Concept explainers

1.

Prepare the

1.

Explanation of Solution

Prepare the journal entry to record the sales made during October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Cash or | 58,800 | |

| Sales | 58,800 | ||

| (To record the sale of 21,000 cereal boxes) |

Table (1)

Prepare the journal entry to record the purchase of shovel set:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Inventory of premiums | 2,640 | |

| Cash | 2,640 | ||

| (To record the purchase of toy shovel sets) |

Table (2)

Prepare the journal entry to record the estimated total premium liability:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Premium expenses (2) | 2,940 | |

| Estimated premium liability | 2,940 | ||

| (To record the recognition of estimated premium liability) |

Table (3)

Working note (1):

Calculate the total box tops estimated for redemption:

| Particulars | Amount ($) | Amount ($) |

| Total box tops outstanding in October 2016 (A) | 21,000 | |

| Estimated percent redeemed (B) | 70% | |

| Total box tops estimated for redemption (C) | 14,700 |

Table (4)

Working note (2):

Calculate the amount of premium expenses:

Prepare the journal entry to record the redemption of 12,000 top boxes in October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Estimated premium liability (3) | 2,400 | |

| Inventory of premiums | 2,400 | ||

| (To record the redemption of 12,000 top boxes of cereals) |

Table (5)

Working note (3):

Calculate the amount of estimated premium liability:

Prepare the journal entry to record the sales made during November:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Cash or Accounts receivable | 67,200 | |

| Sales | 67,200 | ||

| (To record the sale of 24,000 cereal boxes) |

Table (6)

Prepare the journal entry to record the purchase of shovel set:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Inventory of premiums | 3,249 | |

| Cash | 3,249 | ||

| (To record the purchase of toy shovel sets) |

Table (7)

Prepare the journal entry to record the estimated total premium liability:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Premium expenses (4) | 3,360 | |

| Estimated premium liability | 3,360 | ||

| (To record the recognition of estimated premium liability) |

Table (8)

Working note (3):

Calculate the total box tops estimated for redemption:

| Particulars | Amount ($) | Amount ($) |

| Total box tops outstanding in November 2016 (A) | 24,000 | |

| Estimated percent redeemed (B) | 70% | |

| Total box tops estimated for redemption (C) | $16,800 |

Table (9)

Working note (4):

Calculate the amount of premium expenses:

Prepare the journal entry to record the redemption of 16,005 top boxes in October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Estimated premium liability (5) | 3,201 | |

| Inventory of premiums | 3,201 | ||

| (To record the redemption of 16,005 top boxes of cereals) |

Table (10)

Working note (5):

Calculate the amount of estimated premium liability:

Prepare the journal entry to record the sales made during December:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| December | Cash or Accounts receivable | 92,400 | |

| Sales | 92,400 | ||

| (To record the sale of 33,000 cereal boxes) |

Table (11)

Prepare the journal entry to record the purchase of shovel set:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| December | Inventory of premiums | 5,091 | |

| Cash | 5,091 | ||

| (To record the purchase of toy shovel sets) |

Table (12)

Prepare the journal entry to record the estimated total premium liability:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Premium expenses (7) | 4,620 | |

| Estimated premium liability | 4,620 | ||

| (To record the recognition of estimated premium liability) |

Table (13)

Working note (6):

Calculate the total box tops estimated for redemption:

| Particulars | Amount ($) | Amount ($) |

| Total box tops outstanding in December 2016 (A) | 33,000 | |

| Estimated percent redeemed (B) | 70% | |

| Total box tops estimated for redemption (C) | $23,100 |

Table (14)

Working note (7):

Calculate the amount of premium expenses:

Prepare the journal entry to record the redemption of 20,475 top boxes in October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Estimated premium liability (8) | 4,149 | |

| Inventory of premiums | 4,149 | ||

| (To record the redemption of 20,475 top boxes of cereals) |

Table (15)

Working note (8):

Calculate the amount of estimated premium liability:

2.

Indicate the way in which the inventory of premiums and the estimated liability would be disclosed in the ending balance sheets of Company YC for the months October, November and December.

2.

Explanation of Solution

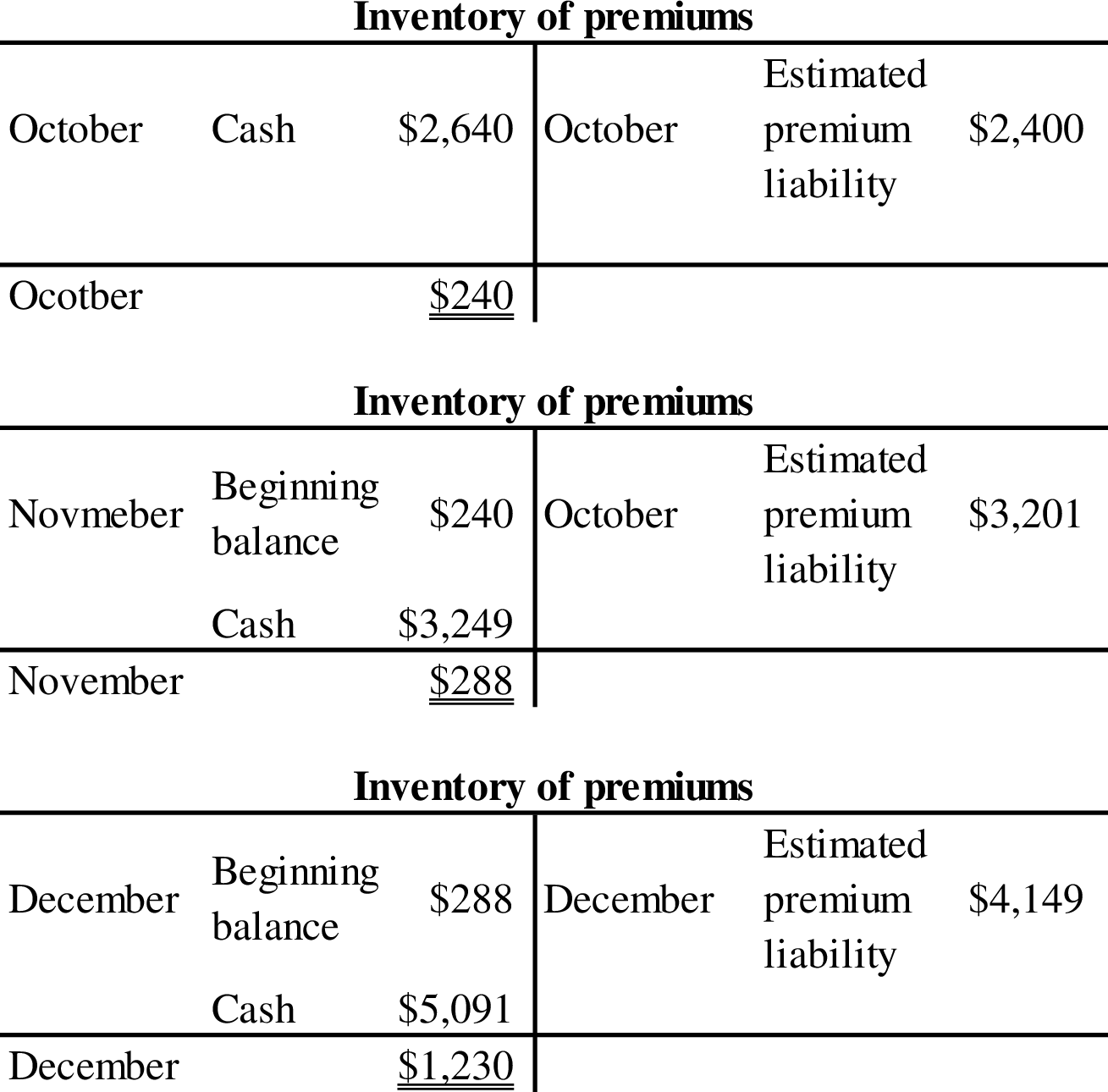

Prepare the partial balance sheet to record the inventory of premiums and the estimated liability:

| Company YC | |||

| Balance Sheet Statement (Partial) | |||

| At The End of | |||

| Assets | October | November | December |

| Current assets: | |||

| Inventory of premiums | $240 | $288 | $1,230 |

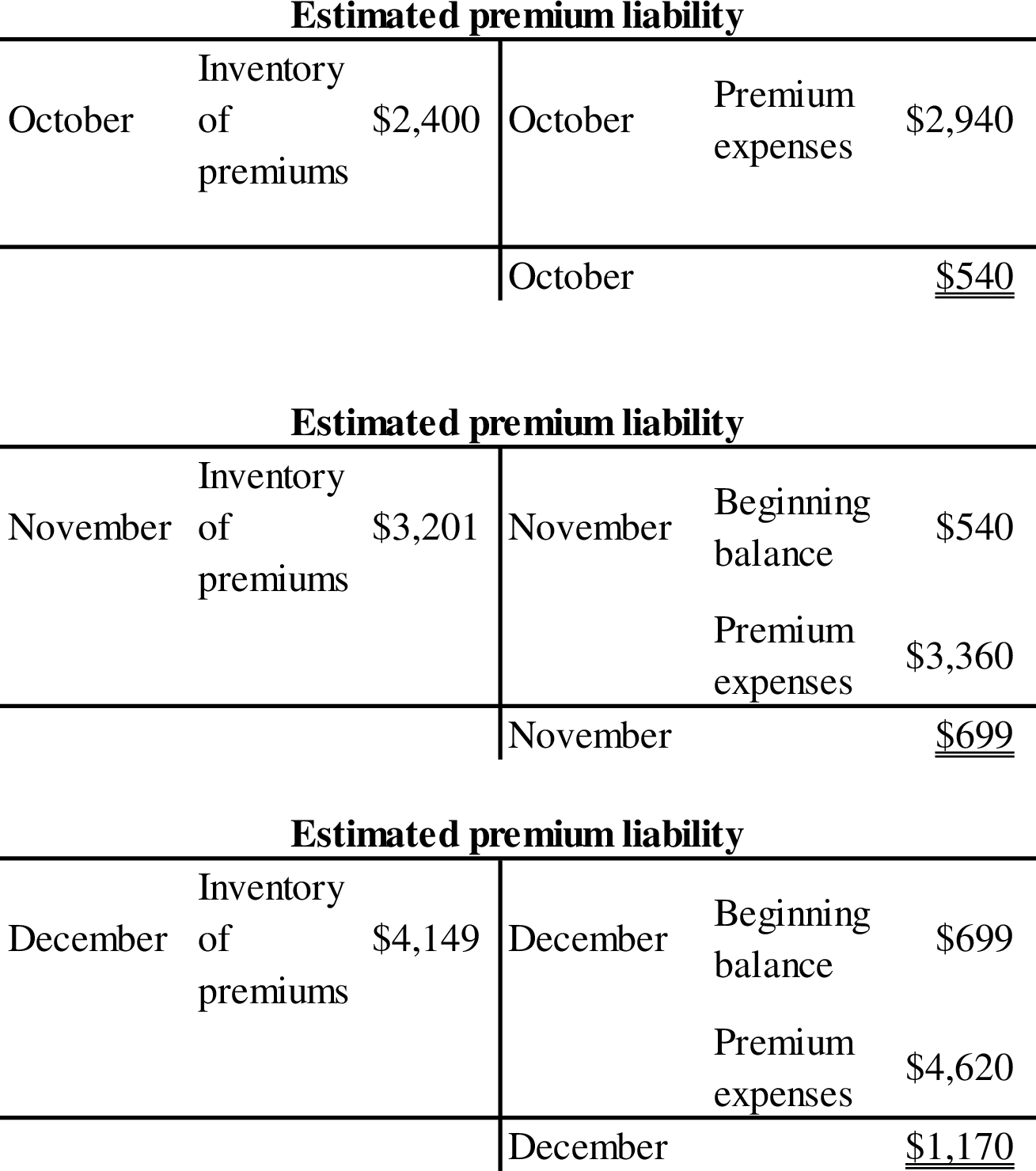

| Liabilities | October | November | December |

| Current liabilities: | |||

| Estimated premium liability | $540 | $699 | $1,170 |

Table (16)

Prepare the T-accounts to determine the estimated premium liability and inventory of premiums:

Want to see more full solutions like this?

Chapter 9 Solutions

Intermediate Accounting: Reporting and Analysis (Looseleaf)

- Chalmers Corporation operates in multiple areas of the globe, and relatively large price changes are common. Presently, the company sells 110,200 units for $50 per unit. The variable production costs are $20, and fixed costs amount to $2,079,500. Production engineers have advised management that they expect unit labor costs to rise by 10 percent and unit materials costs to rise by 15 percent in the coming year. Of the $20 variable costs, 25 percent are from labor and 50 percent are from materials. Variable overhead costs are expected to increase by 20 percent. Sales prices cannot increase more than 12 percent. It is also expected that fixed costs will rise by 10 percent as a result of increased taxes and other miscellaneous fixed charges. The company wishes to maintain the same level of profit in real dollar terms. It is expected that to accomplish this objective, profits must increase by 8 percent during the year. Required: Compute the volume in units and the dollar sales level…arrow_forwardAfter describing a threat/risk in either the revenue cycle (i.e., in sales and cash collection activities) or the expenditure cycle (i.e., in purchases or cash disbursement activities). What are specific internal controls that might be applied to mitigate each of the threats we've identified?arrow_forwardCompare and contrast the procedures for lodging an objection in Jamaica with those of Trinidad and Tobago.arrow_forward

- The actual cost of direct labor per hour is $16.25 and the standard cost of direct labor per hour is $15.00. The direct labor hours allowed per finished unit is 0.60 hours. During the current period, 4,500 units of finished goods were produced using 2,900 direct labor hours. How much is the direct labor rate variance? A. $3,625 favorable B. $3,625 unfavorable C. $4,350 favorable D. $4,350 unfavorablearrow_forwardOn January 1 of the current year, Piper Company issues a 4-year, non-interest-bearing note with a face value of $8,000 and receives $4,952 in exchange. The recording of the issuance of the note includes a: a. credit to Notes Payable for $4,952. b. credit to Discount on Notes Payable for $3,048. c. debit to Discount on Notes Payable for $3,048. d. debit to Cash for $8,000.arrow_forwardPLease helparrow_forward

- What is the budgeted total cost of direct materials purchases?arrow_forwardHy expert provide answer with calculationarrow_forwardDuring September, the assembly department completed 10,500 units of a product that had a standard materials cost of 3.0 square feet per unit at $2.40 per square foot. The actual materials purchased consisted of 22,000 square feet at $2.60 per square foot, for a total cost of $57,200. The actual material used during this period was 25,500 square feet. Compute the materials price variance and materials usage variance.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning