Concept explainers

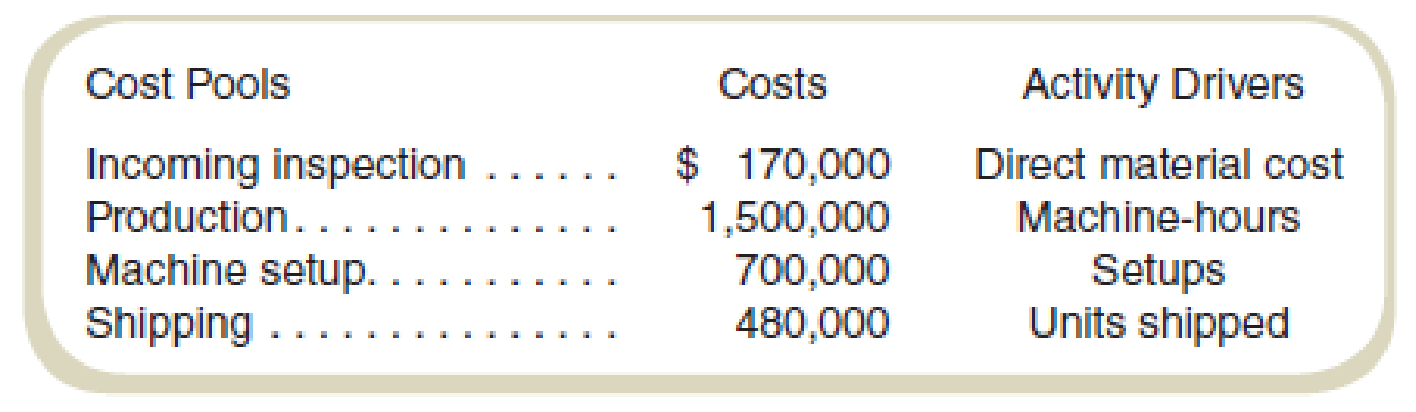

Utica Manufacturing (UM) was recently acquired by MegaMachines, Inc. (MM), and organized as a separate division within the company. Most manufacturing plants at MM use an ABC system, but UM has always used a traditional product costing system. Bob Miller, the plant controller at UM, has decided to experiment with ABC and has asked you to help develop a simple ABC system that would help him decide if it was useful. The controller’s staff has identified costs for the first month in the four

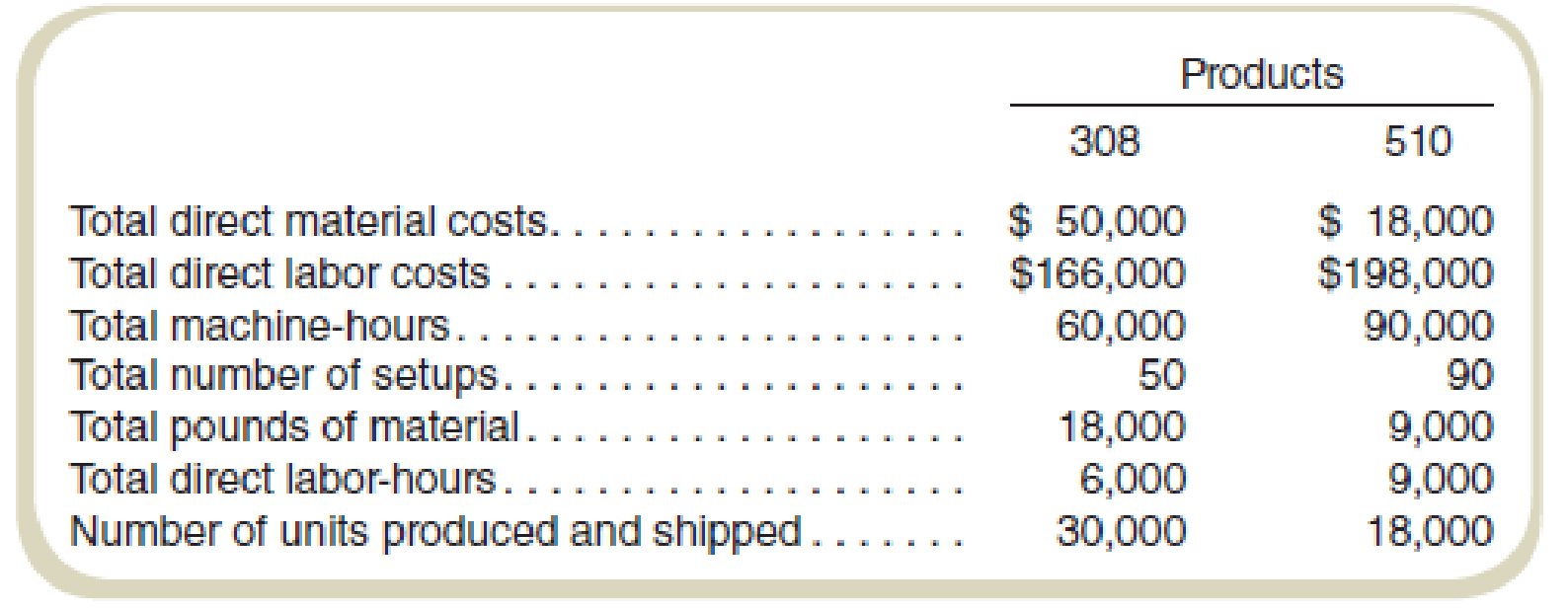

The company manufactures two basic products with model numbers 308 and 510. The following are data for production for the first month as part of MM:

Required

- a. The current cost accounting system charges overhead to products based on machine-hours. What unit product costs will be reported for the two products if the current cost system continues to be used?

- b. A consulting firm has recommended using an activity-based costing system, with the activities based on the cost pools identified by the cost accountant. What are the cost driver rates for the four cost pools identified by the cost accountant?

- c. What unit product costs will be reported for the two products if the ABC system suggested by the cost accountant’s classification of cost pools is used?

- d. If management should decide to implement an activity-based costing system, what benefits should it expect?

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

FUNDAMENTALS OF...(LL)-W/ACCESS>IP<

- I need the correct answer to this financial accounting problem using the standard accounting approach.arrow_forwardwhat is the after-tax income from this increase in sales? accounting questionarrow_forwardI need help finding the accurate solution to thisgeneral accounting problem with valid methods.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning