Concept explainers

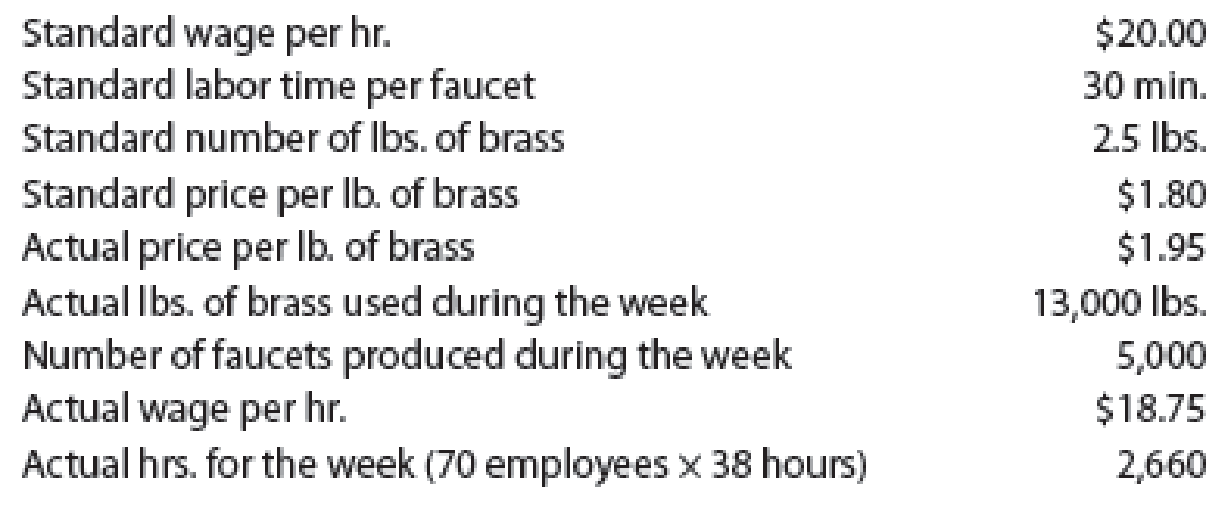

Shasta Fixture Company manufactures faucets in a small manufacturing facility. The faucets are made from brass. Manufacturing has 70 employees. Each employee presently provides 38 hours of labor per week. Information about a production week is as follows:

Instructions

Determine (a) the

Compute the following:

- a. The standard cost per unit for direct materials, and direct labor.

- b. The direct materials price variance, the direct materials quantity variance, and the total direct materials cost variance, and

- c. The direct labor rate variance, direct labor time variance, and total direct labor cost variance.

Explanation of Solution

Direct material variances:

The difference between the actual material cost per unit and the standard material cost per unit for the direct material purchased is known as direct material cost variance. The direct material variance can be classified as follows:

- v Direct materials price variance.

- v Direct materials quantity variance.

Direct labor variances:

The difference between the actual labor cost in the production and the standard labor cost for actual production is known as direct labor cost variance. The direct labor variance can be classified as follows:

- v Labor rate variance.

- v Labor time variance.

- a. Compute the standard cost per unit for direct materials, and direct labor.

| Particulars | Standard materials and labor cost per faucet |

| Direct materials (1) | $4.50 |

| Direct labor (2) | $10.00 |

| $14.50 |

Table (1)

Therefore, the standard cost per unit for direct materials, and direct labor is $14.50.

Working note (1):

Compute the amount of direct materials:

Working note (2):

Compute the amount of direct labor:

- b. Compute the direct materials price variance, the direct materials quantity variance, and the total direct materials cost variance

- Ø Ascertain the direct materials price variance.

Hence, the direct materials price variance is $1,950, and it is an unfavorable variance, since the actual price is more than the standard price.

- Ø Ascertain the direct materials quantity.

Working note (3):

Compute the standard quantity:

Hence, the quantity variance is $900, and it is an Unfavorable variance. Since the actual quantity is more than the standard quantity.

- Ø Ascertain the total direct materials cost variance.

Hence, the total direct materials cost variance is $2,850, and it is an unfavorable variance, since both the direct materials price variance and the direct materials quantity variance are unfavorable.

- c. Compute the direct labor rate variance, direct labor time variance, and total direct labor cost variance:

- Ø Ascertain the direct labor rate variance.

Working note (4):

Compute the actual labor hours:

The direct labor rate variance is $(3,325) and it is a favorable variance, since the actual rate per hour is lesser than the standard rate per hour.

- Ø Ascertain the direct labor time variance.

Working note (5):

Compute the standard direct labor hours:

The direct labor time variance is $3,200 and it is an unfavorable variance, since the actual direct labor hour is more than the standard direct labor hour.

- Ø Ascertain the total direct labor cost time variance.

The direct labor cost variance is $(125) and it is a favorable variance, since the direct labor rate variance is lesser than the direct labor time variance.

Want to see more full solutions like this?

Chapter 9 Solutions

Managerial Accounting

- Can you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardCan you explain the correct approach to solve this general accounting question?arrow_forwardPlease help me solve this general accounting problem with the correct financial process.arrow_forward

- Please help me solve this general accounting problem with the correct financial process.arrow_forwardAccounting solutionarrow_forwardJoe and Ethan each own 50% of JH Corporation, a calendar year taxpayer. Distributions from JH are: $750,000 to Joe on April 1 and $250,000 to Ethan on May 1. JH’s current E & P is $300,000 and its accumulated E & P is $600,000. How much of the accumulated E & P is allocated to Ethan’s distribution? a. $0b. $75,000c. $150,000d. $300,000e. None of the above b or c?arrow_forward

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College