Concept explainers

1.

Periodic Inventory System:

It is a system in which the inventory is updated in the accounting records on a periodic basis such as at the end of each month, quarter or year. In other words, it is an accounting method which is used to determine the amount of inventory at the end of each accounting period.

Perpetual Inventory System:

It is the inventory system that maintains the detailed records of every inventory transactions related to purchases and sales on a continuous basis. It shows the exact on-hand-inventory at any point of time.

In First-in-First-Out method, the cost of initial purchased items are sold first. The value of the ending inventory consists the recent purchased items.

In Last-in-First-Out method, the cost of last purchased items are sold first. The value of the closing stock consists the initial purchased items.

In Weighted-Average Cost Method the cost of inventory is priced at the average rate of the goods available for sale. Following is the mathematical representation:

To Compute: The ending inventory and cost of goods sold for the month of January in the following methods.

1.

Explanation of Solution

Calculate the total cost and units of goods available for sales.

| Calculation of Goods Available for Sales | |||

| Details | Number of Units | Rate per unit ($) | Total Cost ($) |

| Beginning balance | 6,000 | 8 | 48,000 |

| Add: Purchases | |||

| January 10 | 5,000 | 9 | 45,000 |

| January 18 | 6,000 | 10 | 60,000 |

| Total Goods available for Sale | 17,000 | 153,000 | |

Table (1)

Calculate the cost of ending inventory under FIFO, periodic system.

| Calculation of Cost of Ending Inventory (FIFO) | |||

| Details | Number of Units | Rate per Unit ($) | Total Cost ($) |

| January 18 | 6,000 | 10 | 60,000 |

| January 10 | 2,000 | 9 | 18,000 |

| Ending Inventory | 8,000 | 78,000 | |

Table (2)

Calculate the Cost of Goods Sold.

Therefore, the cost of ending inventory, and the cost of goods sold in the FIFO method is $78,000, and $75,000 respectively.

2.

To Calculate: the cost of ending inventory, and cost of goods sold under LIFO, periodic system.

2.

Explanation of Solution

| Calculation of Cost of Ending Inventory (LIFO) | |||

| Details | Number of Units | Rate per Unit ($) | Total Cost ($) |

| Beginning Balance | 6,000 | 8 | 48,000 |

| January 10 | 2,000 | 9 | 18,000 |

| Ending Inventory | 8,000 | 66,000 | |

Table (3)

Calculate the Cost of Goods Sold.

Therefore, the cost of ending inventory, and the cost of goods sold in the LIFO method is $66,000, and $87,000 respectively.

3.

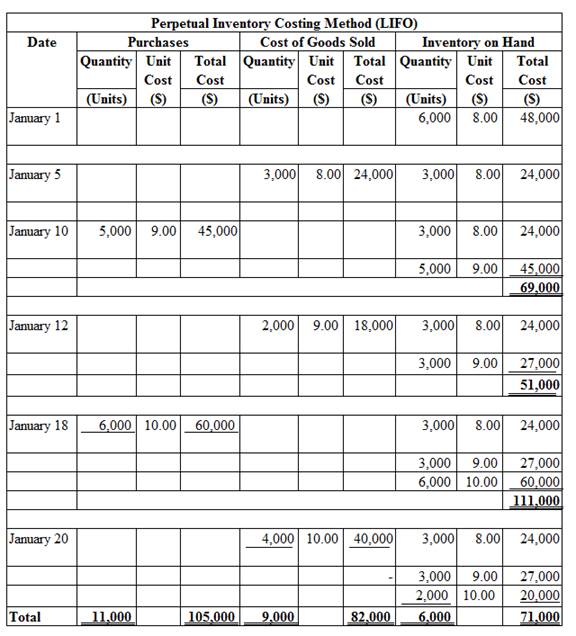

To Calculate: the cost of ending inventory, and cost of goods sold under LIFO, perpetual system.

3.

Explanation of Solution

Figure (1)

Therefore, the cost of ending merchandised inventory and cost of goods sold are $71,000 and $82,000 respectively.

4.

To Calculate: the cost of ending inventory under average cost, periodic system.

4.

Explanation of Solution

Number of units in ending inventory = 8,000

Weighted average cost per unit = $9 (1)

Working Note:

Calculate the Weighted-average cost.

Calculate the Cost of Goods Sold.

Therefore, the cost of ending inventory, and the cost of goods sold in the Average-cost method is $72,000, and $81,000 respectively.

5.

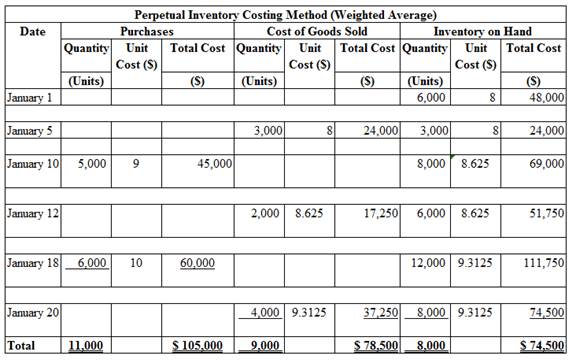

To Calculate: the cost of ending inventory, and cost of goods sold under average cost, perpetual system.

5.

Explanation of Solution

Figure (2)

Working Notes:

Calculate the Weighted-average cost after the January 10th purchase.

Calculate the Weighted-average cost after the January 18th purchase.

Therefore, the cost of ending merchandised inventory and cost of goods sold are 74,500 and $78,500 respectively.

Want to see more full solutions like this?

Chapter 8 Solutions

LooseLeaf Intermediate Accounting w/ Annual Report; Connect Access Card

- Vanessa Enterprises reported pretax book income of $620,800. Included in the computation were favorable temporary differences of $15,500, unfavorable temporary differences of $88,200, and unfavorable permanent differences of $72,400. Assuming a tax rate of 35%, the Corporation's current income tax expense or benefit would be_. a. $225,304 b. $224,000 c. $221,000 d. $217,280arrow_forwardPlease don't answer if u don't know answer .arrow_forwardno use incorrect values , i will give unhelpful..arrow_forward

- Don't use ai tool please !!arrow_forwardWillow & Sons Ltd. has $312,000 in accounts receivable on February 1. Budgeted sales for February are $820,000. Willow & Sons expects to sell 25% of its merchandise for cash. Of the remaining 75% of sales on account, 60% are expected to be collected in the month of sale and the remainder the following month. What are the February cash collections from sales?arrow_forwardplease give answer correctly !! no use incorrect values.arrow_forward

- Solve this qn if you no well otherwise unhekarrow_forwardFinancial accounting 4.2.99arrow_forwardMangesh Analytics, Inc. sells earnings forecasts for European securities. Its credit terms are 2/15, net 40. Based on experience, 60 percent of all customers will take the discount. What is the average collection period? Helparrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education