Concept explainers

Comparing Investment Criteria [LO1, 2, 3, 5, 7] Consider the following two mutually exclusive projects:

| Year | Cash Flow (A) | Cash Flow (B) |

| 0 | −$455,000 | −$65,000 |

| 1 | 58,000 | 31,000 |

| 2 | 85,000 | 28,000 |

| 3 | 85,000 | 25,500 |

| 4 | 572,000 | 19,000 |

Whichever project you choose, if any, you require a return of 11 percent on your investment

a. If you apply the payback criterion, which investment will you choose? Why?

b. If you apply the discounted payback criterion, which investment will you choose? Why?

c. If you apply the

d. If you apply the

e. If you apply the profitability index criterion, which investment will you choose? Why?

f. Based on your answers in (a) through (e), which project will you finally choose? Why?

a)

To compute: The payback period.

Introduction:

Capital budgeting is a process, where the business identifies and assesses the potential investments or expenses that are larger in general.

Answer to Problem 17QP

Here, Project B must be accepted as it pays back sooner than Project A.

Explanation of Solution

Given information:

The cash flows for two mutually exclusive projects are $58,000, $85,000, $85,000, $572,000 for Project A respectively for year 1, year 2, year 3, and year 4. Project A has an initial investment of $455,000. The cash flows of Project B are $31,000, $28,000, $25,500, and $19,000 respectively for year 1, year 2, year 3, and year 4. The initial investment for Project B is $65,000. The rate of return is 11%.

Formula to compute the payback period of a project:

Compute the payback period of a project for Project A:

Hence, the payback period is 3.40 years for Project A.

Compute the payback period of a project for Project B:

Hence, the payback period is 2.24 years for Project B.

b)

To compute: The discounted payback period.

Introduction:

Capital budgeting is a process, where the business identifies and assesses the potential investments or expenses that are larger in general.

Answer to Problem 17QP

Here, Project B must be accepted as it pays back sooner than Project A.

Explanation of Solution

Given information:

The cash flows for two mutually exclusive projects are $58,000, $85,000, $85,000, $572,000 for Project A respectively for year 1, year 2, year 3, and year 4. Project A has an initial investment of $455,000. The cash flows of Project B are $31,000, $28,000, $25,500, and $19,000 respectively for year 1, year 2, year 3, and year 4. The initial investment for Project B is $65,000. The rate of return is 11%.

Table showing the calculation of discounted payback period for Project A:

| Year | Net Cash Inflows | ||

| Annual | Today’s value (discounted) at 11% | Accumulated | |

| 1 | $58,000 | $52,252.25

| $52,252.25 |

| 2 | $85,000 | $68,987.91

| $121,240.16 |

| 3 | $85,000 | $62,151.27

| $183,391.43 |

| 4 | $572,000 | $376,794.12

| $560,185.55 |

Formula to compute the discounted payback period:

By the end of the year 3, the recovery amount is shorter than the initial investment. In the year 4, the recovery amount is higher than initial investment. It means the discounted payback period will be in between the year 3 and 4.

Calculate discounted payback period, if initial cost is $455,000:

Hence, the discounted payback period for Project A is 3.72 years.

Table showing the calculation of discounted payback period for Project B:

| Year | Net Cash Inflows | ||

| Annual | Today’s value (discounted) at 11% | Accumulated | |

| 1 | $31,000 | $27,927.93

| $27,927.93 |

| 2 | $28,000 | $22,725.43

| $50,653.36 |

| 3 | $25,500 | $18,645.38

| $69,298.74 |

| 4 | $19,000 | $12,515.89

| $81,814.63 |

Formula to calculate the discounted payback period for Project B, if initial cost is $65,000:

By the end of the year 2, the recovery amount is shorter than the initial investment. In the year 3, the recovery amount is higher than initial investment. It means the discounted payback period will be in between the year 2 and 3.

Calculate the discounted payback period for Project B, if initial cost is $65,000:

Hence, the discounted payback period for Project B is 2.77 years.

c)

To compute: The NPV (Net present value).

Introduction:

Capital budgeting is a process, where the business identifies and assesses the potential investments or expenses that are larger in general.

Answer to Problem 17QP

Here, Project A must be accepted as the NPV is higher in Project A.

Explanation of Solution

Given information:

The cash flows for two mutually exclusive projects are $58,000, $85,000, $85,000, $572,000 for Project A respectively for year 1, year 2, year 3, and year 4. Project A has an initial investment of $455,000. The cash flows of Project B are $31,000, $28,000, $25,500, and $19,000 respectively for year 1, year 2, year 3, and year 4. The initial investment for Project B is $65,000. The rate of return is 11%.

Formula to calculate the NPV:

Calculate the NPV for Project A:

Hence, the NPV for Project A is $105,185.54.

Calculate the NPV for Project B:

Hence, the NPV for Project B is $16,814.63.

d)

To compute: The IRR for the project.

Introduction:

Capital budgeting is a process, where the business identifies and assesses the potential investments or expenses that are larger in general.

Answer to Problem 17QP

Here, Project B must be accepted as the IRR is higher in Project B.

Explanation of Solution

Given information:

The cash flows for two mutually exclusive projects are $58,000, $85,000, $85,000, $572,000 for Project A respectively for year 1, year 2, year 3, and year 4. Project A has an initial investment of $455,000. The cash flows of Project B are $31,000, $28,000, $25,500, and $19,000 respectively for year 1, year 2, year 3, and year 4. The initial investment for Project B is $65,000. The rate of return is 11%.

Equation of IRR of Project A:

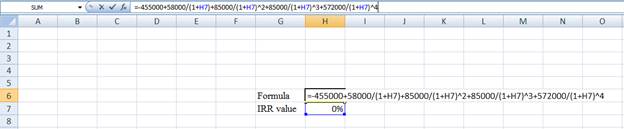

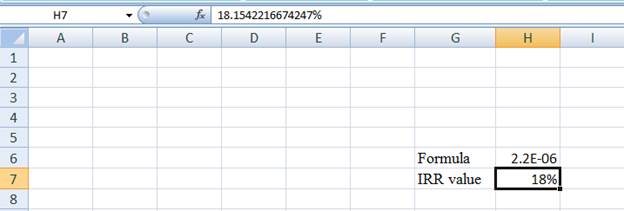

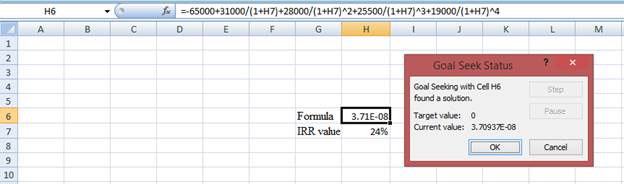

Compute IRR for Project A using a spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the IRR value as H7

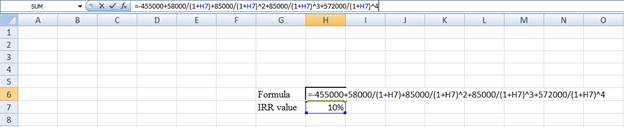

Step 2:

- Assume the IRR value as 10%

Step 3:

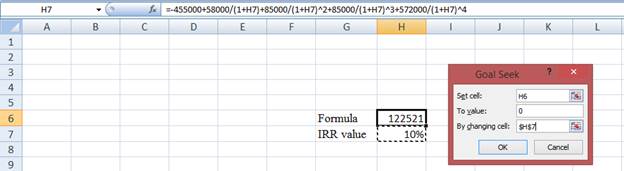

- In the spreadsheet go to data and select the what-if analysis

- In what-if analysis select goal seek

- In set cell select H6 (the Formula)

- The “To value” is considered as 0 (the assumption value for NPV)

- The H7 cell is selected for the by changing cell

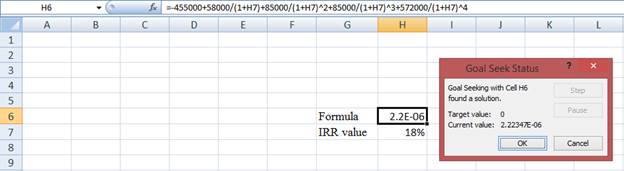

Step 4:

- Following the previous step click OK in the goal seek. The goal seek status appears with the IRR value

Step 5:

- Thevalue appears to be 18.1542216674247%

Hence, the IRRvalue is 18.15%.

Equation of IRR of Project B:

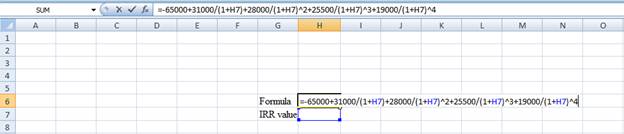

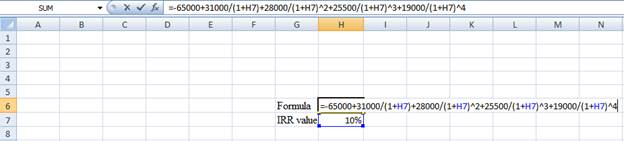

Compute IRR for Project B using a spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the IRR value as H7

Step 2:

- Assume the IRR value as 10%

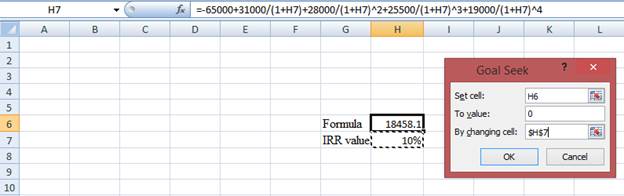

Step 3:

- In the spreadsheet go to data and select the what-if analysis

- In what-if analysis select goal seek

- In set cell select H6 (the Formula)

- The “To value” is considered as 0 (the assumption value for NPV)

- The H7 cell is selected for the by changing cell

Step 4:

- Following the previous step click OK in the goal seek. The goal seek status appears with the IRR value

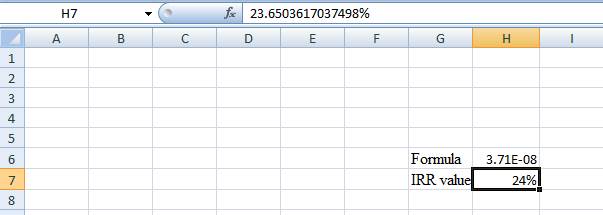

Step 5:

- Thevalue appears to be 23.6503617037489%

Hence, the IRRvalue is 23.65%.

e)

To compute: The profitability index.

Introduction:

Capital budgeting is a process, where the business identifies and assesses the potential investments or expenses that are larger in general.

Answer to Problem 17QP

Here, Project B must be accepted as the PI is higher in Project B.

Explanation of Solution

Given information:

The cash flows for two mutually exclusive projects are $58,000, $85,000, $85,000, $572,000 for Project A respectively for year 1, year 2, year 3, and year 4. Project A has an initial investment of $455,000. The cash flows of Project B are $31,000, $28,000, $25,500, and $19,000 respectively for year 1, year 2, year 3, and year 4. The initial investment for Project B is $65,000. The rate of return is 11%.

Formula to compute the profitability index:

Compute the profitability index for Project A:

Hence, the profitability index for Project A is $1.23.

Compute the profitability index for Project B:

Hence, the profitability index for Project B is $1.26.

f)

To discuss: The project that Person X will select with a reason.

Introduction:

Capital budgeting is a process, where the business identifies and assesses the potential investments or expenses that are larger in general.

Explanation of Solution

Given information:

The cash flows for two mutually exclusive projects are $58,000, $85,000, $85,000, $572,000 for Project A respectively for year 1, year 2, year 3, and year 4. Project A has an initial investment of $455,000. The cash flows of Project B are $31,000, $28,000, $25,500, and $19,000 respectively for year 1, year 2, year 3, and year 4. The initial investment for Project B is $65,000. The rate of return is 11%.

Explanation:

In this case, the criteria of NPV denote that Project A must be accepted, while payback period, discounted payback, profitability index, and IRR denote that Project B must be accepted. The overall decision must be based on the NPV as it does not have the ranking problem when compared with the other techniques of capital budgeting. Hence, Project A must be accepted.

Want to see more full solutions like this?

Chapter 9 Solutions

Fundamentals of Corporate Finance with Connect Access Card

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT