Concept explainers

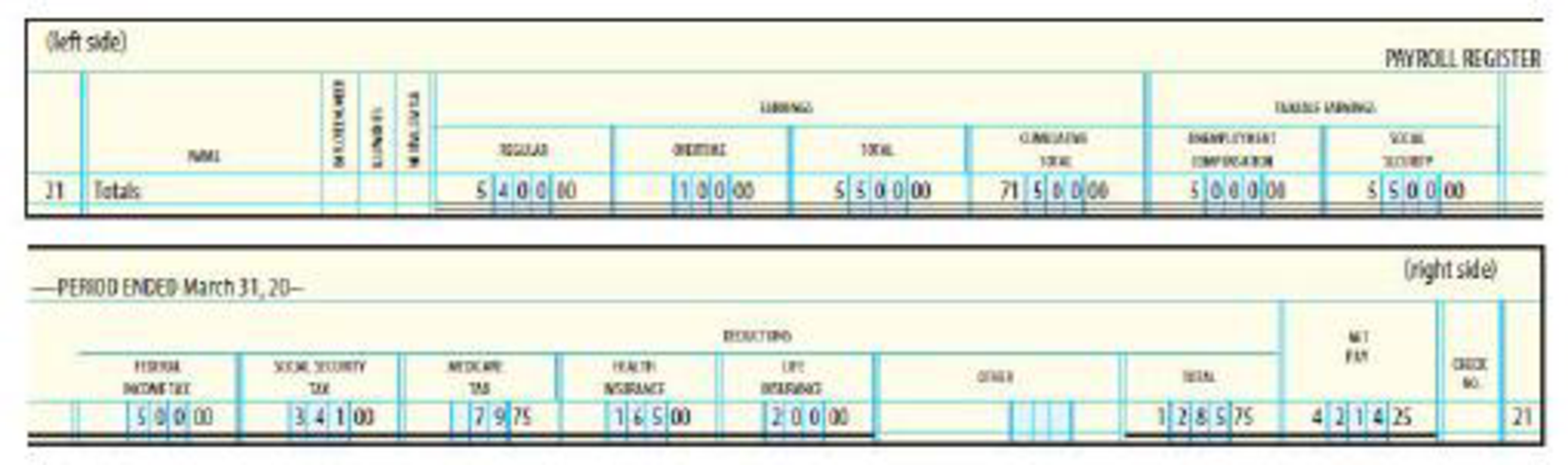

The totals line from Nix Company’s payroll register for the week ended March 31, 20--, is as follows:

Payroll taxes are imposed as follows: Social Security tax, 6.2%; Medicare tax, 1.45%; FUTA tax, 0.6%; and SUTA tax, 5.4%.

REQUIRED

- 1.

- a. Prepare the

journal entry for payment of this payroll on March 31, 20--. - b. Prepare the journal entry for the employer’s payroll taxes for the period ended March 31, 20--.

- a. Prepare the

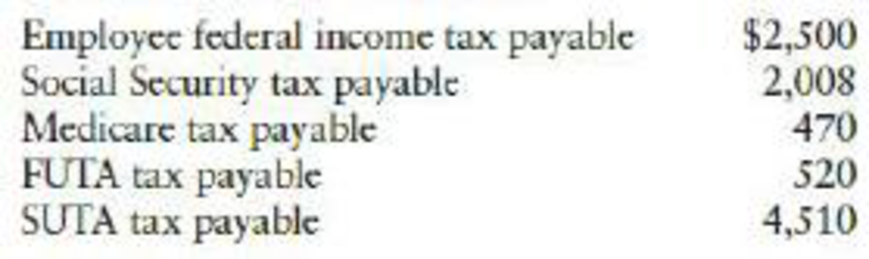

- 2. Nix Company had the following balances in its general ledger before the entries for requirement ( 1 ) were made:

- a. Prepare the journal entry for payment of the liabilities for federal income taxes and Social Security and Medicare taxes on April 15, 20--.

- b. Prepare the journal entry for payment of the liability for FUTA tax on April 30, 20--.

- c. Prepare the journal entry for payment of the liability for SUTA tax on April 30, 20--.

1.

a. Prepare the journal entry for payment of this payroll on March 31.

b. Prepare the journal entry for the employer’s payroll taxes for the period ended March 31.

Explanation of Solution

Payroll:

Payroll refers to the total amount that is required to be paid by the company to its employees during a week, month or other period. It is the financial record of the wages and bonus, net pay, salary and deductions of a company’s employees.

a. Prepare the journal entry for payment of this payroll on March 31, 20--

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| March 31 | Wages and Salaries expense | 5,500 | ||

| Employee federal income tax payable | 500.00 | |||

| FICA-Social Security taxes payable | 341.00 | |||

| FICA-Medicare Taxes payable | 79.75 | |||

| Health insurance premium payable | 165.00 | |||

| Life insurance premium payable | 200.00 | |||

| Cash | 4,214.25 | |||

| (To record the payroll for the week ended March 31) |

Table (1)

- Wages and Salaries expense is an expense account and it is increased. Hence, debit wages and salaries expense with $5,500.00

- Employee Federal income tax payable is a liability and there is an increase in the value of liability. Hence, credit the employee Federal income tax payable by $500.00

- FICA tax – social and security tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – social and security tax payable by $341.00

- FICA tax – medical tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – medical tax payable by $79.75.

- Health insurance premium payable is a liability and it is increased. Hence, credit health insurance premium payable by $165.00.

- Life insurance premium payable is a liability and it is increased. Hence, credit life insurance premium payable by $200.00

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $4,214.25.

b. Prepare the journal entry for the employer’s payroll taxes for the period ended March 31, 20--

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| March 31 | Payroll tax expense | 720.75 | ||

| FICA-Social Security taxes payable | 341.00 | |||

| FICA-Medicare Taxes payable | 79.75 | |||

| FUTA tax payable | 30.00 | |||

| SUTA tax payable | 270.00 | |||

| (To record the employer payroll taxes for the week ended March 31) |

Table (2)

- Payroll taxes expense is an expense account and it is increased. Hence, debit payroll taxes expense with $720.75.

- FICA tax – social and security tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – social and security tax payable by $341.00.

- FICA tax – medical tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – medical tax payable by $79.75.

- FUTA tax payable is a liability and it is increased. Hence, credit FUTA tax payable by $30.00.

- SUTA tax payable is a liability and it is increased. Hence, credit SUTA tax payable by $270.00.

2.

a. Prepare the journal entry for payment of the liabilities for federal income taxes and Social Security and Medicare taxes on April 15.

b. Prepare the journal entry for payment of the liability for FUTA tax on April 30.

c. Prepare the journal entry for payment of the liability for SUTA tax on April 30.

Explanation of Solution

a. Prepare the journal entry for payment of the liabilities for federal income taxes and Social Security and Medicare taxes on April 15.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| April 15 | Employee federal income tax payable (1) | 3,000.00 | ||

| FICA-Social Security taxes payable (2) | 2,690.00 | |||

| FICA-Medicare Taxes payable (3) | 629.50 | |||

| Cash | 6,319.50 | |||

| (To record the deposit of employee federal income tax and social security and Medicare taxes.) |

Table (3)

- Employee federal income tax payable is a liability and it is decreased. Hence, debit employee federal income tax payable by $3,000.00.

- FICA tax – social and security tax payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA tax – social and security tax payable by $2,690.00.

- FICA tax – medical tax payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA tax – medical tax payable by $629.50.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $6,319.50.

b. Prepare the journal entry for payment of the liability for FUTA tax on April 30.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| April 30 | FUTA tax payable (4) | 550.00 | ||

| Cash | 550.00 | |||

| (To record the payment of FUTA tax) |

Table (4)

- FUTA tax payable is a liability and it is decreased. Hence, debit FUTA tax payable by $550.00.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $550.00.

c. Prepare the journal entry for payment of the liability for SUTA tax on April 30.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| April 30 | SUTA tax payable (5) | 4,780.00 | ||

| Cash | 4,780.00 | |||

| (To record the payment of SUTA tax) |

Table (5)

- SUTA tax payable is a liability and it is decreased. Hence, debit SUTA tax payable by $4,780.00.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $4,780.00

Working Notes:

(1) Calculate the employee federal income tax payable.

(2) Calculate the social security tax payable.

(3) Calculate the Medicare tax payable.

(4) Calculate the FUTA tax payable.

(5) Calculate the SUTA tax payable.

3.

Prepare the adjusting entry to reflect the overpayment of the insurance premium at the end of the year December 31.

Explanation of Solution

Prepare the adjusting entry to reflect the overpayment of the insurance premium at the end of the year December 31.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| December 31 | Insurance refund receivable (6) | 20.00 | ||

| Workmen’s compensation insurance expense | 20.00 | |||

| (To record the adjustment for insurance premium) |

Table (6)

- Insurance refund receivable is an asset and there is an increase in the value of an asset. Hence, debit the Insurance refund receivable by $20.00.

- Workmen’s compensation insurance expense is a component of stockholder’s equity and the expense has decreased. Hence, credit the workmen’s compensation insurance expense by $20.00

Working Notes:

(6) Calculate the total insurance premium owed.

| Particulars | Amount in $ |

| Actual amount owed | 400.00 |

| Less: Estimated premium paid | 420.00 |

| Refund due | (20.00) |

Table (7)

Want to see more full solutions like this?

Chapter 9 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

- I want to correct answer general accounting questionarrow_forwardQuestion: Mr. R bought a machine for Rs 25,000 on which he spent Rs 5,000 for carriage and freight; Rs 1,000 for brokerage of the middleman; Rs 3,500 for installation and Rs 500 for an iron pad. The machine is depreciated @ 10% every year on a written down basis. After three years the machine was sold to Mr. B for Rs 30,500 and Rs 500 was paid as commission to the broker. Find out the profit or loss on the sale of the machine. Please help mearrow_forwardHome Insert Share Formulas Data Review View Help Draw 910 " Calibri (Body) 11 AABU DAVA = Wrap Merge v General B75 vxvfx Common stock - Netspeed D E A B 52 QuickPort's share of NetSpeed's dividends 53 Balance 12/31/2024 54 56 57 58 59 60 55 b. Prepare the worksheet adjustments for the December 31, 2024 consolidation of QuickPort and NetSpeed. TA Account Title Investment in Netspeed Equipment Accumulated depreciation 61 S Common stock - Netspeed 62 63 64 65 A 66 67 68 69 70 D 71 E 72 73 ED 74 Retained earnings - Netspeed Investment in Netspeed Amortization expense Database Investment in Netspeed Amortization expense Equity in earnings of Netspeed Investment in Netspeed Investment in Netspeed Dividends declared Equity in earnings of Netspeed Equipment Noncontrolling interest Common stock - Netspeed 75 76 77 78 Debit Credit 79 Students: The scratchpad area is for you to do any additional work you need to solve this question or can be used to show your work. 80 Nothing in this area will be…arrow_forward

- Pinehill Inc. has annual fixed costs of $150,000 and variable costs of $4 per unit. Each unit is sold for $20, and the company expects to sell 15,000 units this year. Compute the operating profit (or loss) if the sales price decreases by 25%.arrow_forwardHi expert please give me answer general accounting questionarrow_forwardABC Corp has fixed costs of $200,000, and variable costs as a percentage of sales are 70%. If the company currently makes $1,000,000 in sales, what amount of sales must be achieved to earn a net income of $90,000?arrow_forward

- RIO is a retailer of smart televisions. Typically, the company purchases atelevision for $1,200 and sells it for $1,500. What is the gross profit margin on this television? General Accountarrow_forwardMCQarrow_forwardA Medical Lab has introduced a new sample processing efficiency measurement system. This system awards points for adherence to standards: 5 points for tests completed within one hour, 3 points for proper documentation, and 2 points for maintaining sample integrity. Yesterday's analysis of 150 samples showed 140 met timing standards, 144 were properly documented, and all samples maintained integrity. The lab director needs to assess the overall efficiency percentage. [JOB COSTING 2.8]. ANSWERarrow_forward

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage