Concept explainers

Leather Works is a family-owned maker of leather travel bags and briefcases located in the northeastern part of the United States. Foreign competition has forced its owner, Heather Gray, to explore new ways to meet the competition. One of her cousins, Wallace Hayes, who recently graduated from college with a major in accounting, told her about the use of cost

In May of last year, Heather asked Matt Jones, chief accountant, and Alfred Prudest, production manager, to implement a

Recently, the following dialogue took place among Heather, Matt, and Alfred:

HEATHER: How is the business performing?

ALFRED: You know, we are producing a lot more than we used to, thanks to the contract that you helped obtain from Lean, Inc., for laptop covers. (Lean is a national supplier of computer accessories.)

MATT: Thank goodness for that new product. It has kept us from sinking even more due to the inroads into our business made by those foreign suppliers of leather goods.

HEATHER: What about the standard costing system?

MATT: The variances are mostly favorable, except for the first few months when the supplier of leather started charging more.

HEATHER: How did the union members take to the standards?

ALFRED: Not bad. They grumbled a bit at first, but they have taken it in stride. We’ve consistently shown favorable direct labor efficiency variances and direct materials usage variances. The direct labor rate variance has been flat.

MATT: It should be since direct labor rates are negotiated by the union representative at the start of the year and remain the same for the entire year.

HEATHER: Matt, would you send me the variance report for laptop covers immediately?

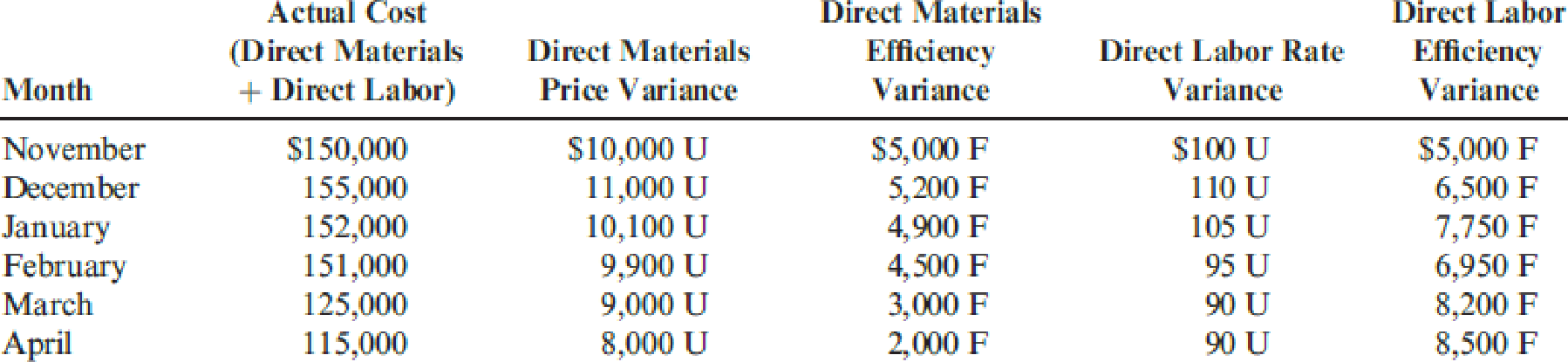

The following chart summarizes the direct materials and direct labor variances from November of last year through April of this year (extracted from the report provided by Matt). Standards for each laptop cover are as follows:

- a. Three feet of direct materials at $7.50 per foot

- b. Forty-five minutes of direct labor at $14 per hour

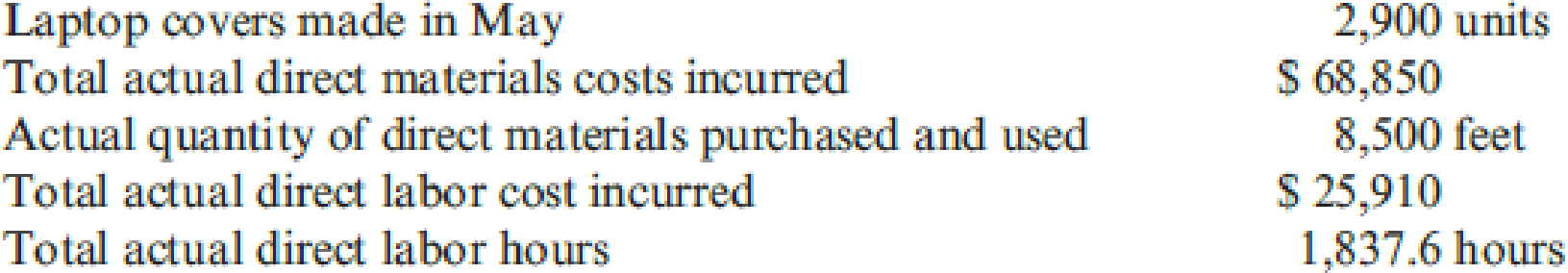

In addition, the data for May of this year, but not the variances for the month, are as follows:

Actual direct labor cost per hour exceeded the budgeted rate by $0.10 per hour.

Required:

- 1. For May of this year, calculate the price and quantity variances for direct labor and direct materials.

- 2. Discuss the trend of the direct materials and labor variances.

- 3. What type of actions must the workers have taken during the period they were being observed for the setting of standards?

- 4. What can be done to ensure that the standards are set correctly? (CMA adapted)

Trending nowThis is a popular solution!

Chapter 9 Solutions

Cornerstones of Cost Management

- Solve clearly with correct dataarrow_forwardPROBLEM E Mulles, the owner of a successful fertilizer business, felt that it is time to expand operations. Mulles offered to form a partnership with Lucena, the owner of a nearby warehouse. The partnership would be called Mulles & Lucena Storage and Sales. Lucena accepted Mulles' offer and the partnership was formed on July 1,2024. Presented below is the trial balance for Mulles Fertilizer Supply on June 30, 2024: Cash Accounts Receivable Allowance for Uncollectible Accounts. Inventory Prepaid Rent Store Equipment Accumulated Depreciation Notes Payable Accounts Payable Mulles, Capital Total P 229,500 2,103,000 P 117,000 1,012,500 29,250 390,000 P3,764,250 97,500 330,000 505,500 2,714,250 P3,764,250 The partners agreed to share profits and losses equally and decided to invest an equal amount in the partnership. Lucena and Mulles agreed that Lucena's land is worth P500,000 and his building P1,450,000. Lucena is to contribute cash in an amount sufficient to make his capital account…arrow_forwardPLEASE HELP. ALL RED CELLS ARE INCORRECT. NOTICE, REVENUE ACCOUNTS ARE IN THE DROPDOWN!arrow_forward

- Journalize these transactions, also post the transcations to T-accounts and determine month-end balances. Finally prepare a trail balance.arrow_forwardSuppose during 2023, BlueStar Shipping reported the following financial information (in millions): Net Sales: $40,000 Net Income: $150 Total Assets at Beginning of Year: $26,000 • Total Assets at End of Year: $24,800 Calculate the following: (a) Asset Turnover (b) Return on Assets (ROA) as a percentagearrow_forwardPlease fill all cells! I need helparrow_forward

- Hilary owns a fruit smoothie shop at the local mall. Each smoothie requires 1/2 pound of mixed berries, which are expected to cost $5.50 per pound during the summer months. Shop employees are paid $7.00 per hour. Variable overhead consists of utilities and supplies, with a variable overhead rate of $0.12 per minute of direct labor time. Each smoothie should require 4 minutes of direct labor time. Determine the following standard costs per smoothie: Direct materials cost Direct labor cost Variable overhead costarrow_forwardgeneral accountingarrow_forwardThe following financial information is provided for Brightstar Corp.: Net Income (2023): $500 million Total Assets on January 1, 2023: $3,500 million Total Assets on December 31, 2023: $4,500 million What is Brightstar Corp. _ s return on assets (ROA) for 2023? A. 11.80% B. 12.50% C. 13.20% D. 14.00%arrow_forward

- PLEASE FILL ALL CELLS. ALL RED CELLS ARE INCORRECT OR EMPTY.arrow_forwardAssume Bright Cleaning Service had a net income of $300 for the year. The company's beginning total assets were $4,500, and ending total assets were $4,100. Calculate Bright Cleaning Service's Return on Assets (ROA). A. 6.50% B. 7.25% C. 6.98% D. 5.80%arrow_forwardwhat is the investment turnover?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning