Concept explainers

Accounting for Accounts and Notes Receivable Transactions

Execusmart Consultants has provided business consulting services for several years. The company uses the percentage of credit sales method to estimate

- a. During January, the company provided services for $200,000 on credit.

- b. On January 31, the company estimated bad debts using 1 percent of credit sales.

- c. On February 4, the company collected $100,000 of accounts receivable.

- d. On February 15, the company wrote off a $500 account receivable.

- e. During February, the company provided services for $150,000 on credit.

- f. On February 28, the company estimated bad debts using 1 percent of credit sales.

- g. On March 1, the company loaned $12,000 to an employee, who signed a 10% note due in 3 months.

- h. On March 15, the company collected $500 on the account written off one month earlier.

- i. On March 31, the company accrued interest earned on the note.

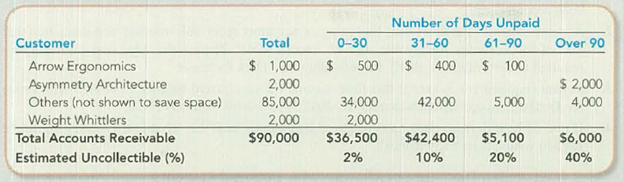

- j. On March 31, the company adjusted for uncollectible accounts, based on the following aging analysis. Allowance for Doubtful Accounts has an unadjusted credit balance of $6,000.

Required:

- 1. For items (a)–(j), analyze the amount and direction (+ or −) of effects on specific financial statement accounts and the overall

accounting equation. TIP: In item (j), you must first calculate the desired ending balance before adjusting the Allowance for Doubtful Accounts.

- 2. Prepare

journal entries for items (a)–(j). - 3. Show how Accounts Receivable, Notes Receivable, and their related accounts would be reported in the current assets section of a classified

balance sheet at the end of the quarter on March 31. - 4. Sales Revenue and Service Revenue are two income statement accounts that relate to Accounts Receivable. Name two other accounts related to Accounts Receivable and Note Receivable that would be reported on the income statement and indicate whether each would appear before, or after. Income from Operations for Execusmart Consultants.

1.

To indicate: The amount and direction of effects of each transaction from (a)-(j) on the financial statement accounts and on the overall accounting equation.

Explanation of Solution

Bad debt expense:

Bad debt expense is an expense account. The amounts of loss incurred from extending credit to the customers are recorded as bad debt expense. In other words, the estimated uncollectible accounts receivable are known as bad debt expense.

Allowance method:

It is a method for accounting bad debt expense, where amount of uncollectible accounts receivables are estimated and recorded at the end of particular period. Under this method, bad debts expenses are estimated and recorded prior to the occurrence of actual bad debt, in compliance with matching principle by using the allowance for doubtful account.

Write-off:

Write-off refers to the deduction of a certain amount from accounts receivable, when it is decided that the amount would be uncollectible forever.

Accounting equation: Accounting equation is an accounting tool expressed in the form of equation, by creating a relationship between the resources or assets of a company, and claims on the resources by the creditors and the owners. Accounting equation is expressed as shown below:

Indicate the amount and direction of effects each transactions on the financial statement accounts and on the overall accounting equation.

a.

| Assets | Amount | = | Liabilities | + | Stockholders’ equity | Amount |

| Accounts receivable | +$200,000 | Service revenue (+R) | +$200,000 |

Table (1)

b.

| Assets | Amount | = | Liabilities | + | Stockholders’ equity | Amount |

| Allowance for doubtful accounts (+xA) | –$2,000 | Bad debt expense (+E) | –$2,000 |

Table (2)

Working note:

Determine the amount of bad debt expense for the year.

c.

| Assets | Amount | = | Liabilities | + | Stockholders’ equity | Amount |

| Cash | +$100,000 | |||||

| Accounts receivable | –$100,000 |

Table (3)

d.

| Assets | Amount | = | Liabilities | + | Stockholders’ equity | Amount |

| Accounts receivable | –$500 | |||||

| Allowance for doubtful accounts (–xA) | +$500 |

Table (4)

e.

| Assets | Amount | = | Liabilities | + | Stockholders’ equity | Amount |

| Accounts receivable | +$150,000 | Service revenue (+R) | +$150,000 |

Table (5)

f.

| Assets | Amount | = | Liabilities | + | Stockholders’ equity | Amount |

| Allowance for doubtful accounts (+xA) | –$1,500 | Bad debt expense (+E) | –$1,500 |

Table (6)

g.

| Assets | Amount | = | Liabilities | + | Stockholders’ equity | Amount |

| Cash | –$12,000 | |||||

| Note receivable | +$12,000 |

Table (7)

h.

| Assets | Amount | = | Liabilities | + | Stockholders’ equity | Amount |

| Accounts receivable | +$500 | |||||

| Allowance for doubtful accounts (+xA) | –$500 | |||||

| Cash | +$500 | |||||

| Accounts receivable | –$500 |

Table (8)

i.

| Assets | Amount | = | Liabilities | + | Stockholders’ equity | Amount |

| Interest receivable | +$100 | Interest revenue (+R) | +$100 |

Table (9)

Working note:

Calculate the amount of interest revenue earned on note, as on March 31.

j.

| Assets | Amount | = | Liabilities | + | Stockholders’ equity | Amount |

| Allowance for doubtful accounts (+xA) | –$2,390 | Bad debt expense (+E) | –$2,390 |

Table (10)

Working note:

Estimate the amount of uncollectible under on the basis of aging analysis method.

| Number of days unpaid | |||||

| Total | 0–30 | 31–60 | 61–90 | Over 90 | |

| Total Accounts Receivable | $ 90,000 | $ 36,500 | $42,400 | $ 5,100 | $ 6,000 |

| Estimated Uncollectible (%) | |||||

| Estimated Uncollectible ($) | $ 8,390 | $ 730 | $ 4,240 | $1,020 | $ 2,400 |

Table (11)

Aging of receivables method:

A method of determining the estimated uncollectible receivables based on the age of individual accounts receivable is known as aging of receivables method. Amount of accounts receivables of different age and its respective uncollectible percentage are multiplied, to determine the estimated uncollectible receivables for each age group of receivable.

It is given that the unadjusted balance of allowance for doubtful accounts is a credit balance of $6,000. It is calculated that the estimated uncollectible is $8,390. Under aging of receivables method, estimated uncollectible would be treated as desired ending balance of allowance for doubtful accounts. To bring the balance of allowance for doubtful accounts from a credit balance of $6,000 to a credit of $8,390, allowance for doubtful accounts must be adjusted (by debiting (increasing) bad debts expenses and by crediting (increasing) allowance for doubtful accounts). So, now calculate the amount needed to be adjusted for uncollectible accounts.

Calculate the amount needed to be adjusted for uncollectible accounts.

Thus, the amount needed to be adjusted for uncollectible accounts is $2,390.

Note:

xA denotes contra asset account

R denotes revenue account

E denotes expenses account

2.

To prepare: Journal entries for items from (a) to (j).

Explanation of Solution

Journal: Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Prepare journal entries for items from (a) to (j) as follows:

| Item | Date | Account Title and Explanation | Debit ($) | Credit ($) |

| a. | January | Accounts Receivable (+A) | 200,000 | |

| Service Revenue (+R) | 200,000 | |||

| (To record service rendered on credit) | ||||

| b. | January 31 | Bad debt expense (+E) | 2,000 | |

| Allowance for doubtful accounts (+xA) | 2,000 | |||

| (To record the estimated bad debt expense) | ||||

| c. | February 4 | Cash (+A) | 100,000 | |

| Accounts receivable (–A) | 100,000 | |||

| (To record the collection of cash on account) | ||||

| d. | February 15 | Allowance for doubtful accounts (–xA) | 500 | |

| Accounts receivable (–A) | 500 | |||

| (To record the write off of receivables) | ||||

| e. | February | Accounts Receivable (+A) | 150,000 | |

| Service Revenue (+R) | 150,000 | |||

| (To record service rendered on credit) | ||||

| f. | February 28 | Bad debt expense (+E) | 1,500 | |

| Allowance for doubtful accounts (+xA) | 1,500 | |||

| (To record the estimated bad debt expense) | ||||

| g. | March 1 | Note Receivable (+A) | 12,000 | |

| Cash (–A) | 12,000 | |||

| (To recordthe acceptance of note) | ||||

| h. | March 15 | Accounts Receivable (+A) | 500 | |

| Allowance for doubtful accounts (+xA) | 500 | |||

| (To reverse the written off receivables) | ||||

| March 15 | Cash (+A) | 500 | ||

| Accounts receivable (–A) | 500 | |||

| (To record the collection of cash on account) | ||||

| i. | March 31 | Interest Receivable (+A) | 100 | |

| Interest Revenue (+R) | 100 | |||

| (To record accrued interest earned on note) | ||||

| j. | March 31 | Bad debt expense (+E) | 2,390 | |

| Allowance for doubtful accounts (+xA) | 2,390 | |||

| (To record the estimated bad debt expense) | ||||

Table (12)

Note:

A denotes asset account, xA denotes contra-asset account, R denotes revenue account, and E denotes expenses account.

3.

To show: How accounts receivable, notes receivable, and their related accounts would be reported in the current asset section of the classified balance sheet at the end of quarter on March 31.

Explanation of Solution

Prepare partial classified balance sheet at the end of quarter on March 31 as follows:

| E Consultants | ||

| Classified balance sheet (Partial) | ||

| At the end of quarter on March 31 | ||

| Assets: | Amount in $ | Amount in $ |

| Current assets: | ||

| Accounts receivable | 90,000 | |

| Less: Allowance for doubtful accounts | (8,390) | |

| Accounts receivable, net of allowance | 81,610 | |

| Notes receivable | 12,000 | |

| Interest receivable | 100 | |

Table (13)

4.

To identify: Two accounts (apart from sales revenue and service revenue) that are related to accounts receivable and notes receivable that would be reported on the income statement.

Explanation of Solution

Bad debt expense:

Bad debt expense is an expense account. The amounts of loss incurred from extending credit to the customers are recorded as bad debt expense. In other words, the estimated uncollectible accounts receivable are known as bad debt expense.

Bad debt expense account is an account which is related to accounts receivables, which would be reported as bad debt expense on the income statement before income from operations.

Interest revenue account is an account which is related to notes receivables, which would be reported as interest revenue on the income statement after income from operations.

Want to see more full solutions like this?

Chapter 8 Solutions

Fundamentals Of Financial Accounting

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI am looking for a step-by-step explanation of this financial accounting problem with correct standards.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forward

- I need help with this financial accounting question using standard accounting techniques.arrow_forwardCould you help me solve this financial accounting question using appropriate calculation techniques?arrow_forwardI am searching for the correct answer to this financial accounting problem with proper accounting rules.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT