Revising

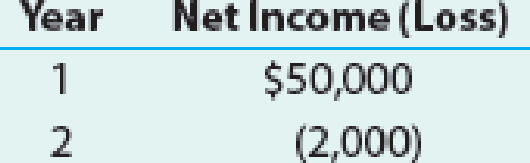

Hard Bodies Co. is a fitness chain that has just completed its second year of operations. At the beginning of its first fiscal year, the company purchased fitness equipment at a cost of $600,000 and estimated that the equipment would have a useful life of five years and no residual value. The company uses the

Mike Gambit, the company’s chief financial officer (CFO), has recently run financial models to predict future net income, and he expects net losses to continue at $(2,000) per year for the next three years. James Steed, the president of Hard Bodies, is concerned about these predictions, as he is under pressure from the company’s owner to return the company to Year 1 net income levels. If the company does not meet these goals, both he and Mike will likely be fired. Mike suggests that the company change the estimated useful life of the fitness equipment to 10 years and increase the equipment’s estimated residual value to $50,000. This will reduce depreciation expense and increase net income.

- 1. Evaluate the decision to change the equipment’s estimated useful life and estimated residual value to improve earnings. How does this change impact the usefulness of the company’s net income for external decision makers?

- 2. If Mike and James make the change, are they acting in an ethical manner? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Financial And Managerial Accounting

- The monthly fee (in dollars) for a streaming service at Madison Entertainment is a linear function of the number of devices registered. The monthly fee for 3 devices is $19.95 and the monthly fee for 6 devices is $31.95. What is the monthly fee for 4 devices?need answerarrow_forwardNonearrow_forwardPlease explain how to solve this financial accounting question with valid financial principles.arrow_forward

- Fresco Prints is producing 20 customized wedding invitations. The production costs include $42 in materials, $36 in hourly wages, and $22 in workstation rental space. What is the average cost per unit (invitation)?arrow_forwardShaan Manufacturing is planning to sell 320 electronic toys and to produce 300 electronic toys in November. Each electronic toy requires 85 grams of plastic and 1.25 hours of direct labor. The cost of the plastic used in each electronic toy is $4.50 per 85 grams. Employees of the company are paid at a rate of $22.50 per hour. Manufacturing overhead is applied at a rate of 125% of direct labor costs. Shaan Manufacturing has 75,000 grams of plastic in its beginning inventory and wants to have 65,000 grams in its ending inventory. What is the amount of budgeted direct labor cost for the month of November?arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forward

- I need guidance with this general accounting problem using the right accounting principles.arrow_forwardAccurate solution wanted. NO AI Please. IF you not sure please dont accept. UNHELPFULarrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage