Concept explainers

1.

Prepare the

1.

Explanation of Solution

Prepare the journal entry to record the sales made during October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Cash or | 58,800 | |

| Sales | 58,800 | ||

| (To record the sale of 21,000 cereal boxes) |

Table (1)

Prepare the journal entry to record the purchase of shovel set:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Inventory of premiums | 2,640 | |

| Cash | 2,640 | ||

| (To record the purchase of toy shovel sets) |

Table (2)

Prepare the journal entry to record the estimated total premium liability:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Premium expenses (2) | 2,940 | |

| Estimated premium liability | 2,940 | ||

| (To record the recognition of estimated premium liability) |

Table (3)

Working note (1):

Calculate the total box tops estimated for redemption:

| Particulars | Amount ($) | Amount ($) |

| Total box tops outstanding in October 2016 (A) | 21,000 | |

| Estimated percent redeemed (B) | 70% | |

| Total box tops estimated for redemption (C) | 14,700 |

Table (4)

Working note (2):

Calculate the amount of premium expenses:

Prepare the journal entry to record the redemption of 12,000 top boxes in October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Estimated premium liability (3) | 2,400 | |

| Inventory of premiums | 2,400 | ||

| (To record the redemption of 12,000 top boxes of cereals) |

Table (5)

Working note (3):

Calculate the amount of estimated premium liability:

Prepare the journal entry to record the sales made during November:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Cash or Accounts receivable | 67,200 | |

| Sales | 67,200 | ||

| (To record the sale of 24,000 cereal boxes) |

Table (6)

Prepare the journal entry to record the purchase of shovel set:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Inventory of premiums | 3,249 | |

| Cash | 3,249 | ||

| (To record the purchase of toy shovel sets) |

Table (7)

Prepare the journal entry to record the estimated total premium liability:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Premium expenses (4) | 3,360 | |

| Estimated premium liability | 3,360 | ||

| (To record the recognition of estimated premium liability) |

Table (8)

Working note (3):

Calculate the total box tops estimated for redemption:

| Particulars | Amount ($) | Amount ($) |

| Total box tops outstanding in November 2016 (A) | 24,000 | |

| Estimated percent redeemed (B) | 70% | |

| Total box tops estimated for redemption (C) | $16,800 |

Table (9)

Working note (4):

Calculate the amount of premium expenses:

Prepare the journal entry to record the redemption of 16,005 top boxes in October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Estimated premium liability (5) | 3,201 | |

| Inventory of premiums | 3,201 | ||

| (To record the redemption of 16,005 top boxes of cereals) |

Table (10)

Working note (5):

Calculate the amount of estimated premium liability:

Prepare the journal entry to record the sales made during December:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| December | Cash or Accounts receivable | 92,400 | |

| Sales | 92,400 | ||

| (To record the sale of 33,000 cereal boxes) |

Table (11)

Prepare the journal entry to record the purchase of shovel set:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| December | Inventory of premiums | 5,091 | |

| Cash | 5,091 | ||

| (To record the purchase of toy shovel sets) |

Table (12)

Prepare the journal entry to record the estimated total premium liability:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Premium expenses (7) | 4,620 | |

| Estimated premium liability | 4,620 | ||

| (To record the recognition of estimated premium liability) |

Table (13)

Working note (6):

Calculate the total box tops estimated for redemption:

| Particulars | Amount ($) | Amount ($) |

| Total box tops outstanding in December 2016 (A) | 33,000 | |

| Estimated percent redeemed (B) | 70% | |

| Total box tops estimated for redemption (C) | $23,100 |

Table (14)

Working note (7):

Calculate the amount of premium expenses:

Prepare the journal entry to record the redemption of 20,475 top boxes in October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Estimated premium liability (8) | 4,149 | |

| Inventory of premiums | 4,149 | ||

| (To record the redemption of 20,475 top boxes of cereals) |

Table (15)

Working note (8):

Calculate the amount of estimated premium liability:

2.

Indicate the way in which the inventory of premiums and the estimated liability would be disclosed in the ending balance sheets of Company YC for the months October, November and December.

2.

Explanation of Solution

Balance sheet: Balance Sheet is one of the financial statements that summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare the partial balance sheet to record the inventory of premiums and the estimated liability:

| Company YC | |||

| Balance Sheet Statement (Partial) | |||

| At The End of | |||

| Assets | October | November | December |

| Current assets: | |||

| Inventory of premiums | $240 | $288 | $1,230 |

| Liabilities | October | November | December |

| Current liabilities: | |||

| Estimated premium liability | $540 | $699 | $1,170 |

Table (16)

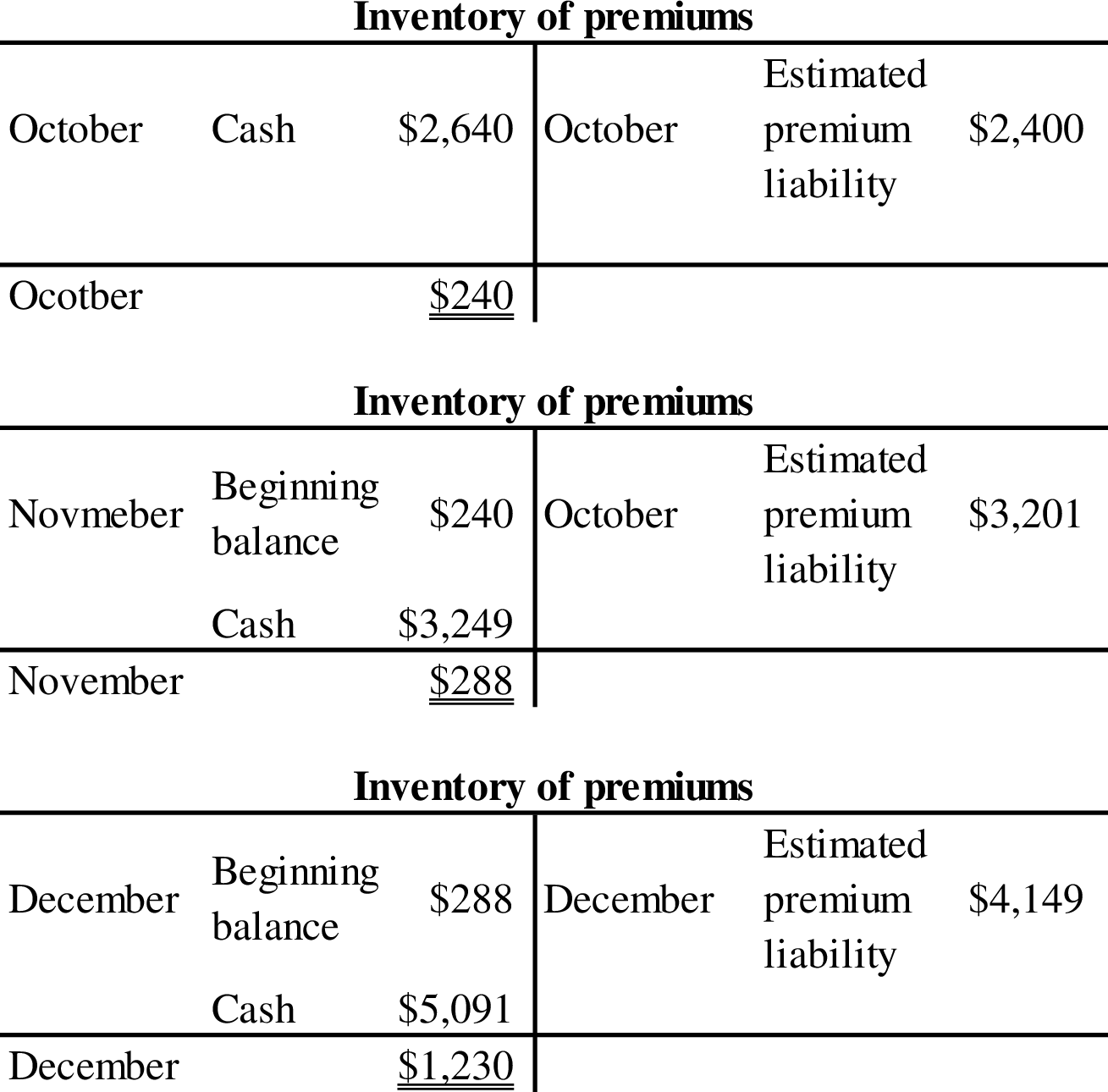

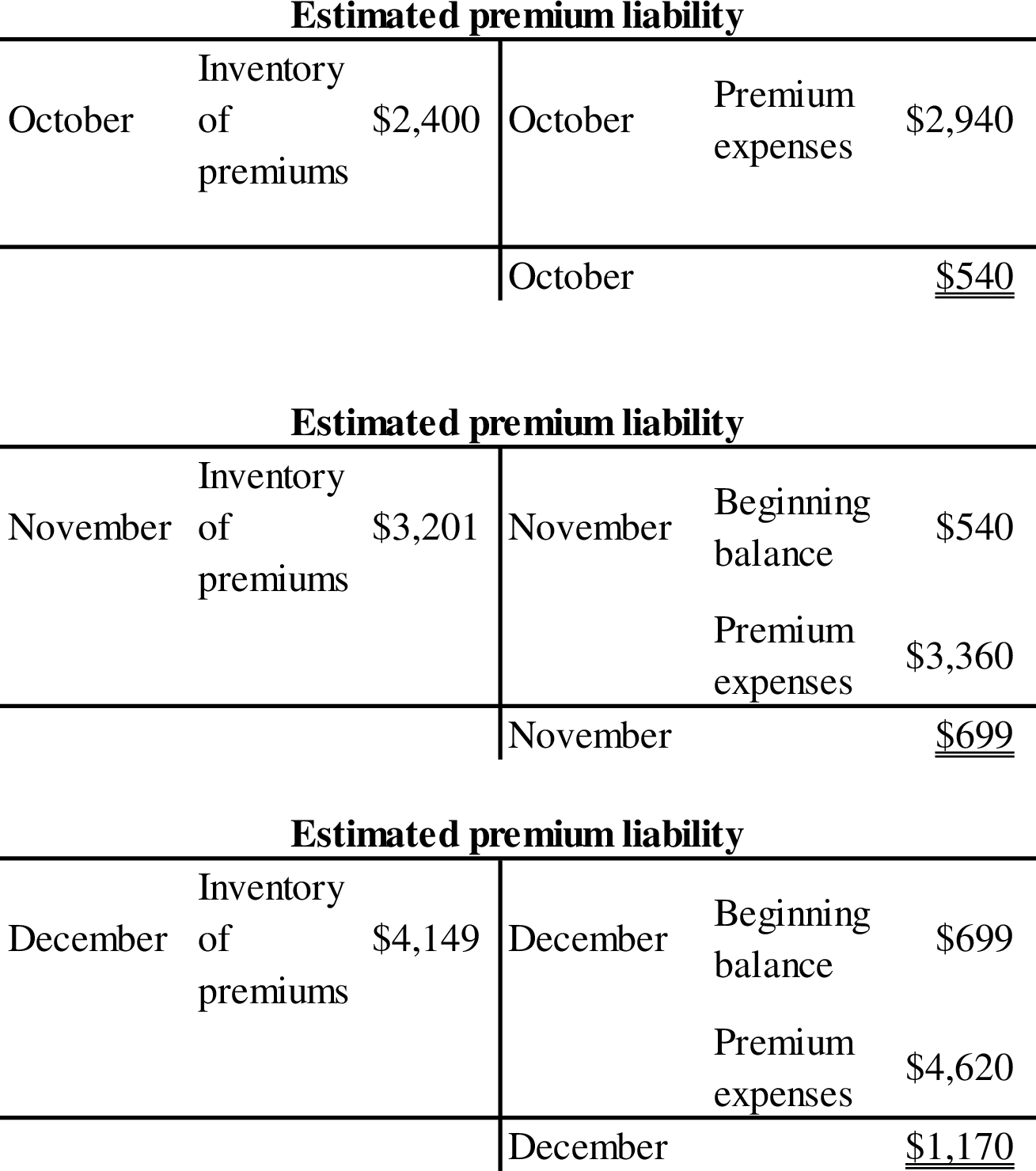

Prepare the T-accounts to determine the estimated premium liability and inventory of premiums:

Want to see more full solutions like this?

Chapter 9 Solutions

EBK INTERMEDIATE ACCOUNTING: REPORTING

- What is the normal balance of Accounts Payable?A. DebitB. CreditC. ZeroD. VariesNeedarrow_forwardGeneral Accounting Question Solutionarrow_forwardWhat is the effect of writing off an uncollectible account under the allowance method?A. Increases net incomeB. No effect on total assetsC. Decreases revenueD. Increases expenses correctarrow_forward

- Need Help of this Financial Accountingarrow_forwardWhat is the effect of writing off an uncollectible account under the allowance method?A. Increases net incomeB. No effect on total assetsC. Decreases revenueD. Increases expensesneed helparrow_forwardWhat is the effect of writing off an uncollectible account under the allowance method?A. Increases net incomeB. No effect on total assetsC. Decreases revenueD. Increases expensesarrow_forward

- The purpose of the trial balance is to:A. Prepare for auditB. Ensure all transactions are postedC. Check that total debits equal total creditsD. Detect all errors correct answerarrow_forwardPlease Make Perfect Answer For this Financial Accountingarrow_forwardThe purpose of the trial balance is to:A. Prepare for auditB. Ensure all transactions are postedC. Check that total debits equal total creditsD. Detect all errors correct solutarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning