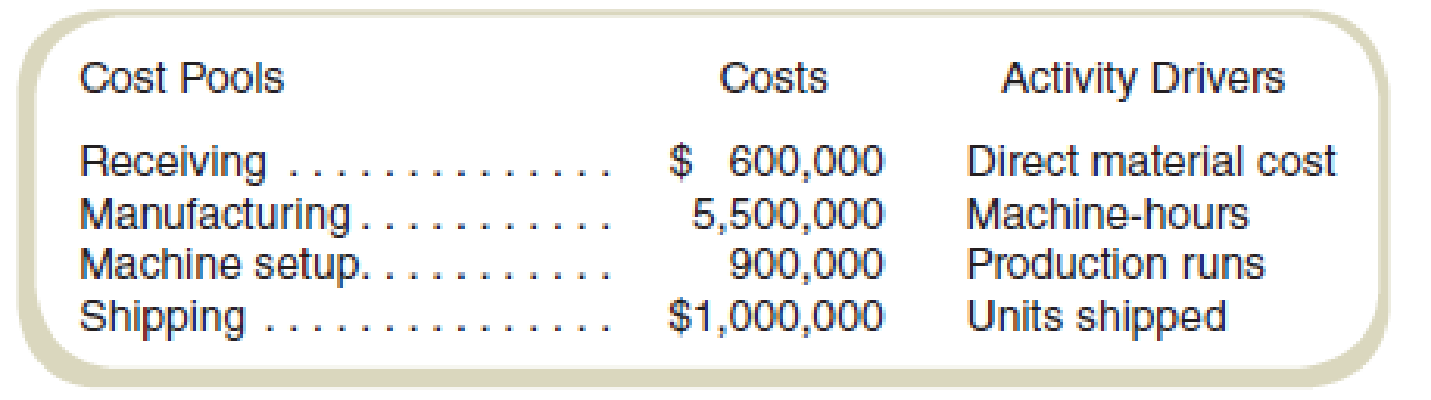

The controller decided that a good summer project for the intern would be to develop, in one self-contained area of the plant, an alternative cost system with which to compare the current system. The intern identified the following cost pools and, after discussion with some plant personnel, appropriate cost drivers for each pool. There were:

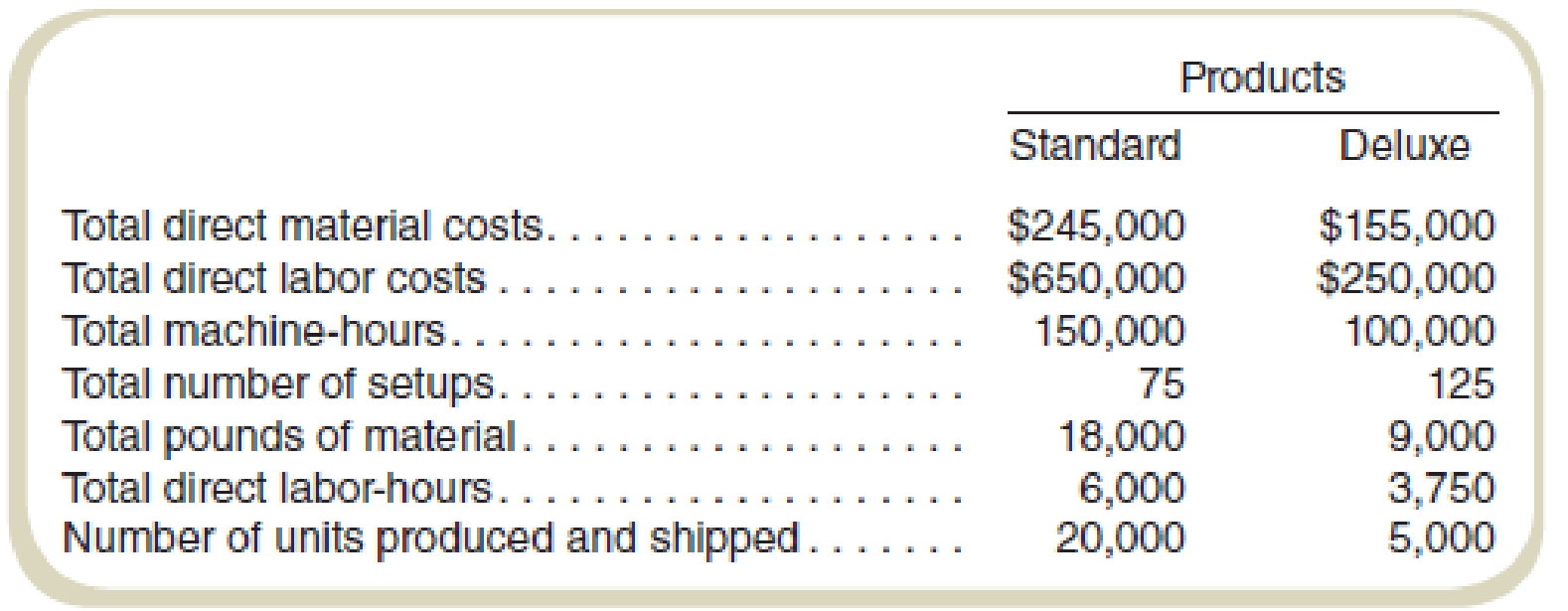

In this particular area, Cain produces two of its many products: Standard and Deluxe. The following are data for production for the latest full year of operations:

Required

- a. The current cost accounting system charges

overhead to products based on machine-hours. What unit product costs will be reported for the two products if the current cost system continues to be used? - b. The intern suggests an ABC system using the cost drivers identified above. What unit product costs will be reported for the two products if the ABC system is used?

- c. Would you recommend that Cain Components adopt the intern’s ABC system? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

FUNDAMENTALS OF COST ACCOUNTING BUNDLE

- Can you help me solve this general accounting problem using the correct accounting process?arrow_forwardApplying the Accounting Equation and Assessing Financial Statement LinkagesThe following information is available for Advanced Micro Devices (AMD) and Intel for a recent fiscal year.• AMD’s assets increased by $1,004 million and its liabilities increased by $334 million.• Intel’s assets increased by $4,714 million and its liabilities decreased by $830 million.a. Complete the following table. Assets, beginning Assets, end Liabilities, Liabilities, Stockholders’ Equity, (in $ millions) of year of year beginning of year end of year end of year AMD Answer 1 $4,556 $2,956 Answer 2 Answer 3 Intel $123,249 Answer 4 Answer 5 $53,400 Answer 6 b. Calculate average assets for each company. (in $ millions) Average Assets AMD Answer 7 Intel Answer 8 c. Which company has the larger proportion of its assets financed by the company’s owners at year-end? Answer 9arrow_forwardApplying the Accounting Equation and Assessing Financial Statement LinkagesThe following information is available for Advanced Micro Devices (AMD) and Intel for a recent fiscal year.• AMD’s assets increased by $1,004 million and its liabilities increased by $334 million.• Intel’s assets increased by $4,714 million and its liabilities decreased by $830 million.a. Complete the following table. Assets, beginning Assets, end Liabilities, Liabilities, Stockholders’ Equity, (in $ millions) of year of year beginning of year end of year end of year AMD Answer 1 $4,556 $2,956 Answer 2 Answer 3 Intel $123,249 Answer 4 Answer 5 $53,400 Answer 6 b. Calculate average assets for each company. (in $ millions) Average Assets AMD Answer 7 Intel Answer 8 c. Which company has the larger proportion of its assets financed by the company’s owners at year-end? Answer 9arrow_forward

- Formulating Financial Statements from Raw Data and Calculating RatiosFollowing is selected financial information from JM Smucker Co. for a recent fiscal year ($ millions). Current assets, end of year $2,010.1 Noncurrent liabilities, end of year $5,962.1 Cash, end of year 169.9 Stockholders' equity, end of year 8,140.1 Cash for investing activities (355.5) Cash from operating activities 1,136.3 Cost of product sold 5,298.2 Total assets, beginning of year 16,284.2 Total liabilities, end of year 7,914.9 Revenue 7,998.9 Cash for financing activities (945.2) Total expenses, other than cost of product sold 2,069.0 Stockholders' equity, beginning of year 8,124.8 Dividends paid (418.1) Requireda. Prepare the income statement for the year. J.M. Smucker Company, Inc. Income Statement ($ millions) Answer 1 Answer 2 Answer 3 Answer 4 Answer 5 Answer 6 Answer 7 Answer 8 Answer 9 Answer 10 b. Prepare the balance sheet at the end of the year. J.M.…arrow_forwardCalculate Total Fixed Cost With General Accounting Methodarrow_forwardIm Waiting for Solution of this General Accounting Questionarrow_forward

- Provide Solutions Pleasearrow_forwardFinancial Accounting Question Solution with Correct Methodarrow_forwardComputing Return on Assets and Applying the Accounting Equation Nordstrom Inc. reports net income of $564 million for a recent fiscal year. At the beginning of that fiscal year, Nordstrom had $8,115 million in total assets. By fiscal year end, total assets had decreased to $7,886 million. What is Nordstrom’s ROA? Note: Enter answer as a percentage rounded to the nearest 2 decimal places (ex: 24.58%). ROA Answer 1arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning