Concept explainers

Activity-Based versus Traditional Costing

Maglie Company manufactures two video game consoles: handheld and home. The handheld consoles are smaller and less expensive than the home consoles. The company only recently began producing the home model. Since the introduction of the new product, profits have been steadily declining. Management believes that the accounting system is not accurately allocating costs to products, particularly because sales of the new product have been increasing.

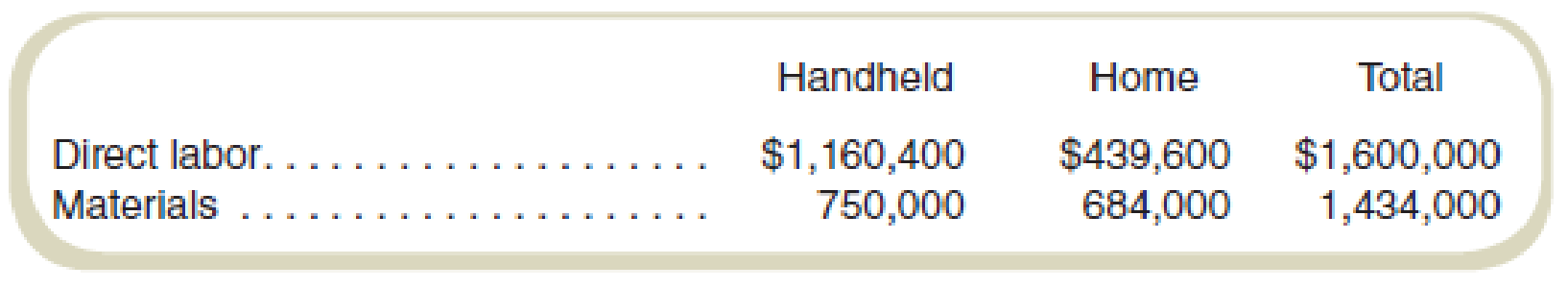

Management has asked you to investigate the cost allocation problem. You find that manufacturing

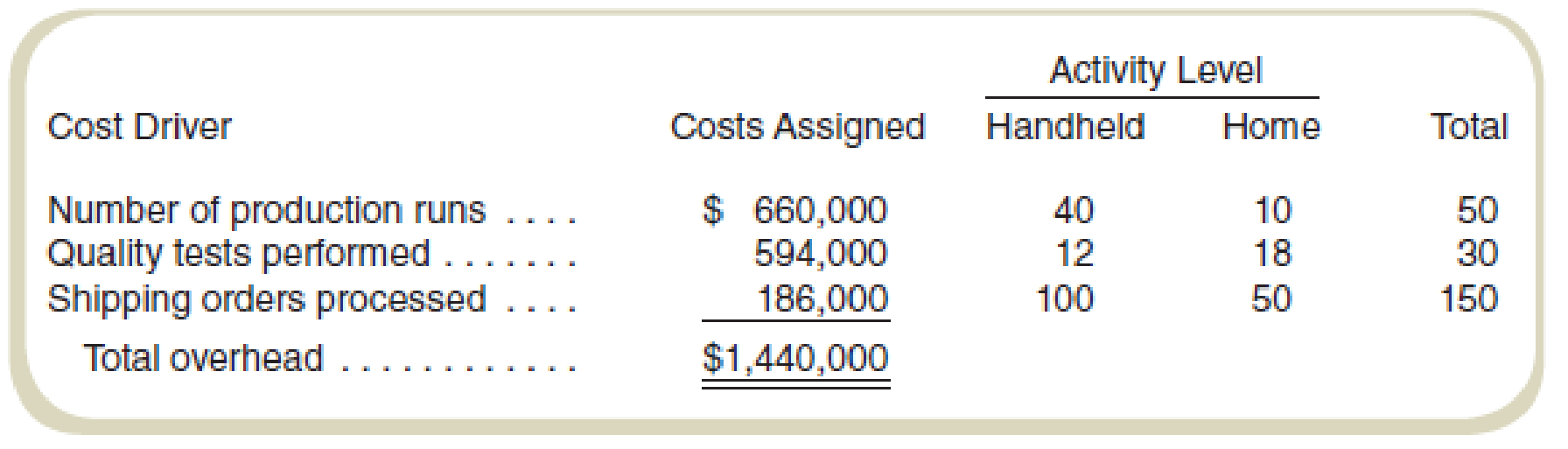

Management has determined that overhead costs are caused by three cost drivers. These drivers and their costs for last year are as follows:

Required

- a. How much overhead will be assigned to each product if these three cost drivers are used to allocate overhead? What is the total cost per unit produced for each product?

- b. How much overhead will be assigned to each product if direct labor cost is used to allocate overhead? What is the total cost per unit produced for each product?

- c. How might the results from using activity-based costing in requirement (a) help management understand Maglie’s declining profits?

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

FUNDAMENTALS OF COST ACCT.-CONNECT CARD

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardHow can I solve this financial accounting problem using the appropriate financial process?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College