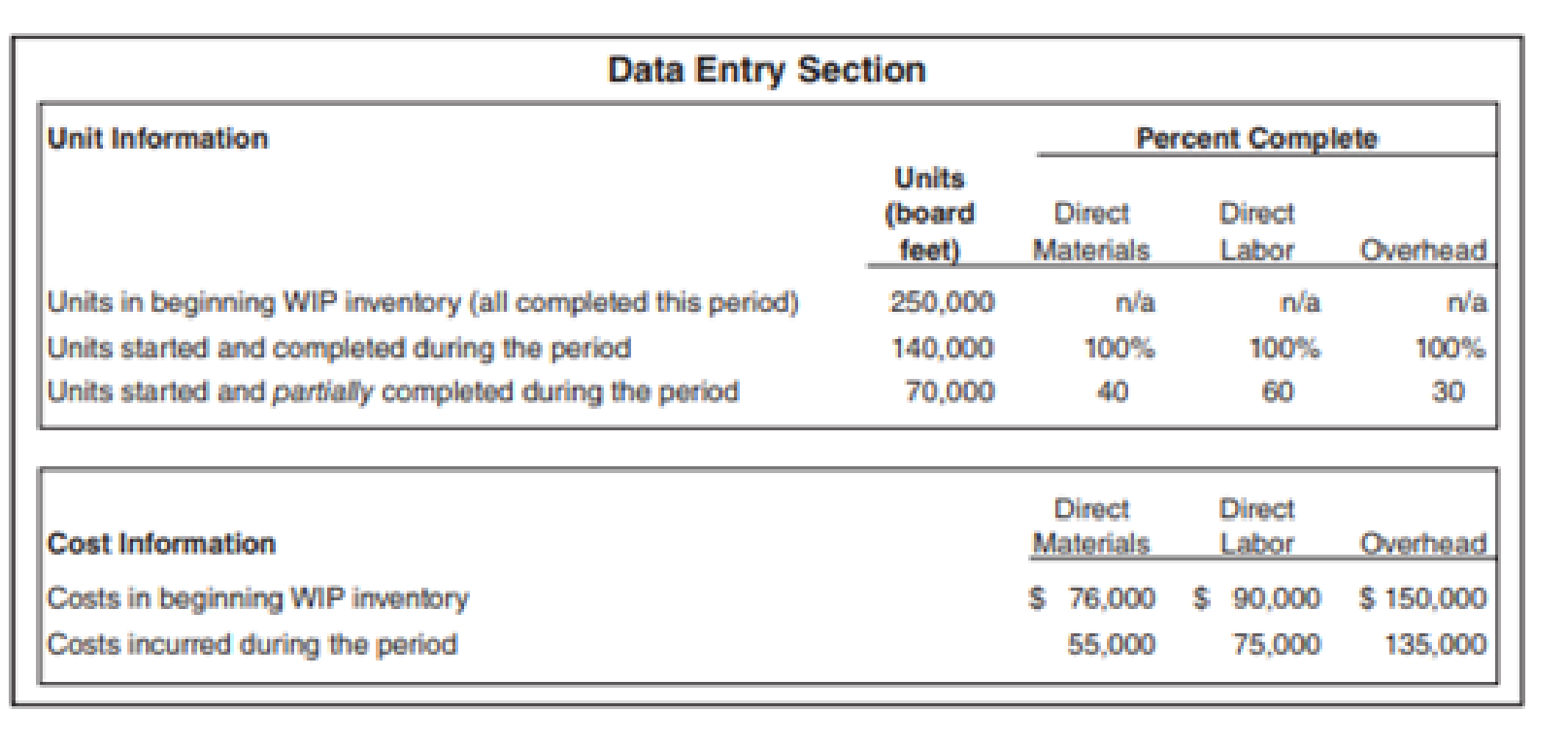

Pacific Siding Incorporated produces synthetic wood siding used in the construction of residential and commercial buildings. Pacific Siding’s fiscal year ends on March 31, and the weighted-average method is used for the company’s process costing system.

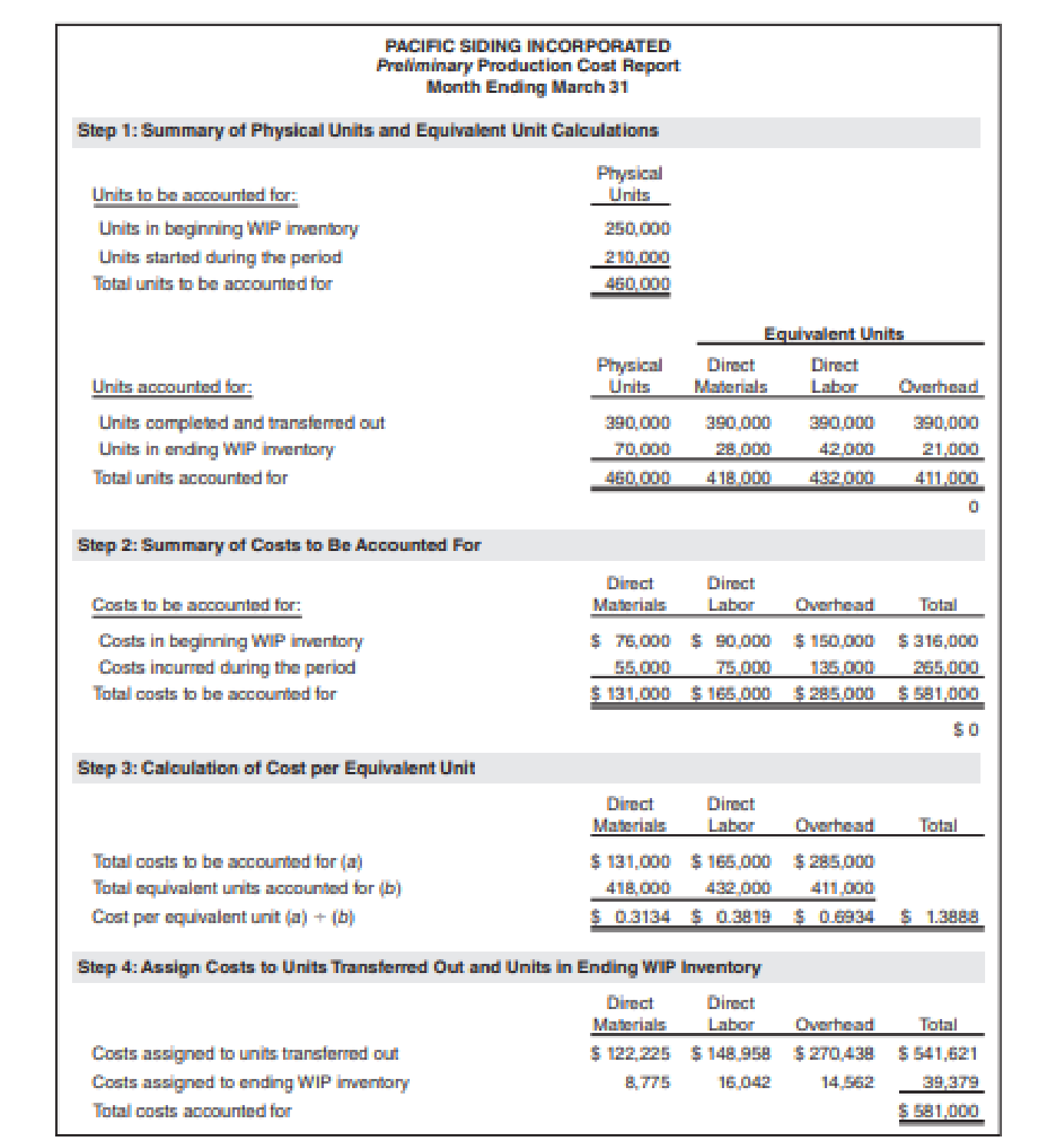

Financial results for the first 11 months of the current fiscal year (through February 28) are well below the expectations of management, owners, and creditors. Halfway through the month of March, the chief executive officer (CEO) and the chief financial officer (CFO) ask the controller to estimate the production results for the month of March in the form of a production cost report (the company has only one production department). This report is shown below.

Armed with the preliminary production cost report for March, and knowing that the company’s production is well below capacity, the CEO and CFO decide to produce as many units as possible for the last half of March, even though sales are not expected to increase any time soon. The production manager is told to push his employees to get as far as possible with production, thereby increasing the percentage of completion for ending WIP inventory. However, since the production process takes three weeks to complete, all of the units produced in the last half of March will be in WIP inventory at the end of March.

Required

- a. Explain how the CEO and CFO expect to increase profit (net income) for the year by boosting production at the end of March. Assume that most

overhead costs are fixed. - b. Using the following assumptions, prepare a revised estimate of production results in the form of a production cost report for the month of March. Assumptions based on the CEO and CFO request to boost production:

- (1) Units started and partially completed during the period will increase to 225,000 (from the initial estimate of 70,000). This is the projected ending WIP inventory at March 31.

- (2) Percentage of completion estimates for units in ending WIP inventory will increase to 80 percent for direct materials, 85 percent for direct labor, and 90 percent for overhead.

- (3) Costs incurred during the period will increase to $95,000 for direct materials, $102,000 for direct labor, and $150,000 for overhead (recall that most overhead costs are fixed).

- (4) All units completed and transferred out during March are sold by March 31.

- c. Compare your new production cost report with the one prepared by the controller. How much do you expect profit to increase as a result of increasing production during the last half of March?

- d. Is the request made by the CEO and CFO ethical? Explain your answer.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

FUND.OF COST ACCT >CUSTOM<

- I don't need ai answer general accounting questionarrow_forwardCharlotte Metals' operating activities for the year are listed below: Beginning inventory $950,600 Ending inventory Purchases Sales revenue $420,700 $825,900 $1,601,850 Operating expenses $720.7* What is the cost of goods sold (COGS) for the year?arrow_forwardPlease do not give AI answwrarrow_forward

- No Aiarrow_forwardProblem No. 3 The business assets of Glea Yares and Eunice Alico appear below: Yares Alico Cash P 10,000 P 25,000 Accounts Receivable 245,000 565,000 Inventories 122,000 260,000 Land 664,000 Building 938,000 Furniture and Fixtures Total 87,000 P1,128,000 36,000 P1,824,000 000,00 000,000 19 000,008 Account Payable Notes Payable P 178,000 200,000 Yare, Capital diw 750,000 P 245,000 345,000 adi to omen Alicol, Capital Total P1,128,000 1,234,000 P1,824,000 On March 5, 2025, Yares and Alico agreed to form a partnership contributing their assets and equities subject to the following adjustments: qining arboj su to nam a. Accounts receivable of P15,000 in Yares' books and P30,000 in Alico's are uncollectible. b. Inventories of P5,500 and P6,500 are worthless in Yares' and Alico's respective books. Required: 1. In the books of Yares, prepare the necessary journal entries: a. To record the adjustments to Yares' assets b. To close the books of Yares of viande no 251qgque oroa snemu ni 2. In the…arrow_forwardCritically evaluate the progress and challenges in achieving a single set of global accounting standards. Discuss the benefits and drawbacks of globalization in accounting, providing relevant examples. Critically assess the role of the Conceptual Framework in financial reporting and its influence on accounting theory and practice. Discuss how the qualitative characteristics outlined in the Conceptual Framework enhance financial reporting and contribute to decision-usefulness. Provide examples to support your analysis. a) Define research methodology in the context of accounting theory and discuss the importance of selecting appropriate research methodology. Evaluate the strengths and limitations of quantitative and qualitative approaches in accounting research. (10 marks) b) Assess the role of modern accounting theories in guiding research in accounting. Discuss how contemporary theories, such as stakeholder theory, legitimacy theory, and behavioral accounting theory, shape…arrow_forward

- Critically evaluate the progress and challenges in achieving a single set of global accounting standards. Discuss the benefits and drawbacks of globalization in accounting, providing relevant examples. Critically assess the role of the Conceptual Framework in financial reporting and its influence on accounting theory and practice. Discuss how the qualitative characteristics outlined in the Conceptual Framework enhance financial reporting and contribute to decision-usefulness. Provide examples to support your analysis. a) Define research methodology in the context of accounting theory and discuss the importance of selecting appropriate research methodology. Evaluate the strengths and limitations of quantitative and qualitative approaches in accounting research. (10 marks) b) Assess the role of modern accounting theories in guiding research in accounting. Discuss how contemporary theories, such as stakeholder theory, legitimacy theory, and behavioral accounting theory, shape…arrow_forwardProblem No. 2 The trial balance of Cleint Lumanao Nacho Supplies on February 10, 2025, before accepting Shila Tajonera as partner is shown as follows: Account Title Debit Credit Ato Cash reening smuo P 100,000 Accounts Receivable 250,000 Allowance for Uncollectible Accounts P 20,000 o Merchandise Inventory Equipment Accumulated Depreciation Accounts Payable Notes Payable 120,000 275,000 55,000 50,000 82,000 538,000 Lumanao, Capital Total P 745,000 P 745,000 Tajonera offered to invest cash to get a capital credit equal to one-half of Lumanao's capital after giving effect to the adjustments below. Lumanao accepted the offer. Valuation of some of the assets and liabilities of Lumanao, as agreed by the partners, are the following: • The merchandise is to be valued at P93,000. The accounts receivable is estimated to be 90% collectible. • The equipment is to be valued at P200,000. The partners also agreed that the name of the partnership will be Nacho Business. Required: 1. In the books of…arrow_forwardIf data is unclear in image or image blurr then comment.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning