MANAGERIAL ACCTING LL W/CNCT- UND CUSTOM

17th Edition

ISBN: 9781264343850

Author: Garrison

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 4F15

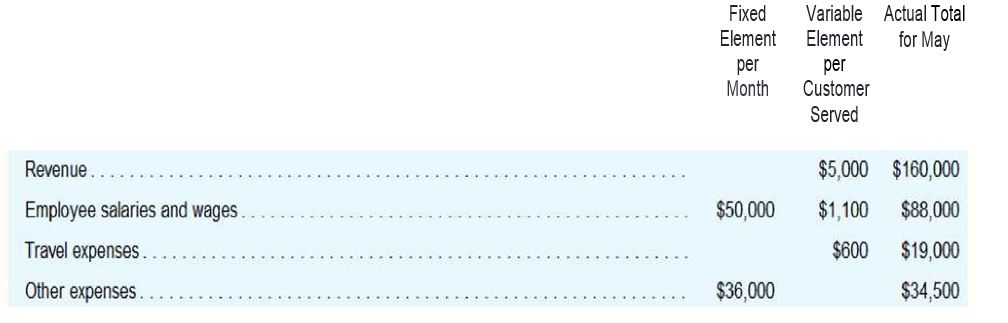

Adger Corporation is a service company that measures its output based on the number of customers served. The company provided the following fixed and variable cost estimates that it uses for budgeting purposes and the actual results for May as shown below:

When preparing its planning budget the company estimated that it would serve 30 customers per month: however, during May the company actually served 35 customers.

Required(all computations pertain to the month of May):

4. What amount of other expenses would be included in Adger’s flexible budget?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I am trying to find the accurate solution to this general accounting problem with the correct explanation

Please provide the answer to this general accounting question with proper steps.

I am looking for the correct answer to this financial accounting question with appropriate explanations.

Chapter 9 Solutions

MANAGERIAL ACCTING LL W/CNCT- UND CUSTOM

Ch. 9 - Prob. 1QCh. 9 - What is a flexible budget and how does it differ...Ch. 9 - Prob. 3QCh. 9 - Why is it difficult to interpret a difference...Ch. 9 - What is an activity variance and what does it...Ch. 9 - Prob. 6QCh. 9 - Prob. 7QCh. 9 - Prob. 8QCh. 9 - Prob. 9QCh. 9 - Prob. 10Q

Ch. 9 - The Excel worksheet form that appears below is to...Ch. 9 - The Excel worksheet form that appears below is to...Ch. 9 - Adger Corporation is a service company that...Ch. 9 - Prob. 2F15Ch. 9 - Prob. 3F15Ch. 9 - Adger Corporation is a service company that...Ch. 9 - Adger Corporation is a service company that...Ch. 9 - Adger Corporation is a service company that...Ch. 9 -

L09-1, LO9-2, LO9-3

Adger Corporation is a...Ch. 9 - Prob. 8F15Ch. 9 - Adger Corporation is a service company that...Ch. 9 - Prob. 10F15Ch. 9 - Prob. 11F15Ch. 9 - Prob. 12F15Ch. 9 - Prob. 13F15Ch. 9 - Prob. 14F15Ch. 9 - Prob. 15F15Ch. 9 - Prob. 1ECh. 9 - Prob. 2ECh. 9 -

EXERCISE 9-3 Revenue and Spending Variances...Ch. 9 - Prob. 4ECh. 9 - Prob. 5ECh. 9 - Prob. 6ECh. 9 - Prob. 7ECh. 9 - Prob. 8ECh. 9 - Prob. 9ECh. 9 - Prob. 10ECh. 9 - Prob. 11ECh. 9 - Prob. 12ECh. 9 - Prob. 13ECh. 9 - Prob. 14ECh. 9 - Prob. 15ECh. 9 - Prob. 16ECh. 9 - Prob. 17PCh. 9 - Prob. 18PCh. 9 - Prob. 19PCh. 9 - Prob. 20PCh. 9 - Prob. 21PCh. 9 - Prob. 22PCh. 9 - Prob. 23PCh. 9 - Prob. 24CCh. 9 - Prob. 25CCh. 9 - Prob. 26C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Give correct answer Global Fitness LLC reported a debt-to-equity ratio of 1.5 times at the end of 2024. If the firm's total assets at year-end were $36.8 million, how much of their assets are financed with equity?arrow_forwardCan you help me solve this financial accounting problem using the correct accounting process?arrow_forwardPlease explain the correct approach for solving this general accounting questionarrow_forward

- Can you solve this general accounting question with accurate accounting calculations?arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forwardGlobal Fitness LLC reported a debt-to-equity ratio of 1.5 times at the end of 2024. If the firm's total assets at year-end were $36.8 million, how much of their assets are financed with equity?a. $14.72 millionb. $22.08 millionc. $9.2 milliond. $55.2 million i need helparrow_forward

- Please provide the accurate answer to this financial accounting problem using valid techniques.arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forwardGlobal Fitness LLC reported a debt-to-equity ratio of 1.5 times at the end of 2024. If the firm's total assets at year-end were $36.8 million, how much of their assets are financed with equity?a. $14.72 millionb. $22.08 millionc. $9.2 milliond. $55.2 million helparrow_forward

- Please help me solve this financial accounting problem with the correct financial process.arrow_forwardPlease provide answer accurate of this Financial Accounting Question without any problemarrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY