Intercorporate Inventory and Debt Transfers (Effective Interest Method)

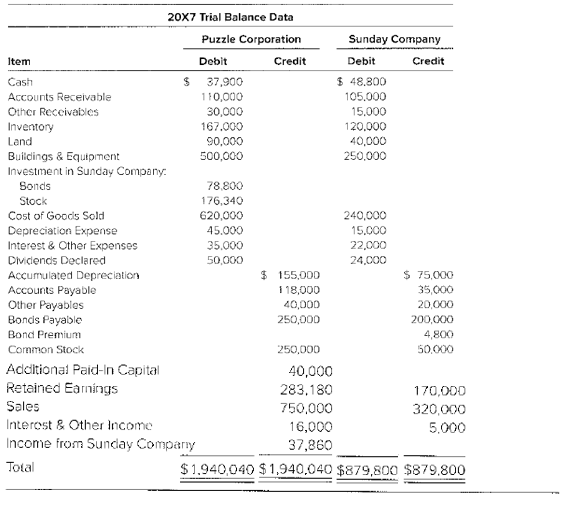

Puzzle Corporation purchased 75 percent of Sunday Company’s common stock at underlying book value on January 1, 20X3. At that date, the fair value of the noncontrolling interest was equal to 25 percent of Sunday’s book value.

During 20X7, Puzzle resold inventory purchased from Sunday in 20X6. It had cost Sunday $44,000 to produce the inventory, and Puzzle had purchased it for $59,000. In 20X7, Puzzle had purchased inventory for $40,000 and sold it to Sunday for $60,000. At December 31, 20X7. Sunday continued to hold $27,000 of the inventory.

Sunday had issued $200,000 of 8 percent, 10−year bonds on January 1, 20X4, at 104. Puzzle had purchased $80,000 of the bonds from one of the original owners for $78,400 on December 31, 20X5. Interest is paid annually on December 31. Assume Puzzle uses the fully adjusted equity method.

Required

a. What amount of cost of goods sold will be reported in the 20X7 consolidated income statement?

b. What inventory balance will be reported in the December 31, 20X7, consolidated

c. Prepare the

d. Prepare the journal entry to record interest income for Puzzle for 20X7.

e. What amount will be assigned to the noncontrolling interest in the consolidated balance sheet prepared at December 31, 20X7?

f. Prepare all consolidation entries needed at December 31, 20X7, to complete a three−part consolidation worksheet.

g. Prepare a consolidation worksheet for 20X7 in good form.

Intercompany debt transfer:when one corporation controls another, the management has the ability to transfer resources between the two legal entities as needed. A direct intercompany debt transfer involves a loan from one affiliate to another without the participation of an unrelated party including trade receivable, payables arising from intercompany sale of inventory on credit and the issuance of note payable by one affiliate to another in exchange of operating funds.

Requirement 1

Amount of cost of goods sold to be reported in consolidated income statement.

Answer to Problem 8.25AP

Cost of goods sold to be reported in consolidated income statement is $794,000

Explanation of Solution

| $ | $ | |

| Amount of cost of goods reported by P corporation | 620,000 | |

| Amount of cost of goods reported by S corporation | 240,000 | |

| Adjustment of unrealized profit on inventory purchased by P from S | (15,000) | |

| Adjustment of inventory purchased from subsidiary and resold 20X7 | ||

| CGS intercompany sales recorded by P | 40,000 | |

| CGS intercompany sales recorded by S | 33,000 | |

| Total | 73,000 | |

| CGS based on P’s cost 40,000 x (33,000 /60,000) | (22,000) | |

| Required adjustment | (51,000) | |

| Cost of goods sold | 794,000 |

b.

Intercompany debt transfer:when one corporation controls another, the management has the ability to transfer resources between the two legal entities as needed. A direct intercompany debt transfer involves a loan from one affiliate to another without the participation of an unrelated party including trade receivable, payables arising from intercompany sale of inventory on credit and the issuance of note payable by one affiliate to another in exchange of operating funds.

Requirement 2

Inventory balance to be reported in consolidated balance sheet December 31 20X7

Answer to Problem 8.25AP

Consolidated inventory balance to be reported in consolidated balance sheet is $278,000

Explanation of Solution

| $ | $ | |

| Amount of inventory reported by P | 167,000 | |

| Amount of inventory reported by S | 120,000 | |

| Total | 287,000 | |

| Less: Unrealized profit in ending inventory held by S (27,000 / 60,000) x20,000 | (9,000) | |

| Consolidated inventory balance | 278,000 |

b.

Intercompany debt transfer:when one corporation controls another, the management has the ability to transfer resources between the two legal entities as needed. A direct intercompany debt transfer involves a loan from one affiliate to another without the participation of an unrelated party including trade receivable, payables arising from intercompany sale of inventory on credit and the issuance of note payable by one affiliate to another in exchange of operating funds.

Requirement 3

Journal entry to record interest expenses by S

Answer to Problem 8.25AP

| Debit | Credit | |

| Interest expense | 15,200 | |

| Bond premium | 800 | |

| Cash | 16,000 |

Explanation of Solution

Computation of interest expenses

| Par value of bond issued | $200,000 |

| Annual Interest $200,000 x 0.8 | $16,000 |

| Annual amortization of premium ($4,800 /6 years) | (800) |

| Interest expenses | $15,200 |

d.

Intercompany debt transfer:when one corporation controls another, the management has the ability to transfer resources between the two legal entities as needed. A direct intercompany debt transfer involves a loan from one affiliate to another without the participation of an unrelated party including trade receivable, payables arising from intercompany sale of inventory on credit and the issuance of note payable by one affiliate to another in exchange of operating funds.

Requirement 4

Journal entry to record interest income

Answer to Problem 8.25AP

| Debit | Credit | |

| Cash | $6,400 | |

| Investment in A company bond | 200 | |

| Interest income | 6,600 |

Explanation of Solution

Computation of interest income

| Annual payment received (80,000 x 0.80 | $6,400 |

| Amortization of discount | 200 |

| Interest income | $6,600 |

e.

Intercompany debt transfer:when one corporation controls another, the management has the ability to transfer resources between the two legal entities as needed. A direct intercompany debt transfer involves a loan from one affiliate to another without the participation of an unrelated party including trade receivable, payables arising from intercompany sale of inventory on credit and the issuance of note payable by one affiliate to another in exchange of operating funds.

Requirement 5

The income assigned to non-controlling interest in consolidated balance sheet

Answer to Problem 8.25AP

Consolidated inventory balance to be reported in consolidated balance sheet is $278,000

Explanation of Solution

| $ | |

| Net income reported by S | 48,000 |

| Adjustment for realization of profit on inventory sold to P | 15,000 |

| Adjustment of gain on bond retirement ($4,160 / 8 years) | (520) |

| Realized net income | 62,480 |

| Income assigned to non-controlling interest $62,480 x 0.25 | 15,620 |

Computation of gain on bond retirement

| $ | $ | |

| Par value of bond | 200,000 | |

| Amortization per year (4,800 / 6 years ) | 800 | |

| Premium maturity value Dec 31 20X5 (800 x 8 years) | 6,400 | |

| Book value of bond | 206,400 | |

| Book value of bond purchase 206,400 x 0.40 | 82,560 | |

| Purchase price | (78,400) | |

| Gain | 4,160 |

f.

Intercompany debt transfer:when one corporation controls another, the management has the ability to transfer resources between the two legal entities as needed. A direct intercompany debt transfer involves a loan from one affiliate to another without the participation of an unrelated party including trade receivable, payables arising from intercompany sale of inventory on credit and the issuance of note payable by one affiliate to another in exchange of operating funds.

Requirement 2

Preparation of consolidation entries needed at December 31 20X7 to complete consolidation worksheet.

Answer to Problem 8.25AP

| Debit | Credit | |

| 1. To eliminate income from subsidiary | ||

| Income from subsidiary | 36,000 | |

| Dividends declared | 18,000 | |

| Investment in S company stock | 18,000 | |

| 2. Assign income to non-controlling interest. | ||

| Income to non-controlling interest | 15,620 | |

| Dividends declared | 6,000 | |

| Non-controlling interest | 9,620 | |

| 3. Eliminate beginning investment balance | ||

| Common stock S company | 50,000 | |

| Retained earnings January 1 | 170,000 | |

| Investment in A’s stock | 165,000 | |

| Non-controlling interest | 55,000 | |

| 4. Eliminating beginning inventory profit | ||

| Retained earnings, January 1 | 11,250 | |

| Non-controlling interest | 3,750 | |

| Cost of goods sold | 15,000 | |

| 5. Eliminating intercompany sale of inventory by P | ||

| Sales | 60,000 | |

| Cost of goods sold | 51,000 | |

| Inventory | 9,000 | |

| 6. Eliminating intercompany bond holdings | ||

| Bond payable | 80,000 | |

| Bond premium | 1,920 | |

| Interest income | 6,600 | |

| Investment on S company’s bonds | 78,800 | |

| Interest expenses | 6,080 | |

| Retained earnings, January 1 | 2,730 | |

| Non-controlling interest | 910 |

Explanation of Solution

- Income from subsidiary is eliminated by debiting to income from subsidiary account.

- Assignment of income to non-controlling interest

- Common stock and retained earnings in the beginning of the year was $170,000 and 50,000 which is $220,000 eliminating by crediting to investment in S account and non- controlling interest account in the ratio of parental and subsidiary holdings.

- Beginning inventory profit of $15,000 is eliminated as required by debiting retained earnings at 75% and non-controlling interest by 25%.

- Intercompany sale of inventory is eliminated by posting reversal entry.

- Eliminating corporate bond holding

Realized net income by S company

Net income reported by S $48,000

Realization of profit on inventory sold to P

(59,000 − 44,000) $15,000

Adjustment of gain on bond retirement ($4,160 / 8 years) (520)

Realized net income62,480

Non-controlling interest $62,480 x 0.25 = $15,620

Bond premium:

Bond premium given $4,800

P bond discount 80,000 − 78,400 (1,600)

Net premium on bond $3,200

Elimination ($3,200 / 10 years) x 6 years = $1,920

Interest on bonds ($80,000 x 0.08) + (1,600 / 8 years) = 6,600.

Calculation of bond investment value:

Bonds purchase consideration $78,400

Amortization of discount (1,600 / 8 years) 200

$78,800

Calculation of interest expenses:

Interest payable $80,000 x0.08 $6,400

Less amortization of premium ($3,200 / 10 years) (320)

$6,080

g.

Intercompany debt transfer:when one corporation controls another, the management has the ability to transfer resources between the two legal entities as needed. A direct intercompany debt transfer involves a loan from one affiliate to another without the participation of an unrelated party including trade receivable, payables arising from intercompany sale of inventory on credit and the issuance of note payable by one affiliate to another in exchange of operating funds.

Requirement 7

Inventory balance to be reported in consolidated balance sheet December 31 20X7

Answer to Problem 8.25AP

Consolidated inventory balance to be reported in consolidated balance sheet is $278,000

Explanation of Solution

P Corporation and S Corporation

Consolidation worksheet

December 31, 20X7

| Elimination | |||||

| P | S | Debit | Credit | Consolidation | |

| Sales | 750,000 | 320,000 | 60,000 | 1,010,000 | |

| Interest and other income | 16,000 | 5,000 | 6,600 | 14,400 | |

| Income from subsidiary | 36,000 | 36,000 | |||

| 802,000 | 325,000 | 1,024,400 | |||

| Less: Cost of goods sold | (620,000) | (240,000) | 15,000 | ||

| 51,000 | (794,000) | ||||

| Depreciation expenses | (45,000) | (15,000) | (60,000) | ||

| Interest and other expenses | (35,000) | (22,000) | 6,080 | (50,920) | |

| Consolidated net income | $119,480 | ||||

| Income to NCI | 15,620 | (15,620) | |||

| Net income | 102,000 | 48,000 | 118,220 | 72,080 | 103,860 |

| Retained earnings Jan 1 | 291,700 | 170,000 | 170,000 | 2,730 | |

| 11,250 | 283,180 | ||||

| 393,700 | 218,000 | 387,040 | |||

| Dividends declared | (50,000) | (24,000) | 18,000 | ||

| 6,000 | (50,000) | ||||

| Retained earnings Dec 31 | 343,700 | 194,000 | 299,470 | 98,810 | 337,040 |

| Balance sheet: | |||||

| Cash | 37,900 | 48,800 | 86,700 | ||

| Accounts receivable | 110,000 | 105,000 | 215,000 | ||

| Other receivable | 30,000 | 15,000 | 45,000 | ||

| Inventory | 167,000 | 120,000 | 9,000 | 278,000 | |

| Land | 90,000 | 40,000 | 130,000 | ||

| Investment in S’s bonds | 78,800 | 78,800 | |||

| Investment in S’s Stock | 183,000 | 18,000 | |||

| 165,000 | |||||

| Buildings and Equipment | 500,000 | 250,000 | 750,000 | ||

| Less Accumulated Depreciation | (155,000) | (75,000) | (230,000) | ||

| Total Assets | 1,041,700 | 175,000 | 1,274,700 | ||

| Accounts payable | 118,000 | 35,000 | 153,000 | ||

| Other payable | 40,000 | 20,000 | 60,000 | ||

| Bonds payable | 250,000 | 200,000 | 80,000 | 370,000 | |

| Bonds premium | 4,800 | 1,920 | 2,880 | ||

| Common Stock: | |||||

| P company | 250,000 | 250,000 | |||

| S company | 50,000 | 50,000 | |||

| Additional Paid in capital | 40,000 | 40,000 | |||

| Retained earnings Dec 31 | 343,700 | 194,000 | 299,470 | 98,810 | 337,040 |

| Non-controlling interest | 3,750 | 9,620 | |||

| 55,000 | |||||

| 910 | 61,780 | ||||

| Liability and equity | 1,041,700 | 175,000 | 1,274,700 | ||

Want to see more full solutions like this?

Chapter 8 Solutions

Advanced Financial Accounting

- Financial Accounting Question Solution with Correct Methodarrow_forwardComputing Return on Assets and Applying the Accounting Equation Nordstrom Inc. reports net income of $564 million for a recent fiscal year. At the beginning of that fiscal year, Nordstrom had $8,115 million in total assets. By fiscal year end, total assets had decreased to $7,886 million. What is Nordstrom’s ROA? Note: Enter answer as a percentage rounded to the nearest 2 decimal places (ex: 24.58%). ROA Answer 1arrow_forwardGive Answer of this Questionarrow_forward

- Val Sims is a self-employed CPA and is the sole practitioner in her tax practice. She has had several situations arise this year involving client representation, client records, and client fee arrangements. Val is concerned that her actions may be in violation of the Circular 230 regulations governing practice before the Internal Revenue Service (IRS). Indicate whether Val is in violation of the regulations for each of the actions described. 1. Howard Corporation's prior-year income tax return was prepared and filed by the company's controller. The return was audited and Howard Corporation paid the additional income taxes assessed by the IRS, including penalties and interest. Although Howard Corporation agreed with income tax assessment, it did not agree with the penalties and interest determined by the IRS. Howard Corporation engaged Val to file a refund claim in connection with the penalties and interest assessed. Val charged the client a fee based on 30 percent of the amount by…arrow_forwardHello I'm Waiting For This General Accounting Question Solutionarrow_forwardPlease I want Answer of this Financial Accounting Questionarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education