Concept explainers

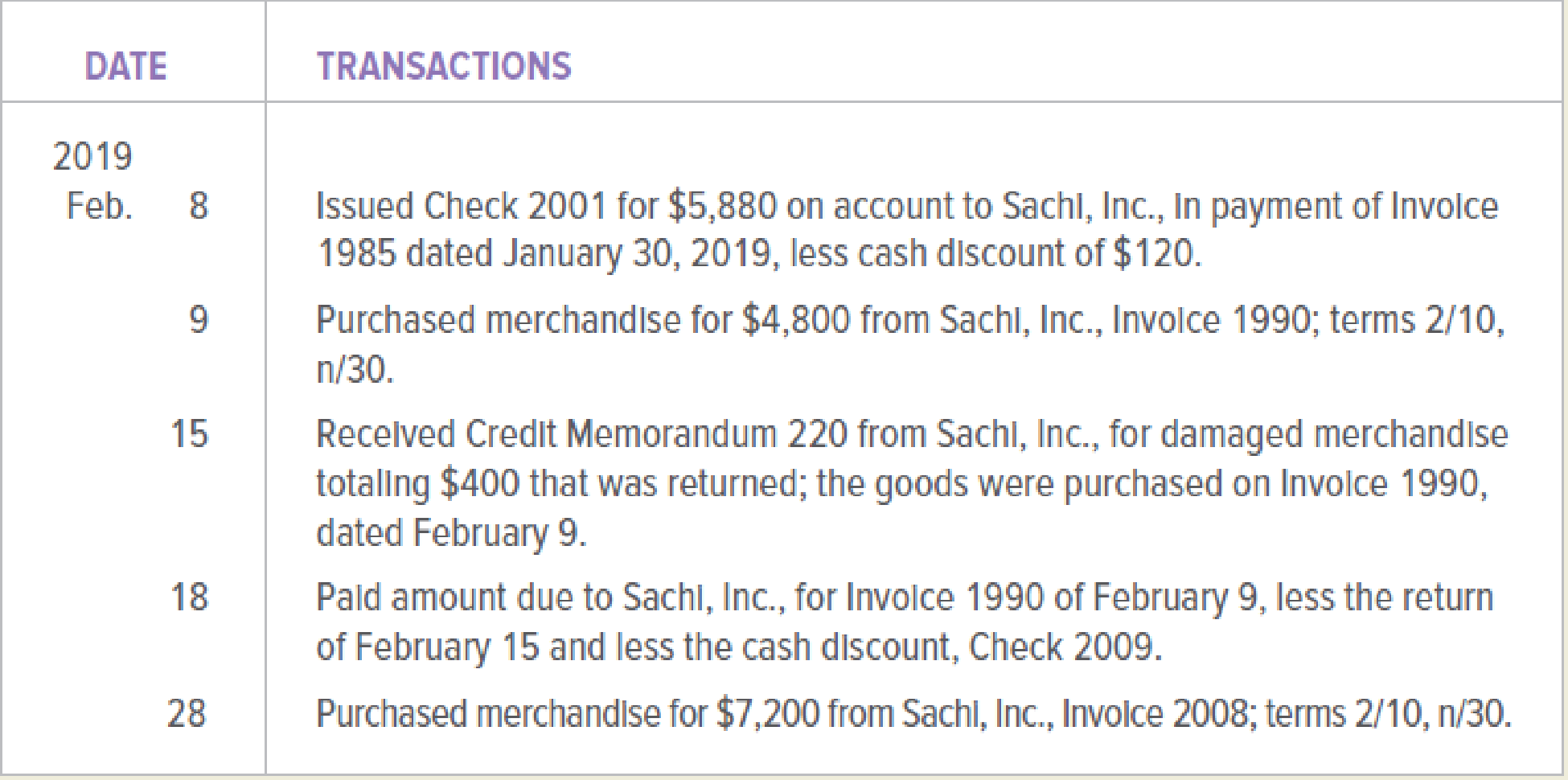

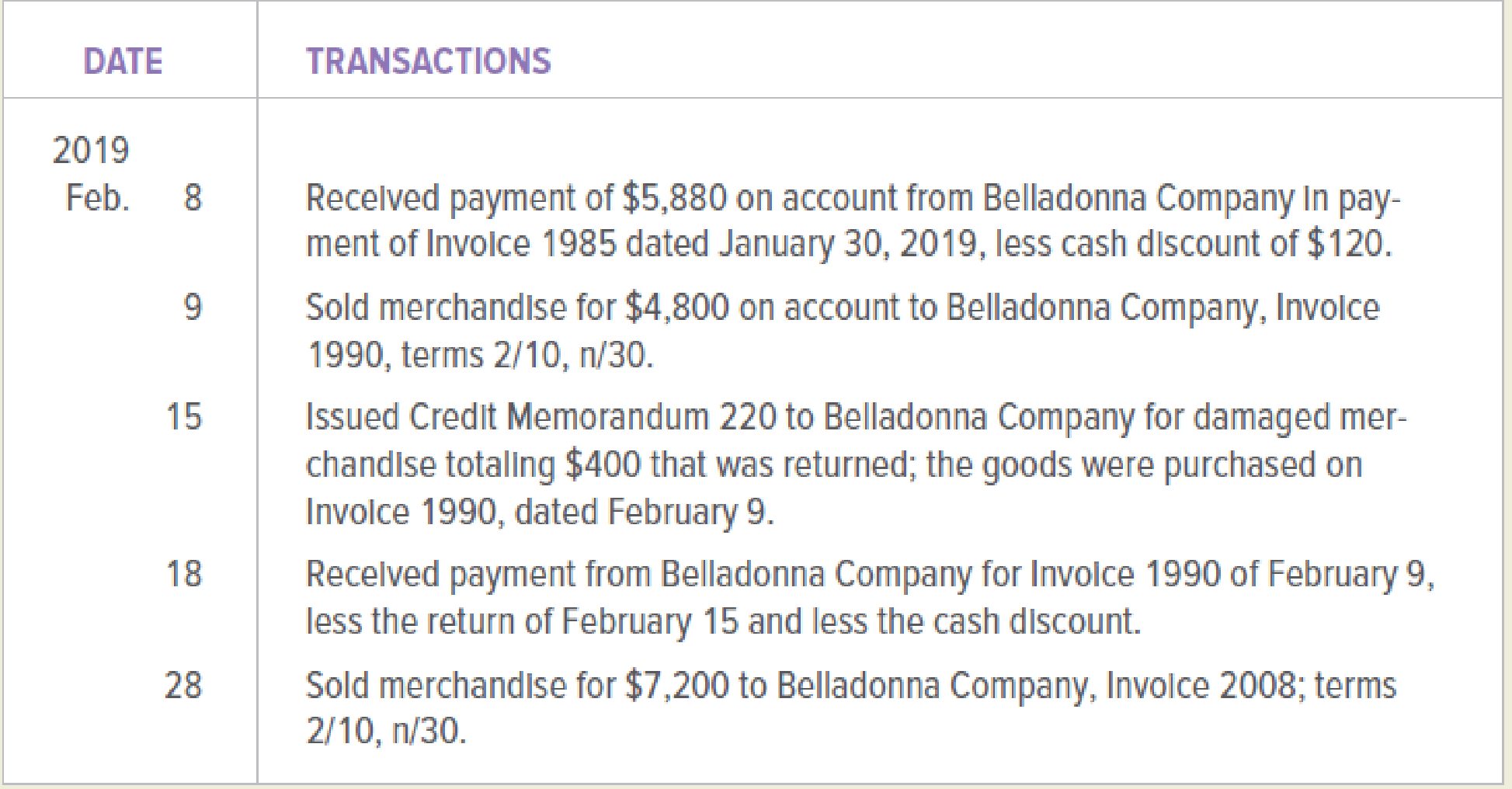

Belladonna Company (buyer) and Sachi, Inc. (seller), engaged in the following transactions during February 2019:

Belladonna Company

Sachi, Inc.

INSTRUCTIONS

- 1. Open the accounts payable ledger account and

accounts receivable ledger account indicated below for both Belladonna Company and Sachi, Inc. Enter the balances as of February 1, 2019. - 2. Journalize the transactions above in a general journal for both Belladonna Company and Sachi, Inc. Begin the journals for both companies with page 12.

- 3.

Post the transactions to the appropriate accounts in the general ledger and the accounts payable subsidiary ledger for Belladonna Company. - 4. Post the transactions to the appropriate accounts in the general ledger and the accounts receivable subsidiary ledger for Sachi, Inc.

GENERAL LEDGER ACCOUNTS—BELLADONNA COMPANY

201 Accounts Payable, $6,000 Cr.

ACCOUNTS PAYABLE LEDGER ACCOUNT—BELLADONNA COMPANY

Sachi, Inc., $6,000

GENERAL LEDGER ACCOUNTS—SACHI, INC.

111 Accounts Receivable, $6,000 Dr.

ACCOUNTS RECEIVABLE LEDGER ACCOUNT—SACHI, INC.

Belladonna Company, $6,000

Analyze: What is the balance of the accounts payable for Sachi, Inc., in the Belladonna Company accounts payable subsidiary ledger? What is the balance of the accounts receivable for Belladonna Company in the Sachi, Inc., accounts receivable subsidiary ledger?

1.

Create the accounts payable ledger account and accounts receivable ledger account of company B and company SI indicating the balances on given date.

Explanation of Solution

Ledgers:

Ledgers are T accounts to which journal entries are posted. Ledgers are used to ascertain transactions of a particular account and its closing balance for the period. The day-to-day transactions of the business are recorded in their respective ledgers.

The accounts payable ledger account of company B is as follows:

| Accounts Payable | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| February 1,2019 | Balance | 6,000 | ||

Table (1)

The accounts receivable ledger account of company SI is as follows:

| Accounts Receivable | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| February 1,2019 | Balance | 6,000 | ||

Table (2)

2.

Record the entries into the general journal of the company B and the company SI.

Explanation of Solution

The recording of entries in the general journal for company B is as follows:

Recording the payment made:

| GENERAL JOURNAL | Page 12 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| February 8, 2019 | Accounts payable/Company SI | 6,000 | ||

| Purchases discounts | 120 | |||

| Cash | 5,880 | |||

| (to record the payment made and receiving purchases discount) | ||||

Table (3)

- • The accounts payable account is liability and the account balance is decreasing. Therefore, accounts payable account is debited.

- • The purchases discount account is a contra expense account. The account has the normal credit balance and it is increasing. Therefore, it is credited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the purchases on credit:

| GENERAL JOURNAL | Page 12 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| February 9, 2019 | Purchases | 4,800 | ||

| Accounts payable/Company SI | 4,800 | |||

| (to record the inventory purchased on account with terms2/10, n/30) | ||||

Table (4)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • Accounts payable is liability and the balance of accounts payable is increasing. Therefore, it is credited.

Recording the purchases returned and credit memorandum received:

| GENERAL JOURNAL | Page 12 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| February 15, 2019 | Accounts payable/Company SI | 400 | ||

| Purchases returns and allowances | 400 | |||

| (to record the inventory returned and credit memorandum received) | ||||

Table (5)

- • The accounts payable account is a liability account. The accounts payable account has the normal credit balance and it is decreasing. Therefore, it is debited.

- • The purchase returns and allowances account is contra expenses account. The account has the normal credit balance and it is increasing. Therefore, it is credited.

Recording the payment made:

| GENERAL JOURNAL | Page 12 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| February 18, 2019 | Accounts payable/Company SI | 4,400 | ||

| Purchases discounts | 88 | |||

| Cash | 4,312 | |||

| (to record the payment made and receiving purchases discount) | ||||

Table (6)

- • The accounts payable is liability and the account balance is decreasing. Therefore, accounts payable account is debited.

- • The purchases discount account is a contra expense account. The account has the normal credit balance and it is increasing. Therefore, it is credited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the purchases on credit:

| GENERAL JOURNAL | Page 12 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| February 28, 2019 | Purchases | 7,200 | ||

| Accounts payable/Company SI | 7,200 | |||

| (to record the inventory purchased on account with terms2/10, n/30) | ||||

Table (7)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • Since, the accounts payable is liability and the account balance is increasing. Therefore, it is credited.

The recording of entries in the general journal for company SI is as follows:

Recording the payment received from the buyer:

| GENERAL JOURNAL | Page 12 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| February 8, 2019 | Sales Discount | 120 | ||

| Cash | 5,880 | |||

| Accounts Receivable/Company B | 6,000 | |||

| (to record the payment received and discount provided) | ||||

Table (8)

- • The sales discount account is identified as contra revenue account and it has normal debit balance which is increasing. Therefore, it is debited.

- • The cash account is debited. This is because the cash account is asset account and the account balance is increasing. The amount in cash account would be calculated by subtracting the merchandise returned by the buyer and the sales discount provided.

- • The accounts receivable account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording of the merchandise sold:

| GENERAL JOURNAL | Page 12 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| February 9, 2019 | Accounts Receivable/ Company B | 4,800 | ||

| Sales | 4,800 | |||

| (to record the merchandise sold on credit on terms of 2/10, n/30) | ||||

Table (9)

- • The accounts receivable is debited. This is because the accounts receivables account is an asset account and the account balance is increasing.

- • The sales account is credited. This because the sales account is identified as the revenue account and the revenue is generated.

Recording the returned merchandise sold and the credit memorandum:

| GENERAL JOURNAL | Page 12 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| February 15, 2019 | Sales returns and allowances | 400 | ||

| Accounts Receivable/ Company B | 400 | |||

| (to record the merchandise returned and issued credit memorandum) | ||||

Table (10)

- • The sales returns and allowances account is identified as contra revenue account with normal debit balance and it is increasing. Therefore, it is debited.

- • The account receivable account is an asset account and the account balance is decreasing. Therefore, the accounts receivable account is credited.

Recording the payment received from the buyer:

| GENERAL JOURNAL | Page 12 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| February 18, 2019 | Sales Discount | 88 | ||

| Cash | 4,312 | |||

| Accounts Receivable/Company B | 4,400 | |||

| (to record the timely payment received from the account receivable) | ||||

Table (11)

- • The sales discount account is identified as contra revenue account and it has normal debit balance which is increasing. Therefore, it is debited.

- • The cash account is debited. This is because the cash account is asset account and the account balance is increasing. The amount in cash account would be calculated by subtracting the merchandise returned by the buyer and the sales discount provided.

- • The accounts receivable account is asset account and the account balance is decreasing. Therefore, it is credited.

Recording of the merchandise sold and sales tax payable:

| GENERAL JOURNAL | Page 12 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| February 28, 2019 | Accounts Receivable/ Company B | 7,200 | ||

| Sales | 7,200 | |||

| (to record the merchandise sold on credit on terms of 2/10, n/30) | ||||

Table (12)

- • The accounts receivables account is debited. This is because the accounts receivables account is an asset account and the account balance is increasing.

- • The sales account is credited. This because the sales account is identified as the revenue account and the revenue is generated.

Working Note:

Calculation of purchases discount:

The purchases discounts are received by the buyer for fulfilling the terms of timely payment to seller for purchases. The terms related to paying on timely basis with the company SI was agreed as 2/10, n/30. The terms 2/10, n/30 means the buyer is entitled to receive two percent of purchase discount on the purchases amount. The buyer will be entitled to the discount only if the payment is paid within ten days after provided invoice.

The amount calculated as purchase discount would be $88.

Calculation for sales discount:

The sales discount is provided to the customer by the seller fulfilling the terms of making the timely payments as per 2/10, n/30 terms. The customer is entitled to receive the one percent of sales discount on the merchandise sold if the payment is made with ten days of invoice provided.

The amount calculated as per given information would be $88.

3.

Record the transactions to the appropriate accounts in the general ledger and the accounts payable subsidiary ledger for company B.

Explanation of Solution

The posting of general journal in the appropriate accounts in the general ledger and the accounts payable subsidiary ledger is as follows:

| Cash | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | - | ||

| February 8, 2019 | 5,880 | (5,880) | ||

| February 18, 2019 | 4,312 | (10,192) | ||

Table (13)

| Accounts Payable/Company SI | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | 6,000 | ||

| February 8, 2019 | 6,000 | - | ||

| February 9, 2019 | 4,800 | 4,800 | ||

| February 15, 2019 | 400 | 4,400 | ||

| February 18, 2019 | 4,400 | - | ||

| February 28, 2019 | 7,200 | 7,200 | ||

Table (14)

| Accounts Payable | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | 6,000 | ||

| February 8, 2019 | 6,000 | - | ||

| February 9, 2019 | 4,800 | 4,800 | ||

| February 15, 2019 | 400 | 4,400 | ||

| February 18, 2019 | 4,400 | - | ||

| February 28, 2019 | 7,200 | 7,200 | ||

Table (15)

| Purchases | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | - | ||

| February 9, 2019 | 4,800 | 4,800 | ||

| February 28, 2019 | 7,200 | 12,000 | ||

Table (16)

| Purchases Returns and Allowances | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | - | ||

| February 15, 2019 | 400 | 400 | ||

Table (17)

| Purchases Discounts | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | - | ||

| February 8, 2019 | 120 | 120 | ||

| February 18, 2019 | 88 | 208 | ||

Table (18)

4.

Record the transactions to the appropriate accounts in the general ledger and the accounts payable subsidiary ledger for company SI.

Explanation of Solution

| Cash | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | - | ||

| February 8, 2019 | 5,880 | 5,880 | ||

| February 18, 2019 | 4,312 | 10,192 | ||

Table (19)

| Accounts Receivable/Company B | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | 6,000 | ||

| February 8, 2019 | 6,000 | - | ||

| February 9, 2019 | 4,800 | 4,800 | ||

| February 15, 2019 | 400 | 4,400 | ||

| February 18, 2019 | 4,400 | - | ||

| February 28, 2019 | 7,200 | 7,200 | ||

Table (20)

| Accounts Receivable | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | 6,000 | ||

| February 8, 2019 | 6,000 | - | ||

| February 9, 2019 | 4,800 | 4,800 | ||

| February 15, 2019 | 400 | 4,400 | ||

| February 18, 2019 | 4,400 | - | ||

| February 28, 2019 | 7,200 | 7,200 | ||

Table (21)

| Sales | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | - | ||

| February 9, 2019 | 4,800 | 4,800 | ||

| February 28, 2019 | 7,200 | 12,000 | ||

Table (22)

| Sales Returns and Allowances | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | - | ||

| February 15, 2019 | 400 | 400 | ||

Table (23)

| Sales Discounts | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | - | ||

| February 8, 2019 | 120 | 120 | ||

| February 18, 2019 | 88 | 208 | ||

Table (24)

The balance of accounts payable account for company SI in company B’s subsidiary ledger is $7,200 credit balance. The balance of accounts receivable account for company B in company SL’s subsidiary ledger is $7,200 debit balance.

Want to see more full solutions like this?

Chapter 8 Solutions

LooseLeaf for College Accounting: A Contemporary Approach

- I am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardHello Dear Tutor Please Need Answer of this Question as possible fast and Correctarrow_forward15. The balance in the dividends account is closed to:A. CashB. RevenueC. Retained EarningsD. Common Stock dont use AIarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,