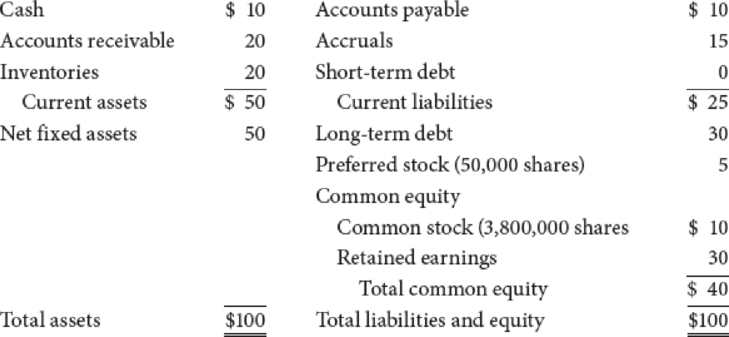

The following table gives the current

Travellers Inn (Millions of Dollars)

The following facts also apply to TII.

- (1) The long-term debt consists of 29,412 bonds, each having a 20-year maturity, semiannual payments, a coupon rate of 7.6%, and a face value of $1,000. Currently, these bonds provide investors with a yield to maturity of 11.8%. If new bonds were sold, they would have an 11.8% yield to maturity.

- (2) TII’s perpetual

preferred stock has a $100 par value, pays a quarterly dividend per share of $2, and has a yield to investors of 10%. New perpetual preferred stock would have to provide the same yield to investors, and the company would incur a 3.85% flotation cost to sell it. - (3) The company has 3.8 million shares of common stock outstanding, a price per share = P0 = $20, dividend per share = D0 = $1, and earnings per share = EPS0 = $5. The

return on equity (ROE) is expected to be 10%. - (4) The stock has a beta of 1.6%. The T-bond rate is 6%, and RPM is estimated to be 5%.

- (5) TII’s financial vice president recently polled some pension fund investment managers who hold TII’s securities regarding what minimum

rate of return on TII’s common would make them willing to buy the common rather than TII bonds, given that the bonds yielded 11.8%. The responses suggested a risk premium over TII bonds of 3 percentage points. - (6) TII is in the 25% federal-plus-state tax bracket.

Assume that you were recently hired by TII as a financial analyst and that your boss, the treasurer, has asked you to estimate the company’s WACC under the assumption that no new equity will be issued. Your cost of capital should be appropriate for use in evaluating projects that are in the same risk class as the assets TII now operates. Based on your analysis, answer the following questions.

- a. What are the current market value weights for debt, preferred stock, and common stock? (Hint: Do your work in dollars, not millions of dollars. When you calculate the market values of debt and preferred stock, be sure to round the market price per bond and the market price per share of preferred to the nearest penny.)

- b. What is the after-tax cost of debt?

- c. What is the cost of preferred stock?

- d. What is the required return on common stock using

CAPM ? - e. Use the retention growth equation to estimate the expected growth rate. Then use the expected growth rate and the dividend growth model to estimate the required return on common stock.

- f. What is the required return on common stock using the own-bond-yield-plus-judgmental-risk-premium approach?

- g. Use the required return on stock from the CAPM model, and calculate the WACC.

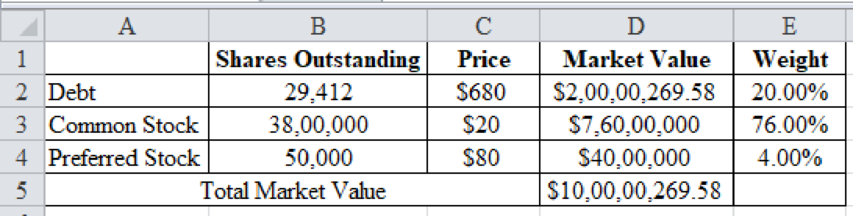

a.

To determine: The market value weights of debt, common stock and preferred stock.

Answer to Problem 17P

The market value weights of debt are 20%, common stock is 76% and preferred stock is 4%.

Explanation of Solution

Determine the market value weights of debt, common stock and preferred stock

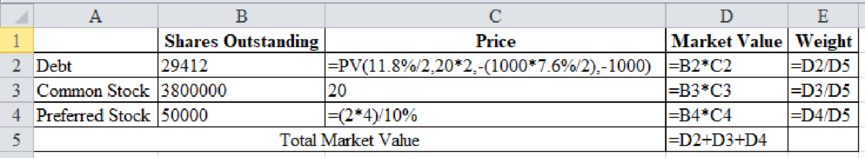

Excel Spreadsheet:

Excel Workings:

Therefore, the market value weights of debt are 20%, common stock is 76% and preferred stock is 4%.

b.

To determine: The after-tax cost of debt.

Answer to Problem 17P

The after-tax cost of debt is 8.85%.

Explanation of Solution

Determine the after-tax cost of debt

Therefore, the after-tax cost of debt is 8.85%.

c.

To determine: The cost of preferred stock.

Answer to Problem 17P

The cost of preferred stock is 10.40%.

Explanation of Solution

Determine the cost of preferred stock

Therefore, the cost of preferred stock is 10.40%.

d.

To determine: The required return on common stock using CAPM.

Answer to Problem 17P

The required return on common stock using CAPM is 14%.

Explanation of Solution

Determine the required return on common stock using CAPM

Therefore, the required return on common stock using CAPM is 14%.

e.

To determine: The required return on common stock using dividend growth model.

Answer to Problem 17P

The required return on common stock using dividend growth model is 13.40%.

Explanation of Solution

Determine the payout ratio

Therefore, the payout ratio is 20%.

Determine the growth rate

Therefore, the growth rate is 8%.

Determine the required return on common stock using dividend growth model

Therefore, the required return on common stock using dividend growth model is 13.40%.

f.

To determine: The required return on common stock using own-bond-yield-plus-judgmental- risk-premium approach.

Answer to Problem 17P

The required return on common stock using own-bond-yield-plus-judgmental- risk-premium approach is 14.80%.

Explanation of Solution

Determine the required return on common stock using own-bond-yield-plus-judgmental- risk-premium approach

Therefore, the required return on common stock using own-bond-yield-plus-judgmental- risk-premium approach is 14.80%.

g.

To determine: The WACC.

Answer to Problem 17P

The WACC is 12.83%.

Explanation of Solution

Determine the WACC

Therefore, the WACC is 12.83%.

Want to see more full solutions like this?

Chapter 9 Solutions

Financial Management: Theory & Practice

- Question 3Footfall Manufacturing Ltd. reports the following financialinformation at the end of the current year:Net Sales $100,000Debtor’s turnover ratio (based onnet sales)2Inventory turnover ratio 1.25Fixed assets turnover ratio 0.8Debt to assets ratio 0.6Net profit margin 5%Gross profit margin 25%Return on investment 2%Use the given information to fill out the templates for incomestatement and balance sheet given below:Income Statement of Footfall Manufacturing Ltd. for the year endingDecember 31, 20XX(in $)Sales 100,000Cost of goodssoldGross profitOther expensesEarnings beforetaxTax @50%Earnings aftertaxBalance Sheet of Footfall Manufacturing Ltd. as at December 31, 20XX(in $)Liabilities Amount Assets AmountEquity Net fixed assetsLong termdebt50,000 InventoryShort termdebtDebtorsCashTOTAL TOTALarrow_forwardSolve correctly and no aiarrow_forwardSolvearrow_forward

- don't use chatgptIf data is unclear or blurr then comment i will write it.arrow_forwardIf data is unclear or blurr then comment i will write it. please don't use AI i will unhelpfularrow_forwardYou are considering an option to purchase or rent a single residential property. You can rent it for $5,000 per month and the owner would be responsible for maintenance, property insurance, and property taxes. Alternatively, you can purchase this property for $204,500 and finance it with an 80 percent mortgage loan at 4 percent interest that will fully amortize over a 30-year period. The loan can be prepaid at any time with no penalty. You have done research in the market area and found that (1) properties have historically appreciated at an annual rate of 2 percent per year, and rents on similar properties have also increased at 2 percent annually; (2) maintenance and insurance are currently $1,545.00 each per year and they have been increasing at a rate of 3 percent per year; (3) you are in a 24 percent marginal tax rate and plan to occupy the property as your principal residence for at least four years; (4) the capital gains exclusion would apply when you sell the property; (5)…arrow_forward

- If data is unclear or blurr then comment i will write it.arrow_forwardI need answer typing clear urjent no chatgpt used pls i will give 5 Upvotes.arrow_forwardcorrect an If image is blurr or data is unclear then plz comment i will write values or upload a new image. i will give unhelpful if you will use incorrect data.arrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning