FOUNDATIONS OF FINANCE-MYFINANCELAB

10th Edition

ISBN: 9780135160619

Author: KEOWN

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 16SP

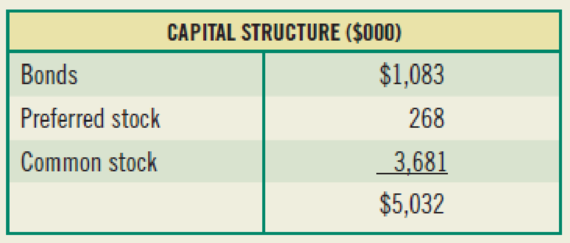

(Weighted average cost of capital) The capital structure for the Carion Corporation is provided here. The company plans to maintain its debt structure in the future. If the firm has a 5.5 percent after-tax cost of debt, a 13.5 percent cost of

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A comparative balance sheet and income statement is shown for Cruz, Incorporated.

CRUZ, INCORPORATED

Comparative Balance Sheets

At December 31

2021

2020

Assets

Cash

Accounts receivable, net

$ 85,600

36,800

$ 21,300

Prepaid expenses

Inventory

Total current assets

Furniture

Accumulated depreciation-Furniture

Total assets

Liabilities and Equity

Accounts payable

Wages payable

77,100

45,200

84,900

4,700

3,900

204,200

155,300

94,700

(14,700)

$ 284,200

$ 13,400

8,000

(8,400)

$ 257,400

$ 19,000

4,500

110,500

Income taxes payable

1,400

2,500

Total current liabilities

Notes payable (long-term)

Total liabilities

Equity

Common stock, $5 par value

Retained earnings

22,800

26,000

28,900

66,400

51,700

92,400

204,000

28,500

162,300

2,700

Total liabilities and equity

$ 284,200

$ 257,400

CRUZ, INCORPORATED

Income Statement

Sales

For Year Ended December 31, 2021

$ 440,700

283,700

157,000

Cost of goods sold

Gross profit

Operating expenses (excluding depreciation)

Depreciation expense

Income before taxes…

How do you calculate the intrinsic value of a stock using the dividend discount model (DDM)? Need help.

Explain the Modigliani-Miller theorem and its assumptions In finance?

Chapter 9 Solutions

FOUNDATIONS OF FINANCE-MYFINANCELAB

Ch. 9 - Define the term cost of capital.Ch. 9 - Prob. 2RQCh. 9 - Why do firms calculate their weighted average cost...Ch. 9 - Prob. 4RQCh. 9 - Prob. 5RQCh. 9 - Prob. 6RQCh. 9 - Prob. 7RQCh. 9 - Prob. 1SPCh. 9 - Prob. 2SPCh. 9 - (Cost of equity) In the spring of 2018, the Brille...

Ch. 9 - Prob. 4SPCh. 9 - Prob. 5SPCh. 9 - Prob. 6SPCh. 9 - Prob. 7SPCh. 9 - (Cost of internal equity) Pathos Co.s common stock...Ch. 9 - (Cost of equity) The common stock for the Bestsold...Ch. 9 - Prob. 10SPCh. 9 - Prob. 11SPCh. 9 - Prob. 12SPCh. 9 - a. Rework Problem 9-12 as follows: Assume an 8...Ch. 9 - (Capital structure weights) Wingate Metal...Ch. 9 - (Weighted average cost of capital) The capital...Ch. 9 - Prob. 17SPCh. 9 - Prob. 18SPCh. 9 - Prob. 19SPCh. 9 - (Divisional costs of capital and investment...Ch. 9 - Prob. 21SPCh. 9 - Prob. 2.1MCCh. 9 - If you were to evaluate divisional costs of...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- How do you calculate the intrinsic value of a stock using the dividend discount model (DDM)? i need coarrow_forwardHow do you calculate the intrinsic value of a stock using the dividend discount model (DDM)?arrow_forwardHow does the weighted average cost of capital (WACC) affect a company’s valuation? i need help in this qarrow_forward

- How does the weighted average cost of capital (WACC) affect a company’s valuation?i need correct answer.arrow_forwardHow does the weighted average cost of capital (WACC) affect a company’s valuation?i need help.arrow_forwardHow does the weighted average cost of capital (WACC) affect a company’s valuation? Need helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License