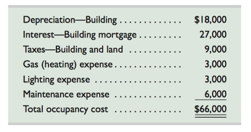

National Bank has several departments that occupy both of a two-story building. The departmental accounting system has a single account, Building Occupancy Cost, in its ledger. The types and amounts of costs recorded in this account for the current period follow.

The building has 4,000 Square feet on each floor. In prior periods, the

Diane Linder manages a first-floor department that 1,000 square feet, and Juan Chiro manages a second-floor department that occupies 1,800 square feet of floor space. In discussing the departmental reports, the second-floor manager questions whether using the same rate per square foot for all departments makes sense because the first-floor space is more valuable. This manager also references a recent real estate study of average local rental costs for similar space that shows first-floor space worth $30 per square foot and second-floor space worth $20 per Square foot (excluding costs for heating, lighting, and maintenance.)

Required

1. Allocate occupancy costs to the Linder and Chiro departments using the current allocation method.

2. Allocate the

Analysis Component

3. Which allocation method would you prefer if you were a manager of a second-floor department? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

MANAGERIAL ACCOUNTING FUND. W/CONNECT

- Can you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardDetermine the prepaid insurance value for Barton & co as this is the one unknown item.arrow_forwardI need help with this financial accounting question using accurate methods and procedures.arrow_forward

- Can you explain the correct methodology to solve this financial accounting problem?arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

- Bon Corporation has the following transactions: $820,000 operating income; $640,000 operating expenses; $55,000 municipal bond interest; $150,000 long-term capital gain; and $70,000 short-term capital loss. Compute Bon Corporation's taxable income for the year.arrow_forwardWhat is the correct answer with accountingarrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

- Calculate the contribution margin ratioarrow_forwardExpert need your helparrow_forwardJuniper Retail plans to open a new store location. The company analysis indicates that fixed costs would be $225,000 annually, while variable costs would be 60% of sales revenue. If Juniper requires a minimum profit of $75,000 before tax from this location, what amount of annual sales revenue must the store generate to meet this target?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub