a.

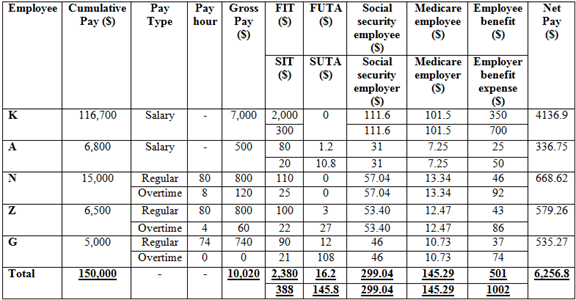

To prepare: Payroll register.

a.

Explanation of Solution

Given,

Wage rate is $10/hour.

Overtime rate is $15/hour.

Normal working hours are 40 hours.

FICA Social security tax is 6.2% of first $118,500.

FICA Medicare tax is 1.45% of gross pay.

FUTA is 0.6% of first $7000

SUTA is 5.4% of first $7000.

Payroll register

Table (1)

Working notes:

Calculation of FUTA of A,

Calculation of FUTA of Z,

Calculation of FUTA of G,

Calculation of SUTA of A,

Calculation of SUTA of Z,

Calculation of SUTA of G,

Calculation of security tax of K,

Calculation of security tax of A,

Calculation of security tax of N,

Calculation of security tax of Z,

Calculation of security tax of G,

Calculation of Medicare tax of K,

Calculation of Medicare tax of A,

Calculation of Medicare tax of N,

Calculation of Medicare tax of Z,

Calculation of Medicare tax of G,

Calculation of employee benefit of K,

Calculation of employee benefit of A,

Calculation of employee benefit of N

Calculation of employee benefit of Z,

Calculation of employee benefit of G,

Calculation of net pay of K,

Calculation of net pay of A,

Calculation of net pay of N,

Calculation of net pay of Z,

Calculation of net pay of G,

(b)

To prepare:

(b)

Explanation of Solution

Journal Entry for accrued biweekly payroll

| Date | Account Title and Explanation | Post ref | Debit ($) | Credit ($) |

| August 31 | Salaries Expense | 10,020 | ||

| FICA- Social security taxes payable | 299.04 | |||

| FICA Medicare taxes payable | 145.29 | |||

| Employee federal taxes payable | 2,380 | |||

| Employee state taxes payable | 388 | |||

| Employee benefits plan payable | 501 | |||

| Salaries Payable | 6306.67 | |||

| (To record payroll for August) | ||||

| Table (2) | ||||

- Salaries expense is an expense account for company. Since the balance of this account is increased it is debited.

- FICA Social security taxes payable is a liability to company. Its balance is increasing, so it is credited.

- FICA Medicare taxes payable is a liability to company. Its balance is increasing, so it is credited.

- Employee federal taxes payable is a liability to company. Its balance is increasing, so it is credited.

- Employee state taxes payable is a liability to company. Its balance is increasing, so it is credited.

- Salaries payable is a liability to company. Its balance is increasing, so it is credited.

(c)

To prepare: Journal Entry to record employer’s cash payment of the net payroll

(c)

Explanation of Solution

Journal Entry to record employer’s cash payment of the net payroll

| Date | Account Title and Explanation | Post ref | Debit ($) | Credit ($) |

| August 31 | Salaries Payable | 6306.67 | ||

| Cash | 6306.67 | |||

| (To record payment for August) | ||||

| Table (3) | ||||

- Salaries Payable is a liability to company. Its balance is decreasing, so it is debited.

- Cash is an asset account. Since company is paying salaries, cash is reducing. Hence cash is credited.

(d)

To prepare: Journal Entry to record employer’s payroll taxes

(d)

Explanation of Solution

Journal Entry to record employer’s payroll taxes

| Date | Account Title and Explanation | Post ref | Debit ($) | Credit ($) |

| August 31 | Payroll Taxes expense | 3212.33 | ||

| Employee benefit plan expenses | 1,002 | |||

| Employee benefit plan payable | 1,002 | |||

| FICA- Social security taxes payable | 299.04 | |||

| FICA Medicare taxes payable | 145.29 | |||

| Employee federal taxes payable | 2,380 | |||

| Employee state taxes payable | 388 | |||

| (To record employer’s payroll taxes) | ||||

| Table (4) | ||||

- Payroll taxes are an expense account for company. Since the balance of this account is increased it is debited.

- Employee benefit plan expenses is an expense account for company. Since the balance of this account is increased it is debited.

- Employee benefit plan payable is a liability to company. Its balance is increasing, so it is credited.

- FICA social security taxes payable is a liability to company. Its balance is increasing, so it is credited.

- FICA Medicare taxes payable is a liability to company. Its balance is increasing, so it is credited.

- Employee federal taxes payable is a liability to company. Its balance is increasing, so it is credited.

- Employee state taxes payable is a liability to company. Its balance is increasing, so it is credited.

(e)

To prepare: Journal Entry to pay all liabilities.

(e)

Explanation of Solution

Journal Entry to pay all liabilities

| Date | Account Title and Explanation | Post ref | Debit ($) | Credit ($) |

| August 31 | FICA- Social security taxes payable | 598.08 | ||

| FICA Medicare taxes payable | 290.58 | |||

| Employee federal taxes payable | 2,380 | |||

| Employee state taxes payable | 388 | |||

| Employee benefits plan payable | 1,503 | |||

| FUTA payable | 16.2 | |||

| SUTA payable | 145.8 | |||

| Cash | 5321.66 | |||

| (To record payment of all liabilities) | ||||

| Table (5) | ||||

- FICA Social security taxes payable is a liability to company Its balance is increasing, so it is credited.

- FICA Medicare taxes payable is a liability to company. Its balance is increasing, so it is credited.

- Employee federal taxes payable is a liability to company. Its balance is increasing, so it is credited.

- Employee state taxes payable is a liability to company. Its balance is increasing, so it is credited.

- Employee benefit plan payable is a liability to company. Its balance is increasing, so it is credited.

- FUTA payable is a liability to company. Its balance is increasing, so it is credited.

- SUTA payable is a liability to company. Its balance is increasing, so it is credited.

- Cash is an asset account. Since company is paying salaries, cash is reducing. Hence cash is credited.

Want to see more full solutions like this?

Chapter 9 Solutions

CONNECT PLUS-FINANCIAL & MANAGERIAL AC

- Depot manufacturing has $31,500 ofending finished goods inventory as of Dec. 31, 2021. If beginning finished goods inventory was $27,800 and COGS was $94,300, how much would Depot reportfor cost of goods manufactured?arrow_forwardCan you explain the correct approach to solve this general accounting question?arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forward

- Please help me solve this financial accounting question using the right financial principles.arrow_forwardRobert purchased Machinery for $72,000 with a salvage value of $12,000 and an 8-year life. Robert used the asset for three years, using straight line depreciation, but it was apparent that the Machinery would last only 5 more years. What was the book value of the Machinery after 3 years? What will be the depreciation expense in each of the remaining 5 years?arrow_forwardEquipment that costs $185,000 and on which $75,000 of accumulated depreciation has been recorded was disposed of for $130,000 cash. Recording this event would include a___. a. loss of $20,000 b. gain of $20,000 c. increase to accumulated depreciation for $35,000 d. decrease to equipment for $35,000.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education