a)

Ascertain the total number of outstanding shares at the end of the period.

a)

Explanation of Solution

Common stock: These are the ordinary shares that a corporation issues to the investors in order to raise funds. In return, the investors receive a share of profit from the profits earned by the corporation in the form of dividend.

Ascertain the total number of outstanding shares at the end of the period:

| Common Stock | Outstanding |

| Beginning Number of Shares | 3,000 |

| Issued in this period | 2,000 |

| Less: Repurchased as | (500) |

| Resold Treasury Stock | 120 |

| Ending number of shares outstanding | 4,620 |

Table (1)

Therefore, the total number of outstanding shares at the end of the period is 4,620 shares.

b)

Ascertain the total number of issued shares at the end of the period.

b)

Explanation of Solution

Ascertain the total number of issued shares at the end of the period:

| Common Stock | Issued |

| Beginning Number of Shares | 3,000 |

| Issued in this period | 2,000 |

| Ending Number of Shares | 5,000 |

Table (2)

Therefore, the total number of issued shares at the end of the period is 5,000 shares.

c)

Organize the transactions data in accounts under the

c)

Explanation of Solution

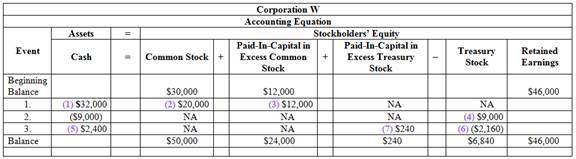

Organize the transactions data in accounts under the accounting equation:

Table (3)

Working note:

(1)Calculate the value of cash received from the issuance of common stock:

(2)Calculate the value of common stock issued at par value:

(3)Calculate the value of paid-in capital in excess of par value:

(4)Calculate the value of treasury stock:

(5)Calculate the value of cash received from the resold of treasury stock:

(6) Calculate the value of treasury stock resold at original cost:

(7) Calculate the value of paid-in capital in excess of cost, TS:

d)

Prepare the stockholder’s equity section of the

d)

Explanation of Solution

Prepare the stockholder’s equity section of the balance sheet:

| Stockholders’ Equity | $ | $ |

| Common Stock, $10 par value, 50,000 shares authorized, 5,000 shares issued, and 4,620 shares outstanding | $50,000 | |

| Paid-In Capital in Excess of Par, Common | $24,000 | |

| Paid-In Capital in Excess of Cost, Treasury Stock | $240 | |

| Total Paid-In Capital | $74,240 | |

| Add: | $46,000 | |

| Less: Treasury Stock | ($6,840) | |

| Total Stockholders’ Equity | $113,400 |

Table (4)

Therefore, the total value of stockholder’s equity at the end of the year is $113,400.

Want to see more full solutions like this?

Chapter 8 Solutions

Survey Of Accounting

- What is the net income percentage ?arrow_forwardCan you please answer the financial accounting question?arrow_forwardidentify the key factors that contributed to the collapse of Northern Rock bank. Compile documents and analysis of regulations (magazine articles, newspapers, online sources, working papers from different organizations, activity summaries, results reports, legal regulations, speeches, public statements, press conferences, etc.). Apply, in a practical and theoretical way, what has been learned in class about the financial world, regulation and risk management.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education