a.

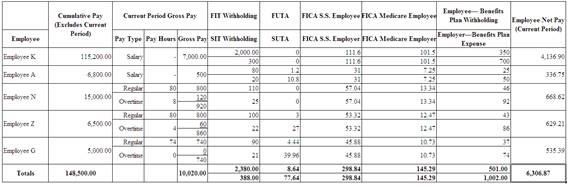

Complete the payroll register by filling in all cells for the pay period ended August 31.

a.

Explanation of Solution

Payroll tax:

Payroll tax refers to the tax that are equally contributed by employees and

employer based on the salary and wages of an employee. Payroll tax includes taxes

like federal tax, local income tax, state tax, social security tax and federal and

state

(Table 1)

b.

Prepare

b.

Explanation of Solution

| Date | Account Titles and Explanation |

Debit (Amount in $) |

Credit (Amount in $) |

| August 31 | Salaries expense | 10,020.00 | |

| FICA - Social security taxes payable | 298.84 | ||

| FICA- Medicare taxes payable | 145.29 | ||

|

Federal income taxes payable- Employee | 2,380.00 | ||

|

State income taxes payable- Employee | 388.00 | ||

| Employee benefits plan payable | 501.00 | ||

| Salaries payable | 6306.87 | ||

| (To record the payroll for period) |

(Table 2)

- Salaries expense is a component of

stockholder’s equity and there is an increase in the value of expense. Hence, debit the salaries expense by $10,020.00 - FICA- Social security taxes payable is a liability and there is an increase in the value of liability. Hence, credit the FICA- social security taxes payable by $298.84.

- FICA- Medicare taxes payable is a liability and there is an increase in the value of liability. Hence, credit the FICA- Medicare taxes payable by $145.29

- Federal income taxes payable- employee is a liability and there is an increase in the value of liability. Hence, credit the federal income taxes payable by $2,380.00.

- State income taxes payable- employee is a liability and there is an increase in the value of liability. Hence, credit the state income taxes payable by $388.00.

- Employee benefits plan payable is a liability and there is an increase in the value of liability. Hence, credit the employee benefits plan payable by $501.00.

- Salaries payable is a liability and there is an increase in the value of liability. Hence, credit the salaries payable by $6,306.87.

c.

Prepare journal entry to record the employer’s cash payment of the net payroll of requirement b.

c.

Explanation of Solution

| Date | Account Titles and Explanation |

Debit (Amount in $) |

Credit (Amount in $) |

| August 31 | Salaries payable | 6,306.87 | |

| Cash | 6306.87 | ||

| (To record the payment of payroll) |

(Table 3)

- Salaries payable is a liability and there is a decrease in the value of liability. Hence, debit the salaries payable by $6,306.87.

- Cash is an asset and there is a decrease the value of an asset. Hence, credit the cash by $6,306.87.

d.

Prepare journal entry to record the employer’s payroll taxes including the contribution to the benefits plan.

d.

Explanation of Solution

| Date | Account Titles and Explanation |

Debit (Amount in $) |

Credit (Amount in $) |

| August 31 | Payroll tax expense | 530.53 | |

| FICA - Social security taxes payable | 298.84 | ||

| FICA- Medicare taxes payable | 145.29 | ||

| Federal unemployment taxes payable | 8.64 | ||

| State unemployment taxes payable | 77.76 | ||

| (To record the payroll taxes) |

(Table 4)

- Payroll tax expense is a component of stockholder’s equity and there is an increase in the value of expense. Hence, debit the payroll tax expense by $530.53.

- FICA- Social security taxes payable is a liability and there is an increase in the value of liability. Hence, credit the FICA- social security taxes payable by $298.84.

- FICA- Medicare taxes payable is a liability and there is an increase in the value of liability. Hence, credit the FICA- Medicare taxes payable by $145.29

- Federal unemployment taxes payable is a liability and there is an increase in the value of liability. Hence, credit the federal unemployment taxes payable by $8.64.

- State unemployment taxes payable is a liability and there is an increase in the value of liability. Hence, credit the state unemployment taxes payable by $77.76.

| Date | Account Titles and Explanation |

Debit (Amount in $) |

Credit (Amount in $) |

| August 31 | Employee benefits expense | 1,002.00 | |

| Employee benefits plan payable | 1,002.00 | ||

| (To record the cost of employee benefits) |

(Table 5)

- Employee benefits expense is a component of stockholder’s equity and there is an increase in the value of expense. Hence, debit the employee benefits expense by $1,002.00.

- Employee benefits plan payable is a liability and there is an increase in the value of liability. Hence, credit the employee benefits plan payable by $1,002.00.

e.

Prepare journal entry to record to pay all liabilities (except for the net payroll in requirement c) for this biweekly period.

e.

Explanation of Solution

| Date | Account Titles and Explanation |

Debit (Amount in $) |

Credit (Amount in $) |

| August 31 | FICA - Social security taxes payable | 597.68 | |

| FICA- Medicare taxes payable | 290.58 | ||

| Federal income taxes payable- employee | 2,380.00 | ||

| State income taxes payable- employee | 388.00 | ||

| Employee benefits plan payable | 1,503.00 | ||

| Federal unemployment taxes payable | 8.64 | ||

| State unemployment taxes payable | 77.76 | ||

| Cash | 5,245.66 | ||

| (To record payment of FICA, income taxes, SUTA, FUTA, and benefit plan contributions) |

(Table 6)

- FICA- Social security taxes payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA- social security taxes payable by $597.68.

- FICA- Medicare taxes payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA- Medicare taxes payable by $290.58.

- Federal income taxes payable- employee is a liability and there is a decrease in the value of liability. Hence, debit the federal income taxes payable by $2,380.00.

- State income taxes payable- employee is a liability and there is a decrease in the value of liability. Hence, debit the state income taxes payable by $388.00.

- Employee benefits plan payable is a liability and there is a decrease in the value of liability. Hence, debit the employee benefits plan payable by $1,503.00

- Federal unemployment taxes payable is a liability and there is a decrease in the value of liability. Hence, debit the federal unemployment taxes payable by $8.64.

- State unemployment taxes payable is a liability and there is a decrease in the value of liability. Hence, debit the state unemployment taxes payable by $77.76.

- Cash is an asset and there is a decrease the value of an asset. Hence, credit the cash by $5,245.66.

Want to see more full solutions like this?

Chapter 9 Solutions

FINANCIAL ACCOUNTING ACCT 2301 >IC<

- Brun Company produces its product through two processing departments: Mixing and Baking. Information for the Mixing department follows. Direct Materials Conversion Unit Percent Complete Percent Complete Beginning work in process inventory 7.500 Units started this period 104,500 Units completed and transferred out 100.000 Ending work in process inventory 12.000 100% 25% Beginning work in process inventory Direct materials Conversion $6.800 14.500 $21.300 Costs added this period Drect materials 116,400 Conversion Total costs to account for 1.067,000 1.183.400 $1.204.700 Required 1. Prepare the Mixing department's production cost report for November using the weighted average method Check (1) C$1.000 2. Prepare the November 30 journal entry to transfer the cost of completed units from Mixing to Bakingarrow_forwardNonearrow_forwardNot need ai solution please solve this general accounting questionarrow_forward

- What is the amount of current liabilities the firm has?arrow_forwardNeed answer of this question with financial accountingarrow_forwardThompson Aggrotech has a return on equity of 14.85 percent, a debt-equity ratio of 0.65, and a total asset turnover of 1.1. What is the return on assets?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education