The Mega Supply Corporation has three divisions: Commercial Products, Consumer Products, and Corporate Offices, which are located in Hatfield, South Carolina; Palo Alto, California; and Tulsa, Oklahoma, respectively. The Commercial Products division deals exclusively in sales of industrial products and supplies to business organizations. The Consumer Products division sells nonindustrial products to private consumers. Both divisions have dedicated inventory warehouses at their respective locations in Hatfield and Palo Alto. Because of the dissimilar nature of the commercial and consumer division product lines, they do not share customers or vendors.

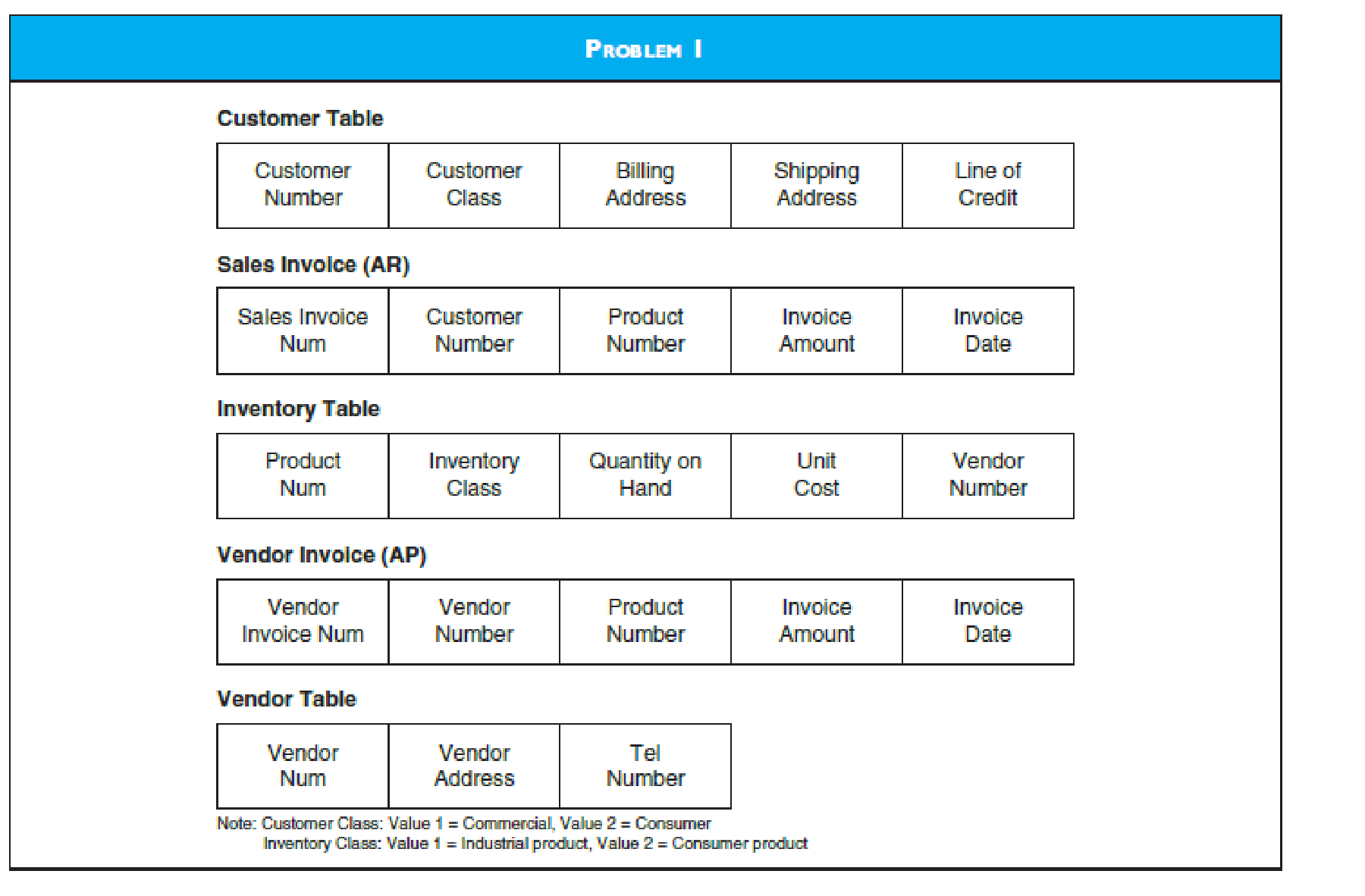

Currently Mega Supply uses a centralized database, which is located at their Corporate Division in Tulsa. Some relevant database tables and attributes are presented in the figure designated Problem 1.

When customers contact their respective sales division, the sales clerk logs into the corporate database, checks credit, determines product availability, and creates a sales invoice. The corporate office typically bills the customer within 3 or 4 days and extends terms of net 30. Inventory control,

Due to Mega’s rapid growth, the company has seen a significant increase in sales and purchase transactions, which has resulted in excessive delays in processing transactions from the central database. Since customer service, including rapid response to customer inquiries and sales order processing, is a cornerstone of Mega’s business model, these delays are unacceptable.

Required

Mega wants to improve response time by distributing some parts of the corporate database while keeping other parts of it centralized.

- (A) Develop a schema for distributing Mega Supply Corporation’s database. Add new tables and attributes as needed but limit the schema to the tables needed to support sales, cash receipts, purchases/AP, and cash disbursements. In your schema, indicate whether tables are centralized, replicated, or partitioned.

- (B) Explain how the new system will operate.

Trending nowThis is a popular solution!

Chapter 9 Solutions

Accounting Information Systems

- How much is the adjusted cost of goods sold on the schedule of cost of goods sold?arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forwardHarmony Outdoors plans to sell 6,300 camping tents at $95 each in the coming year. The unit variable cost is $56.05 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Fixed factory overhead is $28,500, and fixed selling and administrative expenses are $41,200. Calculate the variable cost ratio. Calculate the contribution margin ratio.arrow_forward

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardWhat is the accounts receivable turnover ratio?arrow_forwardBeachside Hotel has sales of $1,250,000 and a profit margin of 10%. The annual depreciation expense is $135,000. What is the amount of the operating cash flow if the company has no long-term debt?arrow_forward

- Please provide the correct answer to this general accounting problem using valid calculations.arrow_forwardBased on potential sales of 800 units per year, a new product at Waverly Manufacturing has estimated traceable costs of $1,600,000. What is the target price to obtain a 25% profit margin on sales? A. $2,500.68 B. $2,400.21 C. $2,666.67 D. $1,950.55arrow_forwardFinancial accountingarrow_forward

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning