Concept explainers

(a)

To determine:

To set the spreadsheet for calculating the relative strength of the banking sector compared to the broad market.

Introduction:

Relative strength helps to measure the extent to which a security has underperformed or it has outperformed its own industry or the entire market. Relative strength is a ratio of price of security to industry price index.

Answer to Problem 26PS

The spreadsheet is obtained and given in explanation.

Explanation of Solution

Given Information:

The data given in the website. The initial value of the sector index and S&P 500 Index is equal to 100. Each week's

The data was downloaded from the given website.

| Week | SPY rate | FSRBX rate |

| 2013.01 | 1.64 | 1.75 |

| 2013.02 | 0.17 | 0.55 |

| 2013.03 | -0.82 | -0.92 |

| 2013.04 | 0.85 | 0.93 |

| 2013.05 | 0.59 | 0.92 |

| 2013.06 | -0.21 | -0.08 |

| 2013.07 | 0.12 | 1.37 |

| 2013.08 | 1.19 | 1.80 |

| 2013.09 | -3.27 | -2.73 |

| 2013.10 | -1.00 | -0.58 |

| 2013.11 | -0.03 | -0.87 |

| 2013.12 | 3.25 | 1.09 |

| 2013.13 | -0.23 | -0.21 |

| 2013.14 | -0.47 | -3.37 |

| 2013.15 | 0.47 | 0.00 |

| 2013.16 | -2.97 | -1.55 |

| 2013.17 | -0.91 | -1.75 |

| 2013.18 | 0.07 | 0.40 |

| 2013.19 | -0.20 | 1.11 |

| 2013.20 | 2.77 | 2.50 |

| 2013.21 | 0.11 | 0.04 |

| 2013.22 | 1.21 | 0.38 |

| 2013.23 | -0.27 | -0.89 |

| 2013.24 | 0.19 | 0.52 |

| 2013.25 | -0.85 | -0.17 |

| 2013.26 | -1.02 | -1.16 |

| 2013.27 | -0.92 | 0.04 |

| 2013.28 | -1.57 | 0.04 |

| 2013.29 | 1.72 | 0.95 |

| 2013.30 | -3.60 | -1.97 |

| 2013.31 | 0.32 | 0.83 |

| 2013.32 | 3.07 | 3.47 |

| 2013.33 | 0.88 | 1.05 |

| 2013.34 | 0.59 | 0.58 |

| 2013.35 | 0.85 | 0.54 |

| 2013.36 | 0.50 | 0.21 |

| 2013.37 | -1.49 | -1.72 |

| 2013.38 | 1.96 | 2.08 |

| 2013.39 | -1.00 | 0.16 |

| 2013.40 | -1.11 | -0.37 |

| 2013.41 | -1.13 | -1.51 |

| 2013.42 | 2.91 | 3.28 |

| 2013.43 | 3.61 | 2.73 |

| 2013.44 | 1.29 | 1.60 |

| 2013.45 | -0.86 | -2.16 |

| 2013.46 | 0.79 | 1.18 |

| 2013.47 | 0.76 | 0.19 |

| 2013.48 | 0.06 | -0.19 |

| 2013.49 | 0.57 | 0.04 |

| 2013.50 | 1.11 | 1.83 |

| 2013.51 | 0.08 | -0.15 |

| 2013.52 | -2.01 | -2.22 |

| 2014.01 | -0.17 | -1.56 |

| 2014.02 | -1.24 | 0.16 |

| 2014.03 | 0.56 | -0.28 |

| 2014.04 | 2.38 | 2.74 |

| 2014.05 | 0.45 | -0.39 |

| 2014.06 | -0.32 | -2.45 |

| 2014.07 | 0.87 | 0.36 |

| 2014.08 | 1.07 | 1.63 |

| 2014.09 | -1.91 | -1.87 |

| 2014.10 | -1.15 | -1.23 |

| 2014.11 | -1.18 | -2.58 |

| 2014.12 | 0.25 | 0.29 |

| 2014.13 | 0.48 | 0.66 |

| 2014.14 | -3.26 | -2.29 |

| 2014.15 | 1.24 | 0.75 |

| 2014.16 | 0.16 | 1.54 |

| 2014.17 | 1.15 | 0.78 |

| 2014.18 | -1.17 | -1.30 |

| 2014.19 | 2.93 | 3.13 |

| 2014.20 | 0.96 | -0.52 |

| 2014.21 | -0.09 | -0.36 |

| 2014.22 | 0.05 | -0.04 |

| 2014.23 | 1.37 | 1.65 |

| 2014.24 | -1.96 | -1.07 |

| 2014.25 | 0.46 | 0.80 |

| 2014.26 | 1.49 | 1.19 |

| 2014.27 | 1.26 | 1.65 |

| 2014.28 | 0.57 | 0.35 |

| 2014.29 | 0.16 | -0.92 |

| 2014.30 | -0.69 | -1.24 |

| 2014.31 | 0.14 | 0.04 |

| 2014.32 | -0.47 | 0.39 |

| 2014.33 | -1.39 | -1.92 |

| 2014.34 | 1.24 | 1.00 |

| 2014.35 | 1.91 | 0.63 |

| 2014.36 | -0.46 | 0.08 |

| 2014.37 | -1.67 | -2.36 |

| 2014.38 | 1.32 | -0.08 |

| 2014.39 | -2.79 | -1.73 |

| 2014.40 | -0.78 | 0.04 |

| 2014.41 | -0.45 | 1.02 |

| 2014.42 | 1.41 | 2.23 |

| 2014.43 | 1.93 | 1.03 |

| 2014.44 | 1.35 | 3.02 |

| 2014.45 | 1.10 | -0.19 |

| 2014.46 | 1.60 | 1.72 |

| 2014.47 | -0.22 | -0.68 |

| 2014.48 | -0.41 | -0.38 |

| 2014.49 | 0.55 | 0.72 |

| 2014.50 | 0.31 | 0.19 |

| 2014.51 | -1.77 | -1.73 |

| 2014.52 | 3.15 | 2.41 |

| 2015.01 | 0.19 | -0.52 |

| 2015.02 | -2.10 | -2.89 |

| 2015.03 | 2.04 | 2.59 |

| 2015.04 | -1.76 | -1.81 |

| 2015.05 | 0.29 | 0.81 |

| 2015.06 | 1.72 | 1.71 |

| 2015.07 | 0.47 | 1.35 |

| 2015.08 | -0.50 | -1.07 |

| 2015.09 | -0.13 | 0.07 |

| 2015.1 | 1.99 | 2.13 |

| 2015.11 | -0.32 | -0.51 |

| 2015.12 | -0.29 | -0.66 |

| 2015.13 | -0.23 | -0.04 |

| 2015.14 | -0.64 | -0.41 |

| 2015.15 | 1.90 | 1.37 |

| 2015.16 | 0.24 | 3.11 |

| 2015.17 | 0.80 | 0.57 |

| 2015.18 | -2.48 | -2.76 |

| 2015.19 | -1.66 | -1.49 |

| 2015.2 | 1.01 | 0.59 |

| 2015.21 | 0.48 | 1.06 |

| 2015.22 | -2.83 | -0.80 |

| 2015.23 | -0.12 | -1.72 |

| 2015.24 | -0.17 | -1.60 |

| 2015.25 | 2.29 | 2.08 |

| 2015.26 | -0.53 | -0.11 |

| 2015.27 | -2.44 | -1.30 |

| 2015.28 | 0.34 | 2.67 |

| 2015.29 | 3.25 | 2.31 |

| 2015.3 | 0.17 | 0.72 |

| 2015.31 | -0.93 | -1.99 |

| 2015.32 | 2.89 | 1.88 |

| 2015.33 | -0.67 | -1.14 |

| 2015.34 | 1.23 | 0.54 |

| 2015.35 | -0.86 | -0.54 |

| 2015.36 | 1.73 | 1.80 |

| 2015.37 | -0.38 | -0.25 |

| 2015.38 | 1.61 | 0.78 |

| 2015.39 | 1.08 | 0.67 |

| 2015.4 | 1.20 | 0.87 |

| 2015.41 | 0.15 | -1.21 |

| 2015.42 | 0.78 | 0.28 |

| 2015.43 | -1.00 | -1.01 |

| 2015.44 | 1.25 | 1.62 |

| 2015.45 | 1.58 | 0.28 |

| 2015.46 | -0.05 | -0.62 |

| 2015.47 | -0.09 | -0.49 |

| 2015.48 | 0.85 | 1.12 |

| 2015.49 | 0.65 | 2.04 |

| 2015.5 | -1.11 | 0.03 |

| 2015.51 | 0.62 | 0.34 |

| 2015.52 | -0.76 | -0.74 |

| 2016.01 | 1.92 | 0.34 |

| 2016.02 | -0.29 | -0.65 |

| 2016.03 | -0.48 | -0.27 |

| 2016.04 | 1.88 | 1.78 |

| 2016.05 | -0.60 | -0.20 |

| 2016.06 | 1.24 | 1.82 |

| 2016.07 | -0.29 | -0.50 |

| 2016.08 | -4.57 | -4.10 |

| 2016.09 | 1.52 | 0.35 |

| 2016.1 | -1.21 | -1.77 |

| 2016.11 | 3.51 | 3.45 |

| 2016.12 | -0.97 | -2.21 |

| 2016.13 | 1.58 | -0.31 |

| 2016.14 | 0.74 | -0.24 |

| 2016.15 | 2.27 | 3.50 |

| 2016.16 | 0.61 | -0.30 |

| 2016.17 | 0.93 | 0.95 |

| 2016.18 | -0.03 | 0.34 |

| 2016.19 | 1.16 | 0.60 |

| 2016.2 | -0.61 | -0.97 |

| 2016.21 | 1.57 | 0.84 |

| 2016.22 | -1.97 | -2.20 |

| 2016.23 | 1.78 | 1.47 |

| 2016.24 | -1.64 | -2.55 |

| 2016.25 | -0.08 | -0.41 |

| 2016.26 | 1.70 | 1.18 |

| 2016.27 | 1.22 | 0.24 |

| 2016.28 | -0.87 | -3.31 |

| 2016.29 | -5.46 | -5.40 |

| 2016.3 | -0.90 | -4.03 |

| 2016.31 | 0.63 | 5.80 |

| 2016.32 | 0.00 | 3.71 |

| 2016.33 | 2.51 | 0.07 |

| 2016.34 | -0.50 | -1.49 |

| 2016.35 | -1.03 | -2.52 |

| 2016.36 | 1.94 | 1.66 |

| 2016.37 | 2.55 | 2.50 |

| 2016.38 | 0.40 | -1.74 |

| 2016.39 | 2.14 | 4.61 |

| 2016.4 | 0.31 | -2.58 |

| 2016.41 | -4.26 | -7.57 |

| 2016.42 | 2.63 | 2.98 |

| 2016.43 | -1.57 | -6.13 |

| 2016.44 | -4.01 | -2.14 |

| 2016.45 | 0.45 | -1.90 |

| 2016.46 | -1.14 | -2.72 |

| 2016.47 | 3.15 | 5.34 |

| 2016.48 | 1.52 | -0.24 |

| 2016.49 | -2.48 | -6.53 |

| 2016.5 | 1.18 | 1.08 |

| 2016.51 | -0.56 | -1.15 |

| 2016.52 | -4.06 | -6.69 |

| 2017.01 | -0.82 | 0.56 |

| 2017.02 | -5.77 | -7.23 |

| 2017.03 | 0.75 | 10.91 |

| 2017.04 | 4.91 | 7.74 |

| 2017.05 | -4.67 | -6.93 |

| 2017.06 | 1.56 | -1.07 |

| 2017.07 | 0.35 | 0.45 |

| 2017.08 | -1.32 | -5.12 |

| 2017.09 | -3.08 | -6.53 |

| 2017.1 | -0.07 | 1.77 |

| 2017.11 | 2.41 | 11.69 |

| 2017.12 | -0.43 | -7.26 |

| 2017.13 | 4.09 | 3.60 |

| 2017.14 | -2.56 | -4.91 |

| 2017.15 | 3.82 | 4.78 |

| 2017.16 | 0.81 | 2.42 |

| 2017.17 | 1.37 | 1.95 |

| 2017.18 | -1.85 | -4.99 |

| 2017.19 | 2.70 | 1.13 |

| 2017.2 | -3.52 | -4.13 |

| 2017.21 | 1.96 | 0.15 |

| 2017.22 | -2.89 | -7.05 |

| 2017.23 | -0.11 | -4.31 |

| 2017.24 | -2.87 | -4.07 |

| 2017.25 | -3.08 | -4.19 |

| 2017.26 | -0.96 | -4.67 |

| 2017.27 | -1.95 | -6.75 |

| 2017.28 | 1.72 | 12.69 |

| 2017.29 | -0.40 | 1.30 |

| 2017.3 | 0.55 | 7.63 |

| 2017.31 | 2.54 | 1.03 |

| 2017.32 | 0.62 | -1.55 |

| 2017.33 | -0.40 | -3.05 |

| 2017.34 | -0.66 | 3.25 |

| 2017.35 | -3.40 | 3.86 |

| 2017.36 | 1.35 | 2.30 |

| 2017.37 | -0.99 | 10.94 |

| 2017.38 | -2.63 | -10.46 |

| 2017.39 | -8.70 | -5.66 |

| 2017.4 | -19.79 | -18.66 |

| 2017.41 | 5.33 | 9.99 |

| 2017.42 | -6.63 | -7.68 |

| 2017.43 | 11.25 | 13.61 |

| 2017.44 | -3.07 | -8.20 |

| 2017.45 | -7.71 | -6.40 |

| 2017.46 | -8.19 | -20.03 |

| 2017.47 | 13.29 | 25.04 |

| 2017.48 | -2.39 | -0.34 |

| 2017.49 | 1.20 | -6.79 |

| 2017.5 | -0.09 | 2.69 |

| 2017.51 | -1.17 | -2.55 |

| 2017.52 | 6.66 | -0.29 |

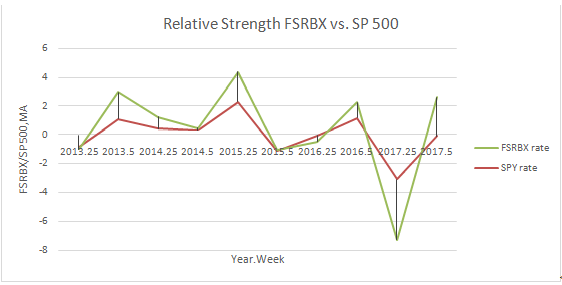

The graph of the relative strength for S&P 500 and FB is plotted as shown below.

Using the price movements and their changing speed, the relative strength of the fund against the S&P 500 can be measured.

(b)

To determine:

To determine the instances where the relative strength ratio exceeds by minimum 5% from its 5 weeks prior value and to determine the number of weeks immediately following the substantial increase the banking sector outperforms S&P500 and how many weeks banking sector underperforms S&P500.

Introduction:

Relative strength helps to measure the extent to which a security has underperformed or it has outperformed its own industry or the entire market. Relative strength is a ratio of price of security to industry price index.

Answer to Problem 26PS

As per the data, 16 times the relative strength increases more than 5%.

Explanation of Solution

Given Information:

The data is available in the given website.

Of the 255 total instances, there are 16 times when the relative strength increases by greater than 5% over the interval of 5 weeks.

Here, it is seen that 10 times the FSRBX underperformed the S&P 500 following the increase of more than 5%.

There are 6 times that FSRBX outperformed S&P 500 following the increase of more than 5%.

(c)

Requirement 3 To Determine:

To determine the instances where the relative strength ratio decreases by minimum 5% from its 5 weeks prior value and to determine the number of weeks immediately following the substantial decrease the banking sector outperforms S&P 500 and how many weeks banking sector underperforms S&P 500.

Introduction:

Relative strength helps to measure the extent to which a security has underperformed or it has outperformed its own industry or the entire market. Relative strength is a ratio of price of security to industry price index.

Answer to Problem 26PS

As per the data, 31 times the relative strength moves decrease by greater than 5%.

Explanation of Solution

Given Information:

The data is available in the given website.

Of the 255 total instances, there are 31 times when the relative strength decreases by greater than 5% over the interval of 5 weeks.

Here it is seen that 17 times the FSRBX underperformed S&P 500 following the decrease of more than 5%.

There are 14 times that FSRBX outperformed S&P 500 following the decrease of more than 5%.

(d)

Requirement 4 To Determine:

To determine how well the relative strength rule functions in identifying the selling or buying opportunities.

Introduction:

Relative strength helps to measure the extent to which a security has underperformed or it has outperformed its own industry or the entire market. Relative strength is a ratio of price of security to industry price index.

Answer to Problem 26PS

The data above gives the bullish sign and the bearish sign.

Explanation of Solution

Given Information:

The data is available in the given website.

We can see the relative strength depicted in second part of requirement as bullish sign. Here the FB fund is likely to underperform the S&P 500 index than to perform better than the index according to this signal.

We can see the relative strength depicted in third part of requirement as bearish sign. Here the FB fund did not give a better performance than the index but there is no statistical difference succeeding the considerable change in the relative strength. There is random successive performance.

Want to see more full solutions like this?

Chapter 9 Solutions

ESSENTIALS OF INVESTMENTS SELECT CHAPT

- Which of the following is the best definition of cash budget? Question 10 options: Costs that rise with increases in the level of investment in current assets. A forecast of cash receipts and disbursements for the next planning period. A secured short-term loan that involves either the assignment or factoring of the receivable. The time between sale of inventory and collection of the receivable. The time between receipt of inventory and payment for it.arrow_forwardShort-term financial decisions are typically defined to include cash inflows and outflows that occur within __ year(s) or less. Question 9 options: Four Two Three Five Onearrow_forwardA national firm has sales of $575,000 and cost of goods sold of $368,000. At the beginning of the year, the inventory was $42,000. At the end of the year, the inventory balance was $45,000. What is the inventory turnover rate? Question 8 options: 8.46 times 13.22 times 43.14 times 12.78 times 28.56 timesarrow_forward

- The formula (Cash cycle + accounts payable period) correctly defines the operating cycle. Question 7 options: False Truearrow_forwardAn accounts payable period decrease would increase the length of a firm's cash cycle. Consider each in isolation. Question 6 options: True Falsearrow_forwardWhich of the following issues is/are NOT considered a part of short-term finance? Question 5 options: The amount of credit that should be extended to customers The firm determining whether to issue commercial paper or obtain a bank loan The amount of the firms current income that should be paid out as dividends The amount the firm should borrow short-term A reasonable level of cash for the firm to maintainarrow_forward

- Liberal credit terms for customers is associated with a restrictive short-term financial policy. Question 3 options: True Falsearrow_forwardAn increase in fixed assets is a source of cash. Question 2 options: True Falsearrow_forwardIf the initial current ratio for a firm is greater than one, then using cash to purchase marketable securities will decrease net working capital. True or falsearrow_forward

- what is going to be the value of American put option that expires in one year modeled with a binomial tree of 3 months step with year to expiry? assume the underlying is oil future with RF of 5% and vol of oil is 30%. Strike is 70 and price is 60 of oil. 13.68 13.44 13.01arrow_forwardhello tutor need step by step approach.arrow_forwardNeed step by step approach hrlparrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education