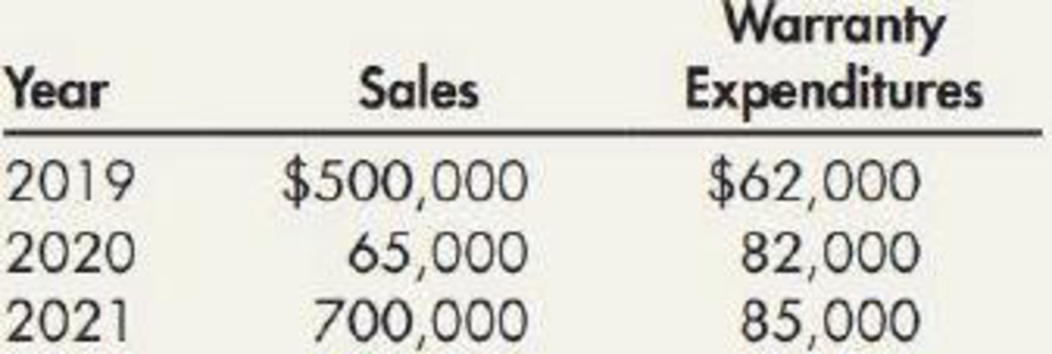

Assurance-Type Warranty Clean-All Inc. sells washing machines with a 3-year assurance-type warranty. In the past, Clean-All has found that in the year after sale, warranty costs have been 3% of sales; in the second year after sale, 5% of sales; and in the third year after sale, 7% of sales. The following data are also available:

Required:

- 1. Prepare the

journal entries for the preceding transactions for 2019–2021. Closing entries are not required. - 2. What amount would Clean-All report as a liability on its December 31, 2021,

balance sheet , assuming the liability had a balance of $88,200 on December 31, 2018? - 3. Next Level How would the failure to recognize a

contingent liability affect the financial statements?

1.

Journalize the transactions for the year 2019-2021 in the books of Incorporation CA.

Explanation of Solution

Warranty:

Warranty is a written guarantee that is given by the seller to the buyer for the product against product’s defect.

Prepare the journal entry to record the sales for the year 2019:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2019 | Cash or Accounts receivable | 500,000 | |

| Sales | 500,000 | ||

| (To record the sale revenue) |

Table (1)

- Cash or an account receivable is an asset account and it is increased. Thus, debit cash or accounts receivable with $500,000.

- Sales are a revenue account and it increases the shareholders’ equity. Thus, credit sales with $500,000.

Prepare the journal entry to record the estimated warranty liability for the year 2019:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2019 | Warranty expense (1) | 75,000 | |

| Estimated warranty liability | 75,000 | ||

| (To record the estimated warranty liability) |

Table (2)

Working note (1):

Determine the amount of estimated warranty liability.

- Warranty expense is an expense account and it decreases the value of shareholders’ equity. Thus, debit warranty expense with $75,000.

- Estimated warranty liability is a liability and it is increased. Thus, credit estimated warranty liability with $75,000.

Prepare the journal entry to record the warranty cost incurred during the year 2019:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2019 | Estimated warranty liability | 62,000 | |

| Cash or other assets | 62,000 | ||

| (To record the warranty cost incurred during the year) |

Table (3)

- Estimated warranty liability is a liability and it is decreased. Thus, debit estimated warranty liability with $62,000.

- Cash or other asset is an asset account and it is decreased. Thus, credit cash or other assets with $62,000.

Prepare the journal entry to record the sales for the year 2020:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2020 | Cash or Accounts receivable | 650,000 | |

| Sales | 650,000 | ||

| (To record the sale revenue) |

Table (4)

- Cash or an account receivable is an asset account and it is increased. Thus, debit cash or accounts receivable with $650,000.

- Sales are a revenue account and it increases the shareholders’ equity. Thus, credit sales with $650,000.

Prepare the journal entry to record the estimated warranty liability for the year 2020:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2020 | Warranty expense (2) | 97,500 | |

| Estimated warranty liability | 97,500 | ||

| (To record the estimated warranty liability) |

Table (5)

Working note (2):

Determine the amount of estimated warranty liability.

- Warranty expense is an expense account and it decreases the value of shareholders’ equity. Thus, debit warranty expense with $97,500.

- Estimated warranty liability is a liability and it is increased. Thus, credit estimated warranty liability with $97,500.

Prepare the journal entry to record the warranty cost incurred during the year 2020:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2020 | Estimated warranty liability | 82,000 | |

| Cash or other assets | 82,000 | ||

| (To record the warranty cost incurred during the year) |

Table (6)

- Estimated warranty liability is a liability and it is decreased. Thus, debit estimated warranty liability with $82,000.

- Cash or other asset is an asset account and it is decreased. Thus, credit cash or other assets with $82,000.

Prepare the journal entry to record the sales for the year 2021:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2021 | Cash or Accounts receivable | 700,000 | |

| Sales | 700,000 | ||

| (To record the sale revenue) |

Table (7)

- Cash or an account receivable is an asset account and it is increased. Thus, debit cash or accounts receivable with $700,000.

- Sales are a revenue account and it increases the shareholders’ equity. Thus, credit sales with $700,000.

Prepare the journal entry to record the estimated warranty liability for the year 2021:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2021 | Warranty expense (3) | 105,000 | |

| Estimated warranty liability | 105,000 | ||

| (To record the estimated warranty liability) |

Table (8)

Working note (3):

Determine the amount of estimated warranty liability.

- Warranty expense is an expense account and it decreases the value of shareholders’ equity. Thus, debit warranty expense with $105,000.

- Estimated warranty liability is a liability and it is increased. Thus, credit estimated warranty liability with $105,000.

Prepare the journal entry to record the warranty cost incurred during the year 2021:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2021 | Estimated warranty liability | 85,000 | |

| Cash or other assets | 85,000 | ||

| (To record the warranty cost incurred during the year) |

Table (9)

- Estimated warranty liability is a liability and it is decreased. Thus, debit estimated warranty liability with $85,000.

- Cash or other asset is an asset account and it is decreased. Thus, credit cash or other assets with $85,000.

2.

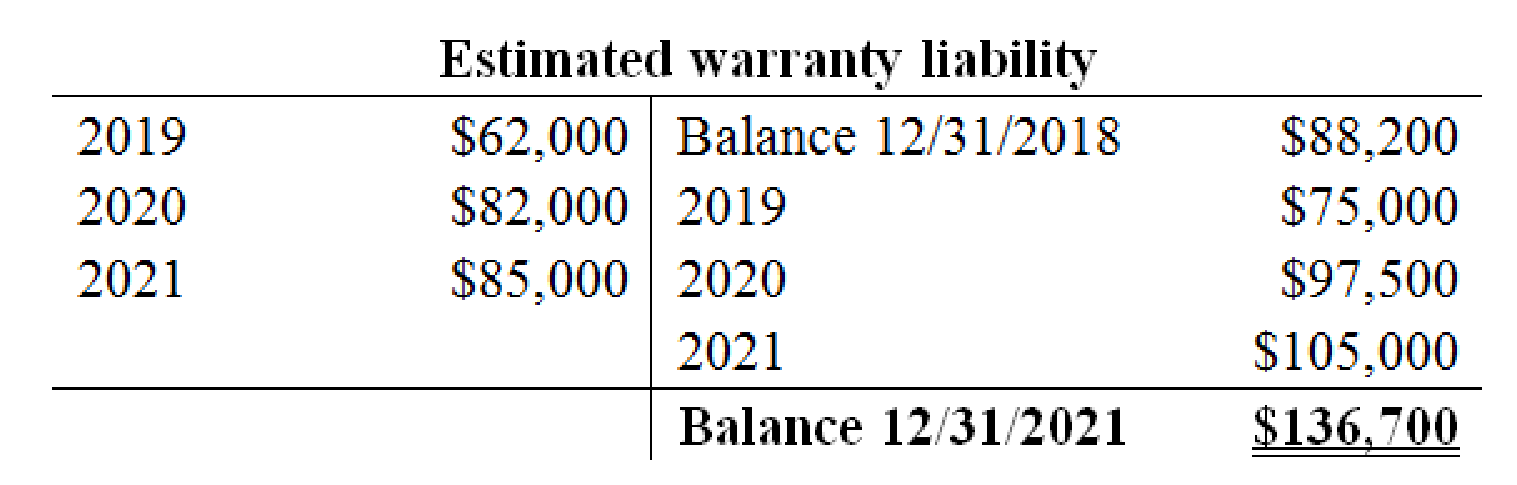

Determine the amount of liability that would be reported by Incorporation CA on its December 31, 2021 balance sheet.

Explanation of Solution

Liabilities: The claims creditors have over assets or resources of a company are referred to as liabilities. These are the debt obligations owed by company to creditors. Liabilities are classified on the balance sheet as current liabilities and long-term liabilities.

Prepare the T-account to determine the amount of estimated warranty liability:

The amount of liability that would be reported by Incorporation CA on its December 31, 2021 balance sheet is $136,700.

3.

Explain the manner in which the financial statements are affected for not recognizing the contingent liability.

Explanation of Solution

According to the recognition principle, recognition of loss contingencies is to record the loss during the current period in which it is incurred. Thus, a loss must be recognized in the same period in which it is incurred and that would result in the probable decrease in an asset or the probable increase in the value of liability. If the loss contingencies are not recognized during the particular period, then it would understate the expense, overstate the earnings, overstate the shareholders’ equity, understate the liabilities in the beginning period and understate the earning of the future period.

Want to see more full solutions like this?

Chapter 9 Solutions

Intermediate Accounting: Reporting And Analysis

- Can you please help me by providing clear neat organized answers. Thank you!arrow_forwardSummary: You will investigate a case of asset theft involving several fraudsters for this assignment. The case offers a chance to assess an organization's corporate governance, fraud prevention, and risk factors. Get ready: Moha Computer Services Limited Links to an external website: Finish the media activity. The scenario you need to finish the assignment is provided by this media activity. Directions: Make a four to five-page paper that covers the following topics. Management must be questioned by an auditor regarding the efficacy of internal controls and the potential for fraud. A number of warning signs point to the potential for fraud in this instance. List at least three red flags (risk factors for fraud) that apply to the Moha case. Sort them into three groups: opportunities, pressures/incentives, and (ethical) attitudes/justifications. Determine which people and organizations were impacted by Moha Computer Services Limited's enormous scam. Describe the fraud's financial and…arrow_forwardCoarrow_forward

- Critically assess the role of the Conceptual Framework in financial reporting and its influence onaccounting theory and practice. Discuss how the qualitative characteristics outlined in theConceptual Framework enhance financial reporting and contribute to decision-usefulness. Provideexamples to support your analysis.arrow_forwardCritically analyse the role of financial reporting in investment decision-making,emphasizing the qualitative characteristics that enhance the usefulness of financialstatements. Discuss how financial reporting influences both investor confidence andregulatory decisions, using relevant examples.arrow_forwardHelp need!!arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning