a. 1

Identify Person J’s net pay per month.

a. 1

Explanation of Solution

Net pay is the amount which is received by the employee from the employer after deductions (Withholdings) made from the gross earnings. Net pay is otherwise called as the take-home pay.

Calculate Person T’s net pay:

| Particulars | Amount ($) | Amount ($) |

| Gross Earnings | $5,200.00 | |

| Deductions: | ||

| Federal Income Tax | 800.00 | |

| FICA Tax – Social security tax (1) | 312.00 | |

| FICA Tax – Medicare (2) | 78.00 | |

| Total Deductions | (1,190.00) | |

| Net Pay | 4,010.00 |

Table (1)

Calculate the amount of social security tax:

Calculate the amount of Medicare tax:

Hence, the net pay of Person J is $4,010.00.

a. 2

Identify the amount of FICA tax paid by Person J monthly.

a. 2

Explanation of Solution

Federal Insurance Contributions Act (FICA) tax: Federal government imposes taxes on the employees’ pay to provide benefits to retired, old age, orphans, and disabled. This tax is also referred to as Social Security tax because the program is devised to benefit the society. The two components of this tax are:

- Social Security tax

- Medicare tax

Calculate the amount of FICA tax paid:

Thus, the amount of FICA tax is $390.00 is paid monthly by Person J.

a. 3

Identify the amount of total payroll tax expense for Corporation C for the months January, February, March, and December.

a. 3

Explanation of Solution

Payroll tax:

Payroll tax refers to the tax that are equally contributed by employees and employer based on the salary and wages of an employee. Payroll tax includes taxes like federal tax, local income tax, state tax, social security tax and federal and state

Calculate the payroll tax expenses for January 1.

| Particulars | Amount ($) | Amount ($) |

| Employer FICA Social Security tax (1) | 312.00 | |

| Employer FICA Medicare tax (2) | 78.00 | 390.00 |

| Employer unemployment tax | ||

| Federal tax @ 0.6% (3) | 31.20 | |

| State tax @ 5.4% (4) | 280.80 | |

| Total unemployment tax | 312.00 | |

| Total employer payroll tax | 702.00 |

Table (2)

Calculate the amount of employer unemployment tax.

Thus, the total employer payroll tax expense for the month January is $702.00.

Calculate the payroll tax expenses for February 1.

| Particulars | Amount ($) | Amount ($) |

| Employer FICA Social Security tax (1) | 312.00 | |

| Employer FICA Medicare tax (2) | 78.00 | 390.00 |

| Employer unemployment tax | ||

| Federal tax @ 0.6% (5) | 10.80 | |

| State tax @ 5.4% (6) | 97.20 | |

| Total unemployment tax | 108.00 | |

| Total employer payroll tax | 498.00 |

Table (3)

Calculate the amount of employer unemployment tax.

Thus, the total employer payroll tax expense for the month February is $496.50.

Calculate the payroll tax expenses for March 1.

| Particulars | Amount ($) | Amount ($) |

| Employer FICA Social Security tax (1) | 312.00 | |

| Employer FICA Medicare tax (2) | 78.00 | |

| Total employer payroll tax | 390.00 |

Table (4)

Thus, the total employer payroll tax expense for the month March is $390.00.

Calculate the payroll tax expenses for December 1.

| Particulars | Amount ($) | Amount ($) |

| Employer FICA Social Security tax (1) | 312.00 | |

| Employer FICA Medicare tax (2) | 78.00 | |

| Total employer payroll tax | 390.00 |

Table (5)

Thus, the total employer payroll tax expense for the month December is $390.00.

b. 1

Identify Person J’s net pay per month if gross earnings are $10,000.

b. 1

Explanation of Solution

Net pay is the amount which is received by the employee from the employer after deductions (Withholdings) made from the gross earnings. Net pay is otherwise called as the take-home pay.

Calculate Person T’s net pay for January to November:

| Particulars | Amount ($) | Amount ($) |

| Gross Earnings | 10,000 | |

| Deductions: | ||

| Federal Income Tax | 800.00 | |

| FICA Tax – Social security tax (7) | 600.00 | |

| FICA Tax – Medicare (8) | 150.00 | |

| Total Deductions | (1,550.00) | |

| Net Pay | 8,450.00 |

Table (6)

Calculate the amount of social security tax:

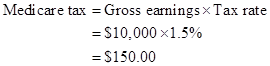

Calculate the amount of Medicare tax:

Hence, the net pay of Person J is $8,450.00 for the month January to November.

Calculate Person T’s net pay for December:

| Particulars | Amount ($) | Amount ($) |

| Gross Earnings | 10,000 | |

| Deductions: | ||

| Federal Income Tax | 800.00 | |

| FICA Tax – Social security tax (9) | 0 | |

| FICA Tax – Medicare (10) | 150.00 | |

| Total Deductions | (950.00) | |

| Net Pay | 9,050.00 |

Table (7)

Calculate the amount of social security tax:

Calculate the amount of Medicare tax:

(10)

Hence, the net pay of Person T is $9,050.00 for the month January to November.

b. 2

Identify the amount of FICA tax paid by Person T monthly.

b. 2

Explanation of Solution

Federal Insurance Contributions Act (FICA) tax: Federal government imposes taxes on the employees’ pay to provide benefits to retired, old age, orphans, and disabled. This tax is also referred to as Social Security tax because the program is devised to benefit the society. The two components of this tax are:

- Social Security tax

- Medicare tax

Calculate the amount of FICA tax paid for January to November:

Thus, the amount of FICA tax is $750.00 is paid for January to December by Person J.

Calculate the amount of FICA tax paid for December:

Thus, the amount of FICA tax is $150.00 is paid for December by Person J.

b. 3

Identify the amount of total payroll tax expense for Corporation S for the months January, February, March, and December.

b. 3

Explanation of Solution

Payroll tax:

Payroll tax refers to the tax that are equally contributed by employees and employer based on the salary and wages of an employee. Payroll tax includes taxes like federal tax, local income tax, state tax, social security tax and federal and state unemployment tax.

Calculate the payroll tax expenses for January 1.

| Particulars | Amount ($) | Amount ($) |

| Employer FICA Social Security tax (7) | 600.00 | |

| Employer FICA Medicare tax (8) | 150.00 | 750.00 |

| Employer unemployment tax | ||

| Federal tax @ 0.6% (11) | 42.00 | |

| State tax @ 5.4% (12) | 378.00 | |

| Total unemployment tax | 420.00 | |

| Total employer payroll tax | 1,170.00 |

Table (8)

Calculate the amount of employer unemployment tax.

Thus, the total employer payroll tax expense for the month January is $1,170.00.

Calculate the payroll tax expenses for February 1.

| Particulars | Amount ($) | Amount ($) |

| Employer FICA Social Security tax (7) | 600.00 | |

| Employer FICA Medicare tax (8) | 150.00 | |

| Total employer payroll tax | 750.00 |

Table (9)

Thus, the total employer payroll tax expense for the month February is $750.00.

Calculate the payroll tax expenses for March 1.

| Particulars | Amount ($) | Amount ($) |

| Employer FICA Social Security tax (7) | 600.00 | |

| Employer FICA Medicare tax (8) | 150.00 | |

| Total employer payroll tax | 750.00 |

Table (10)

Thus, the total employer payroll tax expense for the month March is $750.00.

Calculate the payroll tax expenses for December 1.

| Particulars | Amount ($) | Amount ($) |

| Employer FICA Social Security tax (13) | 0 | |

| Employer FICA Medicare tax (8) | 150.00 | |

| Total employer payroll tax | 150.00 |

Table (11)

Calculate the Social security tax for December:

Thus, the total employer payroll tax expense for the month December is $150.00.

Want to see more full solutions like this?

Chapter 9 Solutions

Fundamental Financial Accounting Concepts, 9th Edition

- At year-end, Simple has cash of $12,000, current accounts receivable of $60,000, merchandise inventory of $37,200, and prepaid expenses totaling $5,200. Liabilities of $24,000 must be paid next year. Assume accounts receivable had a beginning balance of $20,000 and net credit sales for the current year totaled $2,400,000. How many days did it take Simple to collect its average level of receivables? (Assume 365 days/year.)arrow_forwardWhat is the gross profit for the period ?arrow_forwardCan you explain the correct approach to solve this financial accounting question?arrow_forward

- CarniTrin is a manufacturer of Carnival costumes in a highly competitive market. Thecompany's management team is seeking guidance on the use of financial performancemeasures to identify the key drivers of the company's financial performance and develop astrategy to improve it.The following data relate to the company for the year 2023: In its clothing division, the company has $18,000,000 invested in assets. After-taxoperating income from sales of clothing in 2023 is $2,700,000. Income for theclothing division has grown steadily over the last few years. The cosmetics division has $42,000,000 invested in assets and an after-tax operatingincome in 2023 of $5,700,000. The weighted-average cost of capital for CarniTrin is 10% and the 2022’s after-taxreturn on investment for each division was 15%. The general manager of CarniTrin has asserted that in the future, managers shouldhave their compensation structure aligned with their performance measures with nofixed salaries. However, the…arrow_forwardFinancial accounting problemarrow_forwardgeneral accountingarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education