Flexible budget performance report:A flexible budget shows the true difference between the actual cost and revenue and budgeted cost and revenue. The budgeted value is adjusted by preparing a flexible budget which is prepared based on actual level of activity.

1. The preparation of flexible budget performance report for the year.

2. Whether you would be pleased with how well costs were controlled during the year.

3. How accurate the cost formulas figures would be for predicting the cost of a new production or of an additional performance.

Answer to Problem 28C

Solution:

| The Little Theatre

Flexible Budget Performance Report For the Year Ended December 31 |

|||||

| Actual

Results |

Spending

Variance |

Flexible

Budget |

Activity

Variance |

Planning

Budget |

|

| Number of productions (q1) | 7 | 7 | 6 | ||

| Number of performances (q2) | 168 | 168 | 108 | ||

| Actors and directors wages

($2,000q2) |

$341,800 | $5,800 U | $336,000 | $120,000U | $216,000 |

| Stagehands wages ($300q2) | $49,700 | $700 F | $50,400 | $18,000 U | $32,400 |

| Ticket booth personnel and

usher wages ($150q2) |

$25,900 | $700 U | $25,200 | $9,000 U | $16,200 |

| Scenery. Costumes, and props

($18,000q1) |

$130,600 | $4,600 U | $126,000 | $18,000 U | $108,000 |

| Theater hall rent ($500q2) | $78,000 | $6,000 F | $84,000 | $30,000 U | $54,000 |

| Printed programs ($250q2) | $38,300 | $3,700 F | $42,000 | $15,000 U | $27,000 |

| Publicity ($2,000q1) | $15,100 | $1,100 U | $14,000 | $2,000 U | $12,000 |

| Administrative expenses

($32,400+$1,080q1+$40q2) |

$47,500 | $820 U | $46,680 | $3,480 U | $43,200 |

| Total expense | $726,900 | $2,620 U | $724,280 | $215,480 | $508,800 |

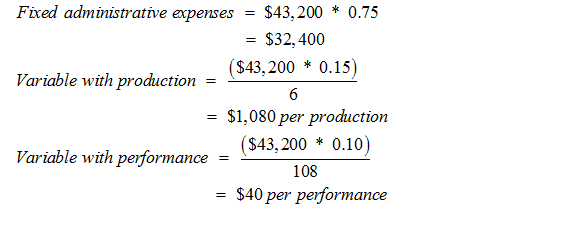

2. If I was a board of director of the company, I would not be pleased by the performance report which shows an overall unfavorable spending variance of $2,620 and an unfavorable activity variance of $215,480. The activity variance is prepared based upon the planned activity, so an activity variance is understandable but the spending variances shows high amount of unfavorable and favorable variances which probably need to be investigated. Small amount of variance is possible since it is highly impossible to predict the exact amount of spending.

3. The cost formula of little theatre would not so accurate in predicting the cost of new production or additional performance as there is high amount of between the flexible budget and actual results in the flexible budget performance report.

Explanation of Solution

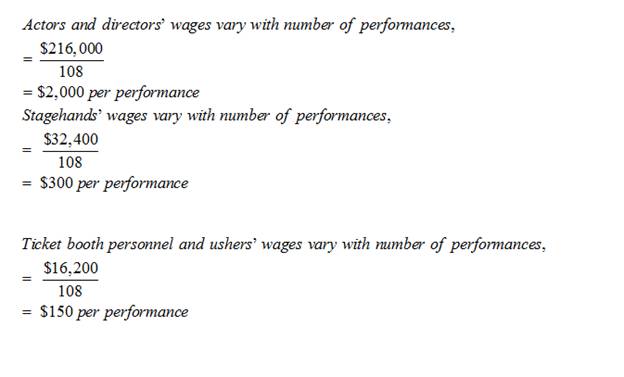

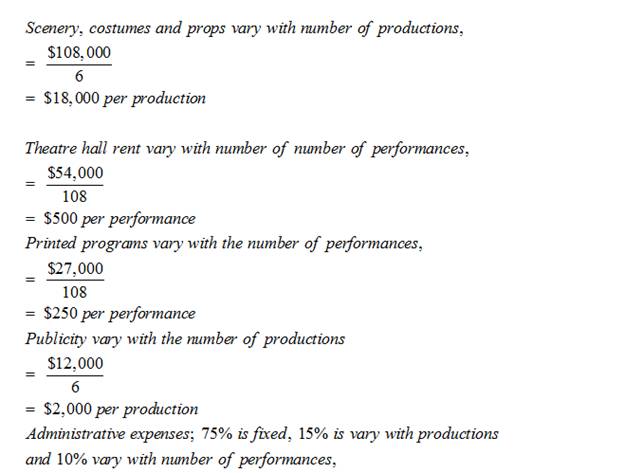

1. A flexible budget is prepared based on actual activity. The costs are adjusted according to the actual results by multiplying the cost formulas with the actual number of activity. The cost formulas of Little Theatre are ascertained as follows:

Given:The cost for the current year’s planning budget appear below:

| The Little Theatre

Costs from the Planning Budget For the Year Ended December 31 |

|||

| Budgeted number of productions | 6 | ||

| Budgeted number of performances | 108 | ||

| Actors and directors wages | $216,000 | ||

| Stagehands wages | $32,400 | ||

| Ticket booth personnel and usher wages | $16,200 | ||

| Scenery. Costumes, and props | $108,000 | ||

| Theater hall rent | $54,000 | ||

| Printed programs | $27,000 | ||

| Publicity | $12,000 | ||

| Administrative expenses | $43,200 | ||

| Total | $508,800 | ||

Data concerning the actual cost appear below:

| The Little Theatre

Actual Costs For the Year Ended December 31 |

|||

| Actual number of productions | 7 | ||

| Actual number of performances | 168 | ||

| Actors and directors wages | $341,800 | ||

| Stagehands wages | $49,700 | ||

| Ticket booth personnel and usher wages | $25,900 | ||

| Scenery. Costumes, and props | $130,600 | ||

| Theater hall rent | $78,000 | ||

| Printed programs | $38,300 | ||

| Publicity | $15,100 | ||

| Administrative expenses | $47,500 | ||

| Total | $726,900 | ||

Conclusion:$ 215,480The difference between the flexible budget and planning budget is called an activity variance while the difference between the flexible budget actual results is called revenue and spending variance. The favorability of variance depends upon whether the variance is improving the net income or decreasing it. If the variance is increasing the net income, it is a favorable variance and if the variance is decreasing the net income, it is an unfavorable variance.

Want to see more full solutions like this?

Chapter 9 Solutions

Managerial Accounting

- If beginning and ending work in process inventories are $12,500 and $21,700, respectively, and cost of goods manufactured is $215,000, what is the total manufacturing cost for the period?arrow_forwardWhat is your firm's cash conversion cyclearrow_forwardWhat is the unit cost of direct material?arrow_forward

- Can you solve this general accounting problem using appropriate accounting principles?arrow_forwardCan you explain the process for solving this financial accounting question accurately?arrow_forwardCan you help me find the accurate solution to this financial accounting problem using valid principles?arrow_forward

- The stockholders' equity at the beginning of the period was $212,000; at the end of the period, assets were $305,000 and liabilities were $70,000. If the owner made no additional investments or paid no dividends during the period, did the business incur a net income or a net loss for the period, and how much?arrow_forwardWhat is the total market value of the firm's equity?arrow_forwardHello tutor please provide correct answer general accounting question with correct solution do fastarrow_forward

- Pension plan assets were $2,300 million at the beginning of the year and $2,560 million at the end of the year. At the end of the year, retiree benefits paid by the trustee were $60 million and cash invested in the pension fund was $65 million. What was the percentage rate of return on plan assets?arrow_forwardSanchez Manufacturing produces lawn mowers that sell for $175. Each lawn mower uses $32 in direct materials and $18 in direct labor per unit. Sanchez has two activities: Assembly, which is applied at the rate of $8 per assembly hour, and Testing, which is applied at the rate of $34 per batch. This month, Sanchez made 245 lawn mowers, using 980 assembly hours in 49 batches. What is the total manufacturing cost for one lawn mower?arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education