Concept explainers

Exercise 8-6 Effect of issuing common stock on the

Newly formed S&J Iron Corporation has 50,000 shares of $10 par common stock authorized. On March 1, 2018, S&J Iron issued 6,000 shares of the stock for $16 per share. On May 2, the company issued an additional 10,000 shares for $18 per share. S&J Iron was not affected by other events during 2018.

Required

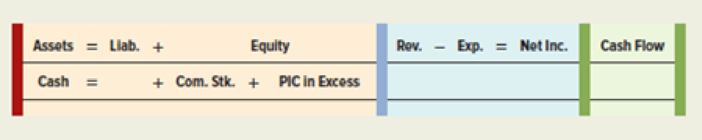

- a. Record the transactions in a horizontal statements model like the following one. In the

Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Use NA to indicate that an element was not affected by the event.

b. Determine the amount S&J Iron would report for common stock on the December 31, 2018, balance

sheet.

c. Determine the amount S&J Iron would report for paid-in capital in excess of par.

d. What is the total amount of capital contributed by the owners?

e. What amount of total assets would S&J Iron report on the December 31, 2018, balance sheet?

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

SURVEY OF ACCOUNTING(LL)>CUSTOM PKG.<

- Can you solve this general accounting problem using appropriate accountarrow_forwardHendrix Plumbing Services purchased machinery for $18,400 on March 1, 2022. The machinery has an estimated useful life of 8 years and a residual value of $1,600. Hendrix uses the straight-line method to calculate depreciation and records depreciation expense at the end of every month. As of September 30, 2022, the book value of this machinery shown on its balance sheet will be: A. $17,175 B. $16,800 C. $16,550 D. $18,400arrow_forwardThe cash purchase price in a stock acquisition is $1,450,000; the book value of the acquired company is $950,000. The book values of equipment, land, and patents need to be adjusted (-$40,000), (-$65,000), and $190,000, respectively. Goodwill, if any, is recorded at_. a. $0 b. $415,000 c. $85,000 d. $195,000arrow_forward

- I need help solving this general accounting question with the proper methodology.arrow_forwardWhat amount of cash did Glenview receive from customer during the year ended December 31, 2017arrow_forwardSunshine Bakery, a popular pastry shop, began its operations in 2019. Its fixed assets had a book value of $720,000 in 2020. The bakery did not purchase any fixed assets in 2020. The annual depreciation expense on fixed assets was $60,000, and the accumulated depreciation account had a balance of $120,000 on December 31, 2020. What was the original cost of fixed assets owned by the bakery in 2019 when it started its operations?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning