Flexible budget performance report:A flexible budget shows the true difference between the actual cost and revenue and budgeted cost and revenue. The budgeted value is adjusted by preparing a flexible budget which is prepared based on actual level of activity.

1. The preparation of flexible budget performance report for the year.

2. Whether you would be pleased with how well costs were controlled during the year.

3. How accurate the cost formulas figures would be for predicting the cost of a new production or of an additional performance.

Answer to Problem 29C

Solution:

| The Little Theatre

Flexible Budget Performance Report For the Year Ended December 31 |

|||||

| Actual

Results |

Spending

Variance |

Flexible

Budget |

Activity

Variance |

Planning

Budget |

|

| Number of productions (q1) | 7 | 7 | 6 | ||

| Number of performances (q2) | 168 | 168 | 108 | ||

| Actors and directors wages

($2,000q2) |

$341,800 | $5,800 U | $336,000 | $120,000U | $216,000 |

| Stagehands wages ($300q2) | $49,700 | $700 F | $50,400 | $18,000 U | $32,400 |

| Ticket booth personnel and

usher wages ($150q2) |

$25,900 | $700 U | $25,200 | $9,000 U | $16,200 |

| Scenery. Costumes, and props

($18,000q1) |

$130,600 | $4,600 U | $126,000 | $18,000 U | $108,000 |

| Theater hall rent ($500q2) | $78,000 | $6,000 F | $84,000 | $30,000 U | $54,000 |

| Printed programs ($250q2) | $38,300 | $3,700 F | $42,000 | $15,000 U | $27,000 |

| Publicity ($2,000q1) | $15,100 | $1,100 U | $14,000 | $2,000 U | $12,000 |

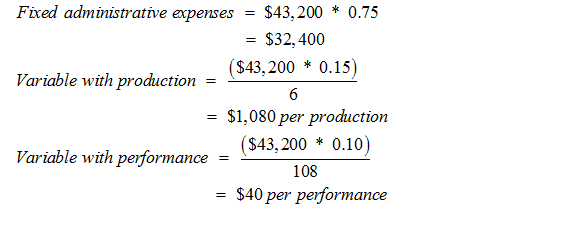

| Administrative expenses

($32,400+$1,080q1+$40q2) |

$47,500 | $820 U | $46,680 | $3,480 U | $43,200 |

| Total expense | $726,900 | $2,620 U | $724,280 | $215,480 | $508,800 |

2. If I was a board of director of the company, I would not be pleased by the performance report which shows an overall unfavorable spending variance of $2,620 and an unfavorable activity variance of $215,480. The activity variance is prepared based upon the planned activity, so an activity variance is understandable but the spending variances shows high amount of unfavorable and favorable variances which probably need to be investigated. Small amount of variance is possible since it is highly impossible to predict the exact amount of spending.

3. The cost formula of little theatre would not so accurate in predicting the cost of new production or additional performance as there is high amount of between the flexible budget and actual results in the flexible budget performance report.

Explanation of Solution

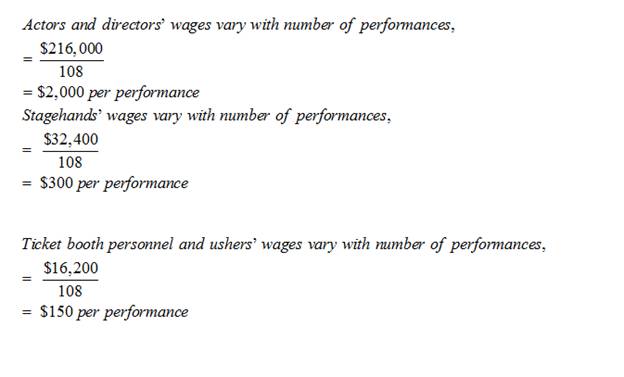

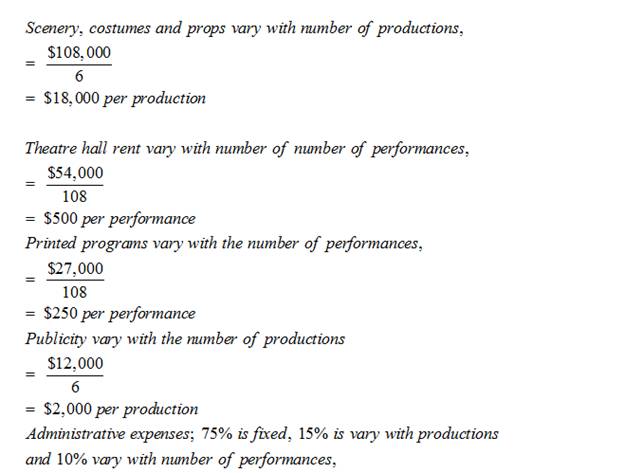

1. A flexible budget is prepared based on actual activity. The costs are adjusted according to the actual results by multiplying the cost formulas with the actual number of activity. The cost formulas of Little Theatre are ascertained as follows:

Given:The cost for the current year’s planning budget appear below:

| The Little Theatre

Costs from the Planning Budget For the Year Ended December 31 |

|||

| Budgeted number of productions | 6 | ||

| Budgeted number of performances | 108 | ||

| Actors and directors wages | $216,000 | ||

| Stagehands wages | $32,400 | ||

| Ticket booth personnel and usher wages | $16,200 | ||

| Scenery. Costumes, and props | $108,000 | ||

| Theater hall rent | $54,000 | ||

| Printed programs | $27,000 | ||

| Publicity | $12,000 | ||

| Administrative expenses | $43,200 | ||

| Total | $508,800 | ||

Data concerning the actual cost appear below:

| The Little Theatre

Actual Costs For the Year Ended December 31 |

|||

| Actual number of productions | 7 | ||

| Actual number of performances | 168 | ||

| Actors and directors wages | $341,800 | ||

| Stagehands wages | $49,700 | ||

| Ticket booth personnel and usher wages | $25,900 | ||

| Scenery. Costumes, and props | $130,600 | ||

| Theater hall rent | $78,000 | ||

| Printed programs | $38,300 | ||

| Publicity | $15,100 | ||

| Administrative expenses | $47,500 | ||

| Total | $726,900 | ||

Conclusion:$ 215,480The difference between the flexible budget and planning budget is called an activity variance while the difference between the flexible budget actual results is called revenue and spending variance. The favorability of variance depends upon whether the variance is improving the net income or decreasing it. If the variance is increasing the net income, it is a favorable variance and if the variance is decreasing the net income, it is an unfavorable variance.

Want to see more full solutions like this?

Chapter 9 Solutions

Managerial Accounting

- Vaughn Industries uses a job order cost system and applies overhead based on estimated rates. The overhead application rate is based on total estimated overhead costs of $372,000 and direct labor hours of 9,300. During the month of March 2025, actual direct labor hours of 8,100 were incurred. Use this information to determine the amount of factory overhead that was applied in March.arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forwardSolve thisarrow_forward

- Please explain the solution to this general accounting problem with accurate explanations.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardRaytheon Manufacturing reports that the cost to manufacture an unfinished unit is $160 ($110 variable, $50 fixed). The selling price per unit is $175. The company has unused productive capacity and has determined that units could be finished and sold for $210 with an increase in variable costs of 35%. What is the additional net income per unit to be gained by finishing the unit?arrow_forward

- Please explain the solution to this general accounting problem using the correct accounting principles.arrow_forwardFinancial Accounting Question need helparrow_forwardWhat are the possible actions to take when an authority figure/company puts you in a compromising situation. Provide examples such as personal experience or recent events.arrow_forward

- Please show me the correct way to solve this financial accounting problem with accurate methods.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forwardwhat is the duty of management of a company? What would happen to shareholder value if they immediately implemented the new regulations? What would happen to shareholder value if they waited but at least informed the shareholders of the impact? Which would be better?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education