Explaining the Nature of a Long-Lived Asset and Determining and Recording the Financial Statement Effects of Its Purchase (P8-1)

LO8-1, 8-2 On June 1, the Wallace Corp. bought a machine for use in operations. The machine has an estimated useful life of six years and an estimated residual value of $2,000. The company provided the following expenditures:

- a. Invoice price of the machine. $60,000.

- b. Freight paid by the vendor per sales agreement. $650.

- c. Installation costs. $ 1,500.

- d. Payment was made as follows:

On June 1:

- The installation costs were paid in cash.

- Wallace Corp. common stock, par $2;2,000 shares (market value, $6 per share).

- Balance of the invoice price on a 12 percent note payable: principal and interest are due September 1 of the current year.

On September 1:

- Wallace Corp. paid the balance and interest due on the note payable.

Required:

- 1. What are the classifications of long-lived assets? Explain their differences.

- 2. Record the purchase on June 1 and the subsequent payment on September 2. Show computations.

- 3. Indicate the accounts, amounts, and effects (+ for increase and − for decrease) of the purchase and subsequent cash payment on the

accounting equation. Use the following structure:

- 4. Explain the basis you used for any questionable items.

1.

Describe the classifications of long-lived assets and to explain their differences.

Explanation of Solution

Long-lived assets:

Long-lived assets refer to the fixed assets, having a useful life of more than a year that is acquired by a company to be used in its business activities, for generating revenue.

Classifications of Long-lived Assets:

The two major classifications of long-lived assets are as follows:

- Tangible assets

- Intangible assets

Difference between tangible assets and intangible assets:

Tangible Assets:

Tangible assets are the long-term assets used by the company, which have physical existence, and can be seen, touched and felt. Some of the examples of the tangible assets include plant, property, land, and building.

Intangible Assets:

Intangible assets are the long-term assets having no physical existence. However, the benefits provided by these assets are used by the company for a long period of time. These intangible assets represent rights. Some of the examples of the intangible assets include patent, trademark, goodwill, and copyrights.

2.

Record the purchase and the subsequent payment made and to show their computations.

Explanation of Solution

Journal entry:

Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Accounting rules for Journal entries:

- To record increase balance of account: Debit assets, expenses, losses and credit liabilities, capital, revenue and gains.

- To record decrease balance of account: Credit assets, expenses, losses and debit liabilities, capital, revenue and gains.

Journalize the transaction for the purchase of the equipment.

| Date | Account titles and explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| June 1 | Equipment | 61,500 | ||

| Cash | 1,500 | |||

| Common stock | 4,000 | |||

| Additional paid-in capital | 8,000 | |||

| Note payable | 48,000 | |||

| (To record the purchase of equipment) |

Table (1)

Working Notes:

Computations required for recording the purchase of the machine:

Compute common stock value.

Compute the additional paid-in capital.

Compute the note payable.

Compute the cost of the equipment:

- Equipment is an asset account and the amount has increased because equipment (plant asset) is purchased; therefore, debit Equipment account.

- Cash is an asset account. The amount has decreased because cash is paid for purchase of equipment. Therefore, credit cash account.

- Common Stock is a stockholders’ equity account and the amount has increased due to the distribution of stock dividends. Therefore, credit common stock account.

- Additional paid-in capital is a component of stockholder’s equity and it has increased the value of stockholder’s equity. Hence, credit the additional paid-in capital.

- Note Payable is a liability account. Note is signed for the purchase of the machine. Therefore, credit note payable account.

Journalize the transaction for the subsequent payment made.

| Date | Account titles and explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| June 1 | Note payable | 48,000 | ||

| Interest expense | 1,440 | |||

| Cash | 49,440 | |||

| (To record the subsequent payment made) |

Table (2)

Working Notes:

Computation required for recording the payment made on the machine:

Calculate the amount of interest expense.

- Note Payable is a liability account and it is decreased. Hence, debit the note payable account.

- Interest expense is an expense account and it is increased, which in turn has decreased the stockholder’s equity account. Hence, debit the interest expense account.

- Cash is an asset account, and it is decreased. Therefore, credit cash account.

3.

Indicate the accounts, amounts, and effects of the purchase and subsequent cash payment on the accounting equation.

Explanation of Solution

Accounting Equation:

Accounting equation is the mathematical representation of the relationship among the assets, liabilities, and stockholder’s equity at any given point of time. The components of the accounting equation include the assets, liabilities and stockholder’s Equity. In the accounting equation, the assets, which are placed on the left side of the equation, and the liabilities, and stockholder’s equity which are placed on the right side, must always balance. The accounting equation is as follows:

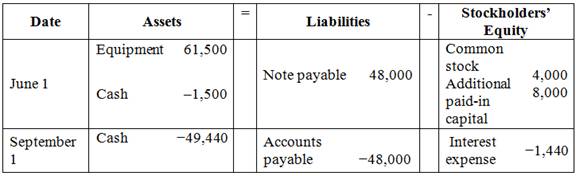

Indicate the accounts, amounts, and effects of purchase and subsequent cash payment on the accounting equation:

Figure (1)

- On 1st June, Corporation W purchased a machine for $61,500 and signed a note payable for $48,000. The payment was made by issuing common stock of $4,000, and additional paid-in capital was $8,000. Hence, this increases the assets (equipment) by $61,500, and liabilities (note payable) by $48,000 and increases the stockholder’s equity (common stock) by $4,000 and (additional paid-in capital) by $8,000. Cash payment on installation costs of the machine decreases the assets (cash) by $1,500.

- On 1st September, Corporation W paid the balance due on the machine. This decreases the assets (cash) balance by $49,440 and liabilities (accounts payable) by $48,000 and stockholder’s equity (interest expense) by $1,440.

4.

Explain the basis which was used for any questionable items.

Explanation of Solution

The basis which was used for the questionable items are as follows:

- Only installation costs are included in the cost of the machinery. The freight charges are not included in the cost of the machinery as it was paid by the vendor.

- Interest expense of $1,440 is the cost of financing. Hence, it should not be included in the cost of the machinery but it should be recorded as an interest expense.

- For the valuation of the common stock, the market price per share of $6 is used. That is, this amount of $6 is allocated between the common stock at the par value of $2 and additional paid-in capital account at the balance amount of $4.

Want to see more full solutions like this?

Chapter 8 Solutions

Connect Access Card for Financial Accounting

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward9. In a bank reconciliation, a bank service charge would be:A. Deducted from the book balanceB. Added to the bank balanceC. Deducted from the bank balanceD. Ignoredarrow_forwardWhich statement is prepared first in the accounting cycle?A. Balance SheetB. Statement of Retained EarningsC. Income StatementD. Cash Flow Statement need helparrow_forward

- 10. Which statement is prepared first in the accounting cycle?A. Balance SheetB. Statement of Retained EarningsC. Income StatementD. Cash Flow Statementhelp mearrow_forwardI need help The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardNo use chatgpt 1. If an adjusting entry is not made for accrued wages, what will be the result?A. Assets overstatedB. Liabilities understatedC. Equity understatedD. Expenses overstatedarrow_forward

- 1. If an adjusting entry is not made for accrued wages, what will be the result?A. Assets overstatedB. Liabilities understatedC. Equity understatedD. Expenses overstatedarrow_forwardDon't use chatgpt The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardThe normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetneed help in this .arrow_forward

- The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the asset Help!arrow_forwardNo AI The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardWhich item would appear on the statement of retained earnings?A. DividendsB. InventoryC. Prepaid RentD. Notes Payablearrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,