1.

Journalize the transactions for the month of July.

1.

Explanation of Solution

Rules of Debit and Credit: Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and

stockholders’ equities . - Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Journalize the transactions for the month of July:

| Date | Account title and explanation | Post Ref. | Amount | ||

| Debit | Credit | ||||

| 20-- | |||||

| July | 1 | Cash | 111 | $25,000.00 | |

| Person AV's Capital | 311 | $25,000.00 | |||

| 1 | Spa Supplies | 115 | $490.00 | ||

| Accounts Payable - Company GSS | 211/✓ | $490.00 | |||

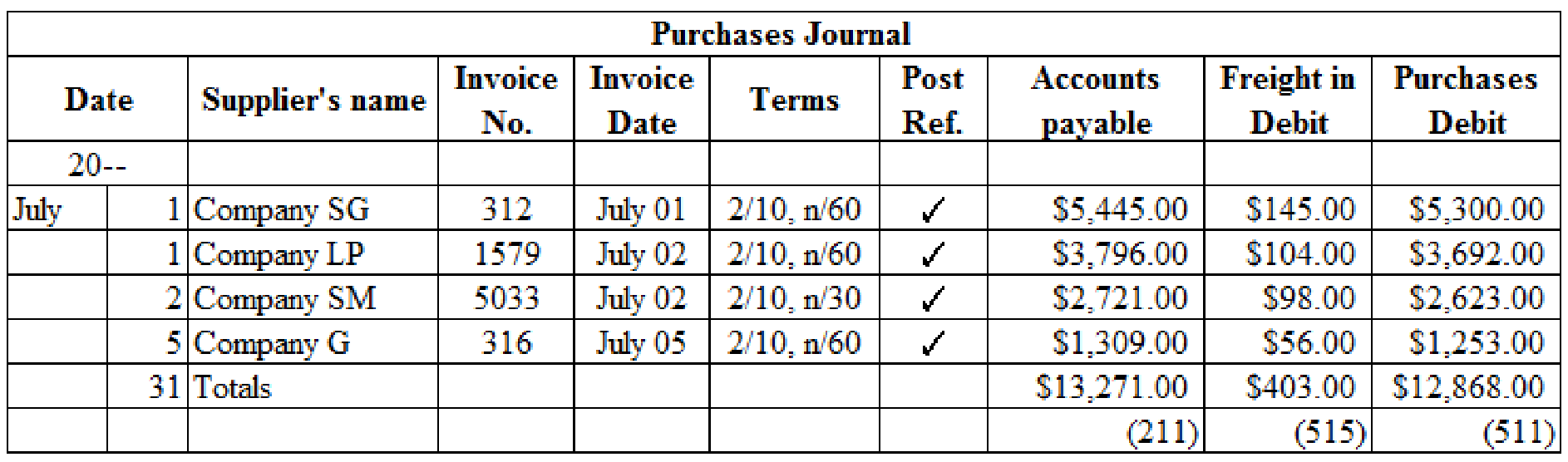

| 1 | Purchases | 511 | $5,300.00 | ||

| Freight In | 515 | $145.00 | |||

| Accounts Payable - Company SG | 211/✓ | $5,445.00 | |||

| 1 | Purchases | 511 | $3,692.00 | ||

| Freight In | 515 | $104.00 | |||

| Accounts Payable – Company LP | 211/✓ | $3,796.00 | |||

| 2 | Purchases | 511 | $2,623.00 | ||

| Freight In | 515 | $98.00 | |||

| Accounts Payable - Company SM | 211/✓ | $2,721.00 | |||

| 2 | Accounts receivable - Company LOL | 113/✓ | $351.00 | ||

| Merchandise Sales | 412 | $325.00 | |||

| Sales Tax Payable | 215 | $26.00 | |||

| 3 | Spa Equipment | 128 | $8,235.00 | ||

| Accounts Payable -Incorporation SE | 211/✓ | $6,235.00 | |||

| Cash | 111 | $2,000.00 | |||

| 3 | Rent Expense | 612 | $1,650.00 | ||

| Cash | 111 | $1,650.00 | |||

| 4 | Accounts Receivable- Company C | 113/✓ | $520.02 | ||

| Merchandise Sales | 412 | $481.50 | |||

| Sales Tax Payable | 215 | $38.52 | |||

| 5 | Accounts Payable - Company GSS | 211/✓ | $492.00 | ||

| Cash | 111 | $492.00 | |||

| 5 | Accounts Payable - Company OS | 211/✓ | $120.00 | ||

| Cash | 111 | $120.00 | |||

| 5 | Miscellaneous Expense | 630 | $98.00 | ||

| Cash | 111 | $98.00 | |||

| 5 | Accounts Payable - Incorporation A | 211/✓ | $397.00 | ||

| Cash | 111 | $397.00 | |||

| 5 | Wages Payable | 212 | $369.50 | ||

| Wages Expense | 611 | $1,476.00 | |||

| Cash | 111 | $1,845.50 | |||

| 5 | Office Equipment | 124 | $420.00 | ||

| Accounts Payable - Company SE | 211/✓ | $420.00 | |||

| 5 | Promotion Expense | 630 | $186.00 | ||

| Accounts Payable - Company OS | 211/✓ | $186.00 | |||

| 5 | Office Supplies | 114 | $118.00 | ||

| Accounts Payable -Company OS | 211/✓ | $118.00 | |||

| 5 | Purchases | 511 | $1,253.00 | ||

| Freight In | 515 | $56.00 | |||

| Accounts Payable - Company G | 211/✓ | $1,309.00 | |||

| 5 | Accounts receivable - Company PS | 113/✓ | $1,961.23 | ||

| Merchandise Sales | 412 | $1,815.95 | |||

| Sales Tax Payable | 215 | $145.28 | |||

| 7 | Cash | 111 | $4,881.60 | ||

| Merchandise Sales | 412 | $1,410.00 | |||

| Income from Services | 411 | $3,110.00 | |||

| Sales Tax Payable | 215 | $361.60 | |||

| 7 | Cash | 111 | $150.00 | ||

| Accounts Receivable - Company JA | 113/✓ | $150.00 | |||

| 10 | Accounts Receivable - Company HC | 113/✓ | $367.47 | ||

| Merchandise Sales | 412 | $340.25 | |||

| Sales Tax Payable | 215 | $27.22 | |||

| 10 | Accounts Receivable - Company MS | 113/✓ | $222.48 | ||

| Merchandise Sales | 412 | $206.00 | |||

| Sales Tax Payable | 215 | $16.48 | |||

| 12 | Wages Expense | 611 | $1,845.50 | ||

| Cash | 111 | $1,845.50 | |||

| 12 | Accounts Receivable - Company AFS | 113/✓ | $521.59 | ||

| Merchandise Sales | 412 | $482.95 | |||

| Sales Tax Payable | 215 | $38.64 | |||

| 14 | Cash | 111 | $200.00 | ||

| Accounts Receivable - Company JM | 113/✓ | $200.00 | |||

| 14 | Cash | 111 | $4,158.00 | ||

| Merchandise Sales | 412 | $1,220.00 | |||

| Income from Services | 411 | $2,630.00 | |||

| Sales Tax Payable | 215 | $308.00 | |||

| 18 | Accounts Payable - Company SE | 211/✓ | $1,150.00 | ||

| Cash | 111 | $1,150.00 | |||

| 19 | Wages Expense | 611 | $1,840.50 | ||

| Cash | 111 | $1,840.50 | |||

| 21 | Cash | 111 | $180.00 | ||

| Accounts Receivable - Company TL | 113/✓ | $180.00 | |||

| 21 | Cash | 111 | $5,248.80 | ||

| Merchandise Sales | 412 | $1,940.00 | |||

| Income from Services | 411 | $2,920.00 | |||

| Sales Tax Payable | 215 | $388.80 | |||

| 25 | Spa Equipment | 128 | $173.00 | ||

| Cash | 111 | $173.00 | |||

| 26 | Wages Expense | 611 | $1,842.00 | ||

| Cash | 111 | $1,842.00 | |||

| 28 | Laundry Expense | 615 | $84.00 | ||

| Cash | 111 | $84.00 | |||

| 28 | Cash | 111 | $109.00 | ||

| Accounts Receivable - Company JW | 113/✓ | $109.00 | |||

| 31 | Cash | 111 | $6,471.36 | ||

| Merchandise Sales | 412 | $1,930.00 | |||

| Income from Services | 411 | $4,062.00 | |||

| Sales Tax Payable | 215 | $479.36 | |||

| 31 | Person AV's Drawing | 312 | $2,500.00 | ||

| Cash | 111 | $2,500.00 | |||

| 31 | Utilities Expense | 617 | $225.00 | ||

| Cash | 111 | $225.00 | |||

| 31 | Utilities Expense | 617 | $248.00 | ||

| Cash | 111 | $248.00 | |||

| 31 | Spa Equipment | 128 | $1,800.00 | ||

| Person AV's Capital | 311 | $1,800.00 | |||

Table (1)

2.

2.

Explanation of Solution

Post the entries to the accounts receivable, accounts payable and general ledger:

General Ledger:

| Sales journal | |||||||

| Date | Invoice No. | Customer's name | Post Ref. | Accounts Receivable debit ($) | Sales tax payable credit ($) | Merchandise sales credit ($) | |

| 20-- | |||||||

| July | 2 | 14 | Company LOL | 351.00 | 26.00 | 325.00 | |

| 4 | 15 | Company C | 520.02 | 38.52 | 481.50 | ||

| 5 | 16 | Company PS | 1,961.23 | 145.28 | 1,815.95 | ||

| 10 | 17 | Company HC | 367.47 | 27.22 | 340.25 | ||

| 10 | 18 | Company MS | 222.48 | 16.48 | 206.00 | ||

| 12 | 19 | Company AFS | 521.59 | 38.64 | 482.95 | ||

| 31 | Totals | 3,943.79 | 292.14 | 3,651.65 | |||

| (113) | (215) | (412) | |||||

Table (2)

Table (3)

| Account: Cash | Account No. 111 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $15,170.00 | |||

| 1 | J6 | $25,000.00 | $40,170.00 | ||||

| 3 | J6 | $2,000.00 | $38,170.00 | ||||

| 3 | J6 | $1,650.00 | $36,520.00 | ||||

| 3 | J7 | $89.00 | $36,431.00 | ||||

| 5 | J7 | $492.00 | $35,939.00 | ||||

| 5 | J7 | $120.00 | $35,819.00 | ||||

| 5 | J7 | $98.00 | $35,721.00 | ||||

| 5 | J7 | $397.00 | $35,324.00 | ||||

| 5 | J7 | $1,845.50 | $33,478.50 | ||||

| 7 | J8 | $4,881.60 | $38,360.10 | ||||

| 7 | J8 | $150.00 | $38,510.10 | ||||

| 12 | J8 | $1,845.50 | $36,664.60 | ||||

| 14 | J8 | $200.00 | $36,864.60 | ||||

| 14 | J9 | $4,158.00 | $41,022.60 | ||||

| 18 | J9 | $1,150.00 | $39,872.60 | ||||

| 19 | J9 | $1,840.50 | $38,032.10 | ||||

| 21 | J9 | $180.00 | $38,212.10 | ||||

| 21 | J9 | $5,248.80 | $43,460.90 | ||||

| 25 | J9 | $173.00 | $43,287.90 | ||||

| 26 | J9 | $1,842.00 | $41,445.90 | ||||

| 28 | J9 | $84.00 | $41,361.90 | ||||

| 28 | J9 | $109.00 | $41,470.90 | ||||

| 31 | J9 | $6,471.36 | $47,942.26 | ||||

| 31 | J10 | $2,500.00 | $45,442.26 | ||||

| 31 | J10 | $225.00 | $45,217.26 | ||||

| 31 | J10 | $248.00 | $44,969.26 | ||||

Table (4)

| Account: Accounts receivable | Account No. 113 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $1,273.00 | |||

| 2 | J6 | $367.20 | $1,640.20 | ||||

| 4 | J7 | $513.54 | $2,153.74 | ||||

| 5 | J8 | $1,639.39 | $3,793.82 | ||||

| 7 | J8 | $150.00 | $3,643.82 | ||||

| 10 | J8 | $351.54 | $3,995.36 | ||||

| 10 | J8 | $244.08 | $4,239.44 | ||||

| 12 | J8 | $503.23 | $4,742.67 | ||||

| 14 | J8 | $200.00 | $4,542.67 | ||||

| 21 | J9 | $185.00 | $4,357.67 | ||||

| 28 | J9 | $110.00 | $4,247.67 | ||||

Table (5)

| Account: Office supplies | Account No. 114 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $130.00 | |||

| 2 | J7 | $118.00 | $248.00 | ||||

Table (6)

| Account: Spa supplies | Account No. 115 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $205.00 | |||

| 5 | J7 | $490.00 | $695.00 | ||||

Table (7)

| Account: Prepaid insurance | Account No. 117 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $800.00 | |||

Table (8)

| Account: Office equipment | Account No. 124 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $1,150.00 | |||

| 5 | J7 | $420.00 | $1,570.00 | ||||

Table (9)

| Account: Accumulated | Account No. 125 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $10.00 | |||

Table (10)

| Account: Spa equipment | Account No. 128 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $7,393.00 | |||

| 3 | J6 | $8,235.00 | $15,628.00 | ||||

| 25 | J9 | $173.00 | $15,801.00 | ||||

| 31 | J10 | $1,800.00 | $17,601.00 | ||||

Table (11)

| Account: Accumulated Depreciation, Spa equipment | Account No. 129 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $64.88 | |||

Table (12)

| Account: Accounts payable | Account No. 211 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $2,248.00 | |||

| 1 | J6 | $490.00 | $2,738.00 | ||||

| 1 | J6 | $5,445.00 | $8,183.00 | ||||

| 1 | J6 | $3,796.00 | $11,979.00 | ||||

| 2 | J6 | $2,721.00 | $14,700.00 | ||||

| 3 | J6 | $6,235.00 | $20,935.00 | ||||

| 3 | J7 | $89.00 | $20,846.00 | ||||

| 5 | J7 | $492.00 | $20,354.00 | ||||

| 5 | J7 | $120.00 | $20,234.00 | ||||

| 5 | J7 | $397.00 | $19,837.00 | ||||

| 5 | J7 | $420.00 | $20,257.00 | ||||

| 5 | J7 | $186.00 | $20,443.00 | ||||

| 5 | J7 | $118.00 | $20,561.00 | ||||

| 5 | J8 | $1,309.00 | $21,870.00 | ||||

| 18 | J9 | $1,150.00 | $20,720.00 | ||||

Table (13)

| Account: Wages payable | Account No. 212 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $369.50 | |||

| 5 | J7 | $369.50 | |||||

Table (14)

| Account: Sales tax payable | Account No. 215 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 2 | J6 | $26.00 | $26.00 | |||

| 4 | J7 | $38.52 | $64.52 | ||||

| 5 | J8 | $145.28 | $209.80 | ||||

| 7 | J8 | $361.60 | $571.40 | ||||

| 10 | J8 | $27.22 | $598.62 | ||||

| 10 | J8 | $16.48 | $615.10 | ||||

| 12 | J8 | $38.64 | $653.74 | ||||

| 14 | J9 | $308.00 | $961.74 | ||||

| 21 | J9 | $388.80 | $1,350.54 | ||||

| 31 | J9 | $479.36 | $1,829.90 | ||||

Table (15)

| Account: Person AV, Capital | Account No. 311 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $23,419.62 | |||

| 1 | J6 | $25,000.00 | 48,419.62 | ||||

| 31 | J10 | $1,800.00 | 50,219.62 | ||||

Table (16)

| Account: Person AV, Drawing | Account No. 312 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 31 | J10 | $2,500.00 | $2,500.00 | |||

Table (17)

| Account: Income summary | Account No. 313 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (18)

| Account: Income from services | Account No. 411 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 7 | J8 | $3,110.00 | $3,110.00 | |||

| 14 | J9 | $2,630.00 | $5,740.00 | ||||

| 21 | J9 | $2,920.00 | $8,660.00 | ||||

| 31 | J9 | $4,062.00 | $12,722.00 | ||||

Table (19)

| Account: Merchandise sales | Account No. 412 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 2 | J6 | $325.00 | $325.00 | |||

| 4 | J7 | $481.50 | $806.50 | ||||

| 5 | J8 | $1,815.95 | $2,622.45 | ||||

| 7 | J8 | $1,410.00 | $4,032.45 | ||||

| 10 | J8 | $340.25 | $4,372.70 | ||||

| 10 | J8 | $206.00 | $4,578.70 | ||||

| 12 | J8 | $482.95 | $5,061.65 | ||||

| 14 | J9 | $1,220.00 | $6,281.65 | ||||

| 21 | J9 | $1,940.00 | $8,221.65 | ||||

| 31 | J9 | $1,930.00 | $10,151.65 | ||||

Table (20)

| Account: Purchases | Account No. 511 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | J6 | $5,300.00 | $5,300.00 | |||

| 1 | J6 | $3,692.00 | $8,992.00 | ||||

| 2 | J6 | $2,623.00 | $11,615.00 | ||||

| 5 | J8 | $1,253.00 | $12,868.00 | ||||

Table (21)

| Account: Freight In | Account No. 515 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | J6 | $145.00 | $145.00 | |||

| 1 | J6 | $104.00 | $249.00 | ||||

| 2 | J6 | $98.00 | $347.00 | ||||

| 5 | J8 | $56.00 | $403.00 | ||||

Table (22)

| Account: Wages expense | Account No. 611 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 5 | J7 | $1,476.00 | $1,476.00 | |||

| 12 | J8 | $1,845.50 | $3,321.50 | ||||

| 19 | J9 | $1,840.50 | $5,162.00 | ||||

| 26 | J9 | $1,842.00 | $7,004.00 | ||||

Table (23)

| Account: Rent expense | Account No. 612 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 3 | J6 | $1,650.00 | $1,650.00 | |||

Table (24)

| Account: Office supplies expense | Account No. 613 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (25)

| Account: Spa supplies expense | Account No. 614 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (26)

| Account: Laundry expense | Account No. 615 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 28 | J9 | $84.00 | $84.00 | |||

Table (27)

| Account: Advertising expense | Account No. 616 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (28)

| Account: Utilities expense | Account No. 617 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 31 | J10 | $225.00 | $225.00 | |||

| 31 | J10 | $248.00 | $473.00 | ||||

Table (29)

| Account: Insurance expense | Account No. 618 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (30)

| Account: Depreciation expense, Office equipment | Account No. 619 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (31)

| Account: Depreciation expense, Spa equipment | Account No. 620 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (32)

| Account: Miscellaneous expense | Account No. 630 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 5 | J7 | $98.00 | $98.00 | |||

| 5 | J7 | $186.00 | $284.00 | ||||

Table (33)

Accounts receivable ledger:

| Accounts receivable ledger | ||||||

| Name : Company AFS | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 12 | J8 | $521.59 | $521.59 | ||

Table (34)

| Accounts receivable ledger | ||||||

| Name : Company JA | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | ✓ | $325.00 | |||

| 7 | J8 | $150.00 | $175.00 | |||

Table (35)

| Accounts receivable ledger | ||||||

| Name : Company C | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 4 | J7 | $520.02 | $520.02 | ||

Table (36)

| Accounts receivable ledger | ||||||

| Name : Company HC | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 10 | J8 | $367.47 | $367.47 | ||

Table (37)

| Accounts receivable ledger | ||||||

| Name : Company TL | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $344.00 | ||

| 21 | J9 | $180.00 | $164.00 | |||

Table (38)

| Accounts receivable ledger | ||||||

| Name : Company LOL | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 2 | J6 | $351.00 | $351.00 | ||

Table (39)

| Accounts receivable ledger | ||||||

| Name : Company MS | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 10 | J8 | $222.48 | $222.48 | ||

Table (40)

| Accounts receivable ledger | ||||||

| Name : Company JM | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | ✓ | $486.00 | |||

| 14 | J8 | $200.00 | $286.00 | |||

Table (41)

| Accounts receivable ledger | ||||||

| Name : Company PS | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 5 | J8 | $1,961.23 | $1,961.23 | ||

Table (42)

| Accounts receivable ledger | ||||||

| Name : Company JW | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $109.00 | ||

| 28 | J8 | $109.00 | ||||

Table (43)

Accounts payable ledger:

| Accounts payable ledger | ||||||

| Name : Incorporation A | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $397.00 | ||

| August | 5 | $397.00 | ||||

Table (44)

| Accounts payable ledger | ||||||

| Name : Company G | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 5 | J8 | $1,309.00 | $1,309.00 | ||

Table (45)

| Accounts payable ledger | ||||||

| Name : Company GSS | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $492.00 | ||

| 1 | J6 | $490.00 | $982.00 | |||

| 5 | J7 | $492.00 | $490.00 | |||

Table (46)

| Accounts payable ledger | ||||||

| Name : Company LP | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | J6 | $3,796.00 | $3,796.00 | |

Table (47)

| Accounts payable ledger | ||||||

| Name : Company OS | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $120.00 | ||

| 5 | J7 | $120.00 | $0.00 | |||

| 5 | J7 | $186.00 | $186.00 | |||

| 5 | J7 | $118.00 | $304.00 | |||

Table (48)

| Accounts payable ledger | ||||||

| Name : Incorporation SE | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $89.00 | ||

| 3 | J6 | $6,235.00 | $6,324.00 | |||

| 3 | J7 | $89.00 | $6,235.00 | |||

Table (49)

| Accounts payable ledger | ||||||

| Name : Company SG | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | J6 | $5,445.00 | $5,445.00 | ||

Table (50)

| Accounts payable ledger | ||||||

| Name : Company SM | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 2 | J6 | $2,721.00 | $2,721.00 | ||

Table (51)

| Accounts payable ledger | ||||||

| Name : Company SE | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $1,150.00 | ||

| 5 | J7 | $420.00 | $1,570.00 | |||

| 18 | J9 | $1,150.00 | $420.00 | |||

Table (52)

3.

Prepare

3.

Explanation of Solution

Trial balance: Trial balance is a summary of all the asset, liability, and equity accounts and their balances.

Prepare the trial balance.

| Company AAY | ||

| Trial balance | ||

| As on July 31, 20-- | ||

| Account name | Debit | Credit |

| Cash | $44,969.26 | |

| Accounts Receivable | $4,568.79 | |

| Office Supplies | $248.00 | |

| Spa Supplies | $695.00 | |

| Prepaid Insurance | $800.00 | |

| Office Equipment | $1,570.00 | |

| Accumulated Depreciation, Office Equipment | $10.00 | |

| Spa Equipment | $17,601.00 | |

| Accumulated Depreciation, Spa Equipment | $64.88 | |

| Accounts Payable | $20,720.00 | |

| Sales Tax Payable | $1,829.90 | |

| Person AV, Capital | $50,219.62 | |

| Person AV, Drawing | $2,500.00 | |

| Income from Services | $12,722.00 | |

| Merchandise Sales | $10,151.65 | |

| Purchases | $12,868.00 | |

| Freight In | $403.00 | |

| Wages Expense | $7,004.00 | |

| Rent Expense | $1,650.00 | |

| Laundry Expense | $84.00 | |

| Utilities Expense | $473.00 | |

| Miscellaneous Expense | $284.00 | |

| Total | $95,718.05 | $95,718.05 |

Table (53)

Thus, the total of trial balance of Company AAY is $95,718.05.

4.

Prepare a schedule of accounts receivable.

4.

Explanation of Solution

Schedule of accounts receivable: A schedule of accounts receivable is a subsidiary ledger that list out the accounts of credit customers individually in alphabetical or numeric order with their respective balances.

Prepare a schedule of accounts receivable:

| Company AAY | |

| Schedule of Accounts receivable | |

| July 31, 20-- | |

| Particulars | Amount |

| Company AFS | $521.59 |

| Company JA | $175.00 |

| Company C | $520.02 |

| Company HC | $367.47 |

| Incorporation TL | $164.00 |

| Company LOL | $351.00 |

| Company MS | $222.48 |

| Company JM | $286.00 |

| Company PS | $1,961.23 |

| Total Accounts receivable | $4,568.79 |

Table (54)

5.

Prepare a schedule of Accounts payable.

5.

Explanation of Solution

Schedule of accounts payable: A schedule of accounts payable lists is a subsidiary ledger that list out the accounts of creditors (vendors/suppliers) individually in alphabetical or numeric order with their respective balances.

Prepare a schedule of Accounts payable:

| Company AAY | |

| Schedule of Accounts payable | |

| July 31, 20-- | |

| Particulars | Amount |

| Company G | $1,309.00 |

| Company GSS | $490.00 |

| Company LP | $3,796.00 |

| Company OS | $304.00 |

| Incorporation SE | $6,235.00 |

| Company SG | $5,445.00 |

| Company SM | $2,721.00 |

| Company SE | $420.00 |

| Total Accounts payable | $20,720.00 |

Table (55)

Want to see more full solutions like this?

Chapter 9 Solutions

College Accounting: A Career Approach (with Quickbooks Accountant 2015 Cd-rom)

- Gross profit would be_.arrow_forwardWhat is Bobby's 2019 net income using accrual accounting?arrow_forwardJob 786 was one of the many jobs started and completed during the year. The job required $8,400 in direct materials and 35 hours of direct labor time at a total direct labor cost of $9,300. If the job contained five units and the company billed at 70% above the unit product cost on the job cost sheet, what price per unit would have been charged to the customer?arrow_forward

- What is the company's gross profit?arrow_forwardMOH Cost: Top Dog Company has a budget with sales of 7,500 units and $3,400,000. Variable costs are budgeted at $1,850,000, and fixed overhead is budgeted at $970,000. What is the budgeted manufacturing cost per unit?arrow_forwardWhat was Ghana's cost of goods sold for 2023?arrow_forward

- Need Answerarrow_forwardSameer has $9,800 of net long-term capital gain and $5,200 of net short-term capital loss. This nets out to a: (a) $4,700 net long-term loss (b) $4,600 net long-term gain (c) $4,700 net short-term gain (d) $4,700 short-term loss helparrow_forwardWhat is the adjusted cost of goods sold for the year?arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning