Flexible budget performance report:A flexible budget shows the true difference between the actual cost and revenue and budgeted cost and revenue. The budgeted value is adjusted by preparing a flexible budget which is prepared based on actual level of activity.

1. The preparation of flexible budget performance report for the year.

2. Whether you would be pleased with how well costs were controlled during the year.

3. How accurate the cost formulas figures would be for predicting the cost of a new production or of an additional performance.

Answer to Problem 29C

Solution:

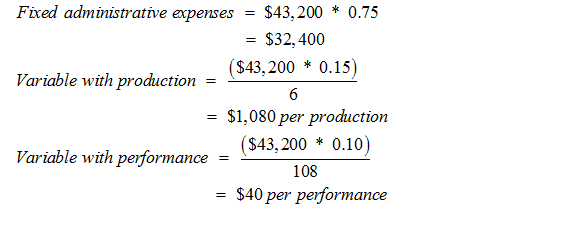

| The Little Theatre

Flexible Budget Performance Report For the Year Ended December 31 |

|||||

| Actual

Results |

Spending

Variance |

Flexible

Budget |

Activity

Variance |

Planning

Budget |

|

| Number of productions (q1) | 7 | 7 | 6 | ||

| Number of performances (q2) | 168 | 168 | 108 | ||

| Actors and directors wages

($2,000q2) |

$341,800 | $5,800 U | $336,000 | $120,000U | $216,000 |

| Stagehands wages ($300q2) | $49,700 | $700 F | $50,400 | $18,000 U | $32,400 |

| Ticket booth personnel and

usher wages ($150q2) |

$25,900 | $700 U | $25,200 | $9,000 U | $16,200 |

| Scenery. Costumes, and props

($18,000q1) |

$130,600 | $4,600 U | $126,000 | $18,000 U | $108,000 |

| Theater hall rent ($500q2) | $78,000 | $6,000 F | $84,000 | $30,000 U | $54,000 |

| Printed programs ($250q2) | $38,300 | $3,700 F | $42,000 | $15,000 U | $27,000 |

| Publicity ($2,000q1) | $15,100 | $1,100 U | $14,000 | $2,000 U | $12,000 |

| Administrative expenses

($32,400+$1,080q1+$40q2) |

$47,500 | $820 U | $46,680 | $3,480 U | $43,200 |

| Total expense | $726,900 | $2,620 U | $724,280 | $215,480 | $508,800 |

2. If I was a board of director of the company, I would not be pleased by the performance report which shows an overall unfavorable spending variance of $2,620 and an unfavorable activity variance of $215,480. The activity variance is prepared based upon the planned activity, so an activity variance is understandable but the spending variances shows high amount of unfavorable and favorable variances which probably need to be investigated. Small amount of variance is possible since it is highly impossible to predict the exact amount of spending.

3. The cost formula of little theatre would not so accurate in predicting the cost of new production or additional performance as there is high amount of between the flexible budget and actual results in the flexible budget performance report.

Explanation of Solution

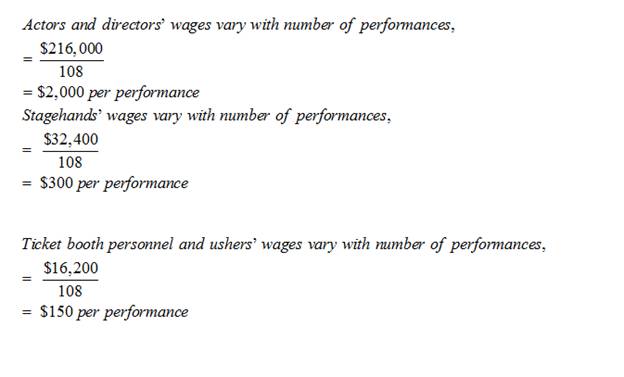

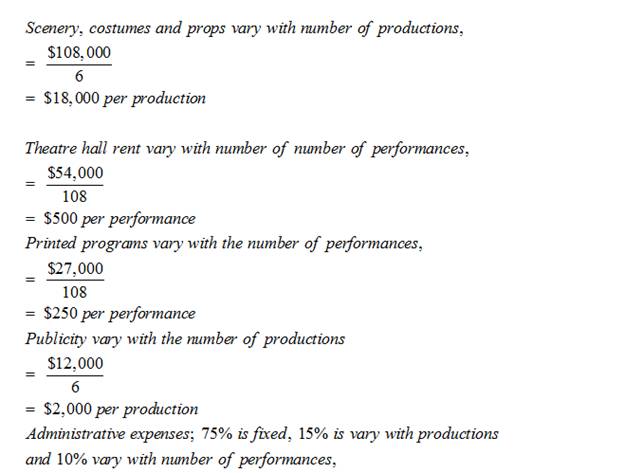

1. A flexible budget is prepared based on actual activity. The costs are adjusted according to the actual results by multiplying the cost formulas with the actual number of activity. The cost formulas of Little Theatre are ascertained as follows:

Given:The cost for the current year’s planning budget appear below:

| The Little Theatre

Costs from the Planning Budget For the Year Ended December 31 |

|||

| Budgeted number of productions | 6 | ||

| Budgeted number of performances | 108 | ||

| Actors and directors wages | $216,000 | ||

| Stagehands wages | $32,400 | ||

| Ticket booth personnel and usher wages | $16,200 | ||

| Scenery. Costumes, and props | $108,000 | ||

| Theater hall rent | $54,000 | ||

| Printed programs | $27,000 | ||

| Publicity | $12,000 | ||

| Administrative expenses | $43,200 | ||

| Total | $508,800 | ||

Data concerning the actual cost appear below:

| The Little Theatre

Actual Costs For the Year Ended December 31 |

|||

| Actual number of productions | 7 | ||

| Actual number of performances | 168 | ||

| Actors and directors wages | $341,800 | ||

| Stagehands wages | $49,700 | ||

| Ticket booth personnel and usher wages | $25,900 | ||

| Scenery. Costumes, and props | $130,600 | ||

| Theater hall rent | $78,000 | ||

| Printed programs | $38,300 | ||

| Publicity | $15,100 | ||

| Administrative expenses | $47,500 | ||

| Total | $726,900 | ||

Conclusion:$ 215,480The difference between the flexible budget and planning budget is called an activity variance while the difference between the flexible budget actual results is called revenue and spending variance. The favorability of variance depends upon whether the variance is improving the net income or decreasing it. If the variance is increasing the net income, it is a favorable variance and if the variance is decreasing the net income, it is an unfavorable variance.

Want to see more full solutions like this?

Chapter 9 Solutions

MANAGERIAL ACCOUNTING

- What is the amount of sales that will be necessary?arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardUsing Excel showing all work and formulas to compute the following How can I Compute the net present value of each project. Rounding computations to 2 decimal points. And Compute the approximate internal rate of return for each project. Round your rates to 6 decimal points Base on this Scenario: Dwight Donovan, the president of Donovan Enterprises, is considering 2 investment opportunities. Because of limited resources, he will be able to invest in only 1 of them. Project A is to purchase a machine that will enable factory automation; the machine is expected to have a useful life of 4 years and no salvage value. Project B supports a training program that will improve the skills of employees operating the current equipment. Initial cash expenditures for Project A are $400,000 and for Project B are $160,000. The annual expected cash inflows are $126,000 for Project A and $52,800 for Project B. Both investments are expected to provide cash flow benefits for the next 4 years. Donovan…arrow_forward

- Portman Solutions paid out $42.5 million in total common dividends and reported $150.3 million of retained earnings at year-end. The prior year's retained earnings were $104.8 million. Assume that all dividends declared were actually paid. What was the net income for the year?arrow_forwardWhat is the corporations net income for the year ending October 31, 2014?arrow_forwardWhat was the net income for the year?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education