Prepare and use contribution margin statements for discontinuing a line decision (Learning Objective 4)

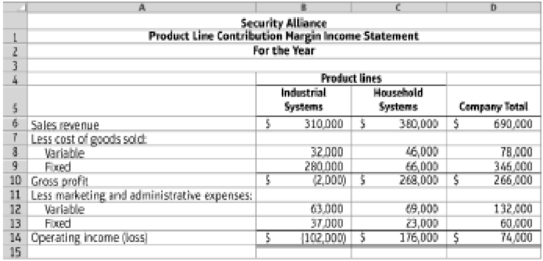

Members of the board of directors of Security Alliance have received the following operating income data for the year just ended:

8.3-32 Full Alternative Text

Members of the board are surprised that the industrial systems product line is losing money. They commission a study to determine whether the company should discontinue the line. Company accountants estimate that discontinuing the industrial systems line will decrease fixed cost of goods sold by $80,000 and decrease fixed marketing and administrative expenses by $11,000.

Requirements

- 1. Prepare an incremental analysis to show whether Security Alliance should discontinue the industrial systems product line.

- 2. Prepare contribution margin income statements to show Security Alliance’s total operating income under the two alternatives: (a) with the industrial systems line and (b) without the line. Compare the difference between the two alternatives’ income numbers to your answer to Requirement 1. What have you learned from this comparison?

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Managerial Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (5th Edition)

- If a company records an expense that was actually a capital expenditure, what will be the result?A. Assets overstatedB. Net income overstatedC. Expenses understatedD. Net income understated need helparrow_forwardIf a company records an expense that was actually a capital expenditure, what will be the result?A. Assets overstatedB. Net income overstatedC. Expenses understatedD. Net income understated correctarrow_forwardIf a company records an expense that was actually a capital expenditure, what will be the result?A. Assets overstatedB. Net income overstatedC. Expenses understatedD. Net income understatedarrow_forward

- If a company records an expense that was actually a capital expenditure, what will be the result?A. Assets overstatedB. Net income overstatedC. Expenses understatedD. Net income understatedneed helparrow_forwardIf a company records an expense that was actually a capital expenditure, what will be the result?A. Assets overstatedB. Net income overstatedC. Expenses understatedD. Net income understatedcorrectarrow_forwardIf a company records an expense that was actually a capital expenditure, what will be the result?A. Assets overstatedB. Net income overstatedC. Expenses understatedD. Net income understated corre solutionarrow_forward

- If a company records an expense that was actually a capital expenditure, what will be the result?A. Assets overstatedB. Net income overstatedC. Expenses understatedD. Net income understatedarrow_forwardWhich of the following transactions would increase owner's equity?A. Paying rentB. Buying equipment with cashC. Earning service revenueD. Paying dividendsarrow_forwardWhich of the following transactions would increase owner's equity?A. Paying rentB. Buying equipment with cashC. Earning service revenueD. Paying dividendsneed helparrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub